Changing the retirement benefit plan for police officers and firefighters will harm recruitment and retention efforts and force them to work longer than desired, the chairman of the Chattanooga Fire & Police Pension Fund board argues.

"You're going to go back to where you have older policeman and older firefighters," said Terry Knowles, board president.

Without assured retirement benefits, he said, the city will have a tougher time recruiting and keeping qualified police officers and firefighters.

Knowles sent detailed fact sheets about retirement benefits for officers and firefighters to City Council members last week. He said some council members have talked about changing the retirement plan from a defined benefit plan to a defined contribution plan, much like a 401k plan.

However, Richard Beeland, spokesman for Chattanooga Mayor Ron Littlefield, said changes to retirement benefits are not on the table.

"There are no plans from the mayor or from the council to change the pension plans," he said.

Councilman Jack Benson has been the only council member in the past to say the city may need to look at a defined contribution plan.

The city, like most other municipal governments, faces a financial crunch as elected officials put together budgets for the new fiscal year, which starts July 1.

The council's Budget, Finance and Personnel Committee is set to meet 1:30 p.m. today about pension plans. Chairwoman Carol Berz said there may be some discussion about the pension plan as a whole.

Discussions about specific parts of the pension plan have not happened, she said.

"We've had no conversations about this," she said. "It's kind of like putting the cart before the horse."

Council Chairwoman Pam Ladd said the council needs to evaluate compensation packages for employees and whether they are costing too much and whether they're in line with other benefits packages across the country.

Some of the costs might not be seen now, she said, but they could be seen growing "years and years" down the road.

More information about an alternative pension plan would be helpful in case the council is presented with such a plan in the future, she said.

BENEFITS EXPLAINED

The fire and police pension fund represents 790 current firefighters and police officers, 540 retired members and 152 beneficiaries, records show.

The city adopted a retirement benefit called the Deferred Retirement Option Plan, or DROP, about 10 years ago to cut the number of police officers and firefighters working past 30 years. Since then, disability cases have been reduced by 25 percent and there has been a "significant reduction" in officers and firefighters working more than 30 years, according to pension fund board.

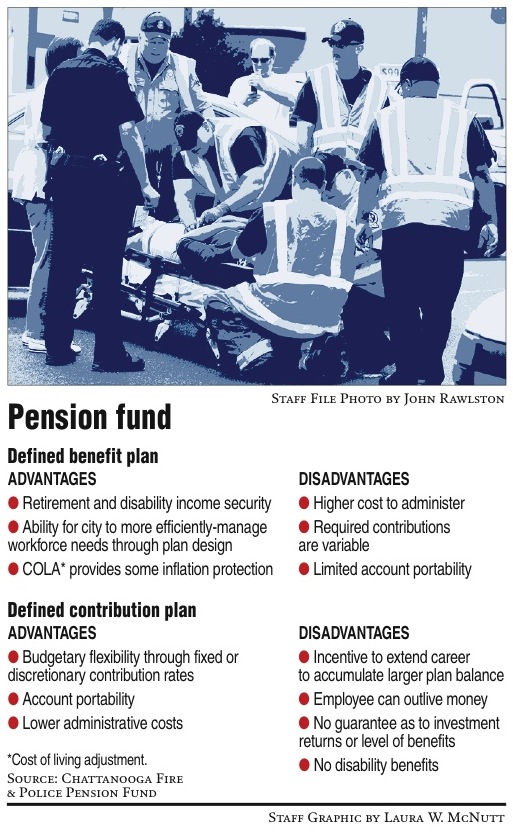

The fact sheets from the pension board analyzes the differences between the current pension plan - a defined benefit plan - and a 401k-type plan.

Knowles said police officers or firefighters would have to work longer under a defined contribution plan to secure the same amount of money in their retirement accounts than a defined benefit plan.

Because public safety workers have a shorter career span than other public or private sector workers, they likely would not have the years needed to fund their retirement plans fully.

Knowles acknowledged that Fire and Police Pension Fund managers are still uncertain about whether a defined contribution plan could save money for the city.

"We don't really know if there will be a cost savings," he said. "We're still looking at that."

Contact Cliff Hightower at chightower@timesfreepress.com or 423-757-6480. Follow him on Twitter at twitter.com/CliffHightower.