Multicultural loan originator let go

Friday, January 1, 1904

THE STORY SO FARThe Tennessee Multicultural Chamber of Commerce faces an investigation by the FBI and an inquiry from the U.S. Department of Housing and Urban Development about the use of federal loans and grants to buy property and build a Business Solutions Center on M.L. King Boulevard. The center has never been built.The inquiries were spurred after a Times Free Press investigation showed inconsistencies with budget requests turned in to Chattanooga and Hamilton County. A later review by City Auditor Stan Sewell showed possible financial mismanagement, questionable land deals and exorbitant salaries and travel expenses.

The man who helped arrange a $579,000 loan to the Tennessee Multicultural Chamber of Commerce for a business center that was never built was dismissed Wednesday as part of a "reorganization."

Elijah Cameron, a commercial lending specialist for Chattanooga Neighborhood Enterprise and the Chattanooga Community Development Financial Institution, no longer works for those entities, confirmed David Johnson, president of the organizations.

"I was brought in specifically to reorganize and to move in a different direction," Johnson wrote in an emailed statement. In earlier interviews, Johnson said he was hired in December 2009. "Mr. Cameron's departure is part of that reorganization process."

Cameron did not respond to a phone message left at his home Wednesday.

Cameron's departure comes just three weeks after the FBI questioned him and Johnson about the loan made in October 2009 to the Multicultural Chamber. The Chattanooga Community Development Financial Institution (CCDFI) helps arrange loans for urban revitalization projects.

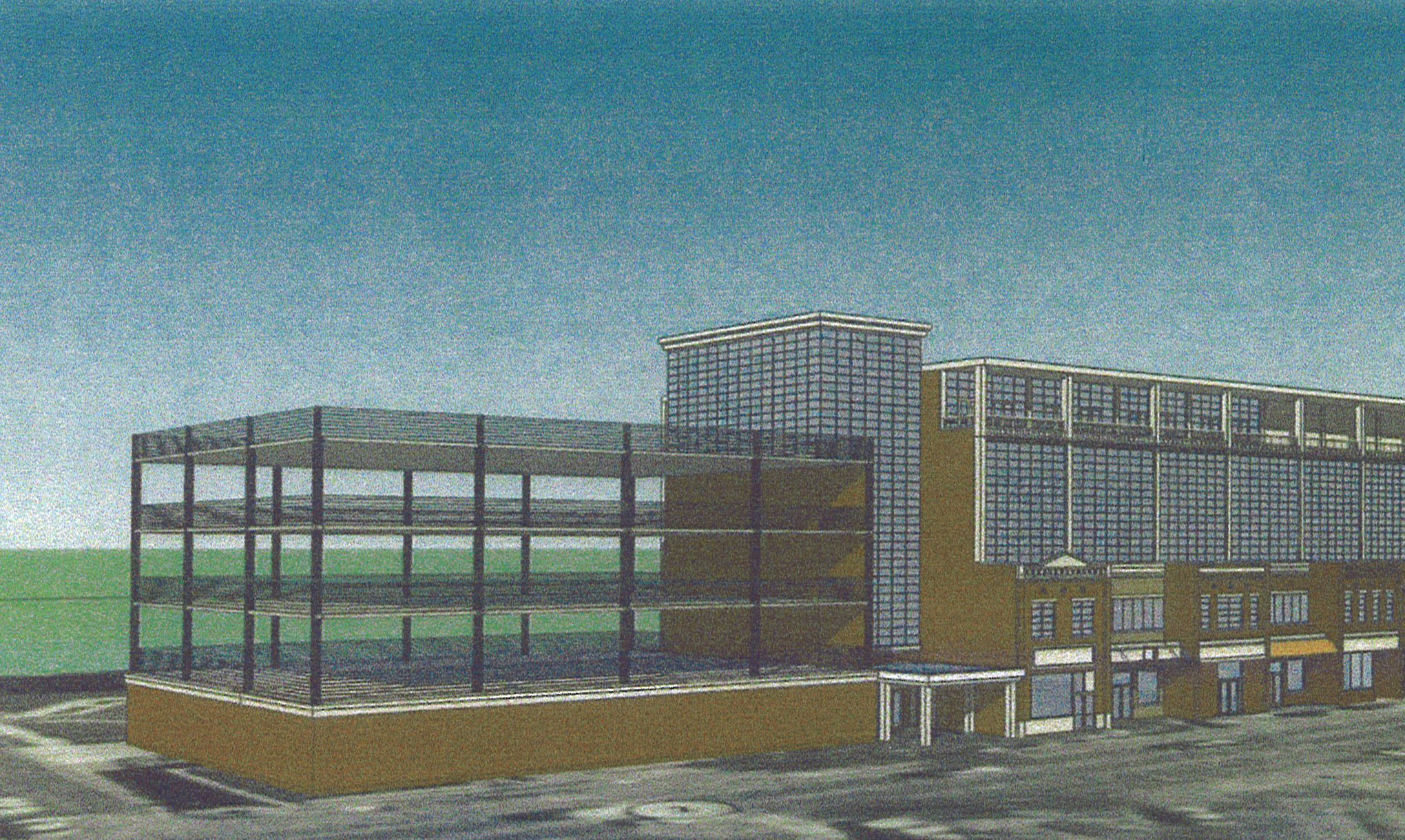

The $579,000 was to be used as part of the funding for a Business Solutions Center the Chamber planned to build on lots it owns on M.L. King Boulevard. The Chamber planned to use part of the complex for its own offices and rent space to other businesses.

Executive Director Sherrie Gilchrist has blamed the recession that began in 2007 for the lack of action to date on the center's construction.

Cameron, who originated the Multicultural Chamber loan and presented it to the CCDFI board, was a founding member of the chamber. Gilchrist was secretary and a longtime member of the CCDFI board, though she recused herself from the vote on the loan to Multicultural Chamber, minutes of the 2009 board meeting show.

The loan now is now more than two months in arrears and the CCDFI is considering whether to foreclose, Johnson has said.

Separately, HUD has asked the chamber to account for a $545,000 grant that HUD gave it to buy land for the Business Solutions Center.

Johnson's email said Cameron's departure had nothing to do with the Multicultural Chamber loan.

"He was laid off as part of a reorganization that had no bearing on the TMCC loans," he said.

Hugh Sharber, chairman of the CCDFI board, declined to comment Wednesday.

Before joining CNE in January 2008, Cameron was executive director of the M.L. King Community Development Corp., whose mission was to revitalize the historic neighborhood. The Community Development Corp. lost funding and is no longer in operation.

In 2007, before Cameron joined CCDFI, the organization had a hand in an M.L. King revitalization project that now is being unwound in U.S. Bankruptcy Court.

Renaissance Square was a combined office and residential building on the corner of M.L. King and Houston streets.

The developer, the 28th Legislative District Community Development Corp., secured $1.2 million in private money for the project. It borrowed more than $950,000 from CCDFI and $510,000 from a separate, New York-based community development financial institution called Seedco, records show.

Now both financial institutions are among the creditors trying to recover their money as the 28th CDC goes through bankruptcy reorganization.