MICHAEL WARREN

Associated Press

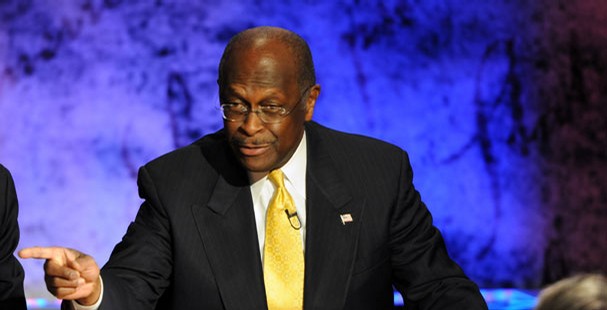

One way that surging GOP presidential candidate Herman Cain has distinguished himself from his rivals is by calling for an alternative to Social Security - a private retirement plan modeled on one instituted a generation ago in Chile.

"Chile - they had the same problem nearly 30 years ago," Cain said last month at a forum in Florida, one of several occasions where he's touted his proposal. "They went to an optional, personal retirement account approach, and they now have individual retirement accounts for their workers."

But there's nothing optional about Chile's system. It requires that all workers contribute 10 percent of their salaries to private pension plans, plus other fees for insurance. These private funds have grown by an average of 9 percent annually after inflation since 1981,creating wealth that has boosted Chile's economy.

Still, many Chileans are unhappy over the funds' commissions and fees, and frustrated that their pensions aren't bigger. Polls have found that if given the choice, most Chileans would rather decide for themselves how to invest for their retirement.

A look at Cain's claims and how they compare with the facts:

---

CAIN: "I believe in the Chilean model, where you give a personal retirement account option so we can move this aside from an entitlement society to an empowerment society. Chile had a broken system the way we did 30 years ago. A worker was paying 28 cents on a dollar into a broken system. They finally awakened and put in a system where the younger workers could - could have a choice - novel idea. Give them a choice with an account with their name on it and over time we would eliminate the current broken system that we have." - GOP debate on Sept. 7 at the Reagan Library in California.

THE FACTS: The U.S. Social Security system faces long-term problems as more baby boomers retire, leaving relatively fewer workers to pay into the system. The Social Security trust funds are projected to be exhausted by 2036 unless Congress enacts changes. Once the funds are exhausted, the system would collect only enough payroll taxes to pay about three-fourths of the benefits Americans have been promised.

Chile had a similar system that was eating up nearly a third of workers' incomes and going bankrupt before Gen. Augusto Pinochet's dictatorship created the private pensions in 1981. At the time, Chilean stocks were performing so badly that the military and police refused to go along. Many civilians also decided to stay with their government-run plans, but most switched.

Since then, all new employees have been required to contribute 10 percent of their first $33,360 in annual wages, choosing among five funds whose investments range from safe bonds to riskier stocks. Roughly half of Chile's 17 million people pay into the private system today and can earn full pensions at age 60 for women and 65 for men, compared with a U.S. retirement age that is rising to 67.

Unlike traditional pension plans or Social Security, these investment accounts are the private property of each Chilean. Upon retirement, they can take out whatever's left after taxes and spend it as they wish. Anything left over at their death can be inherited by their families.

Chilean companies aren't required to pay anything into the system, unlike U.S. employers, who must match each worker's 6.2 percent payroll tax. That makes the total Social Security tax 12.4 percent, applied to the first $106,800 of each employee's wages. (Workers' payroll taxes were cut to 4.2 percent for this year; they'll return to 6.2 percent on Jan. 1 unless extended as President Barack Obama has asked.)

Starting in 2002, Chileans were allowed to invest up to 10 percent more in pretax savings - besides the mandatory program - that could be withdrawn at any time with no penalties other than taxes. Those voluntary plans, used mostly by Chileans wealthy enough to be able put away up to 20 percent of their income, have boomed, creating an additional $5.7 billion investment pool.

Transparency is built in: Chileans can use ATM-style cards or go online at any time to make projections and changes, and the government tightly regulates the funds, reporting each month on their progress. Success has bred imitation; 30 other countries have adopted something similar.

So why are so many Chileans unhappy?

Many complain of commissions and fees that have added up to nearly 15 percent of their contributions, according to the International Association of Latin American Pension Fund Supervisors.

The system's regulators say people who start paying the legal limit every month at age 25 can retire on 70 percent of their working salary. But that's not common. The average payout is $351 a month, just 36 percent of the average working wage, said Gonzalo Cid Vega, a pensions expert with Chile's Center for National Studies of Alternative Development.

"We created a private system with good intentions, but when a person retires, they become poor," Cid said.

U.S. Social Security benefits aren't much better, despite adjusting for inflation and using a sliding scale so that low-wage workers get a higher share of their earnings than higher-wage workers do. American workers retiring this year after making an average of $41,000 annually over 35 years would initially get about 45 percent of their working wage; an $88,000-a-year worker would get about 30 percent. The average U.S. monthly benefit is about $1,180, just 28 percent of the median U.S. monthly household income of $4,159.

Fear of stock market volatility is a big barrier to switching from Social Security to private accounts. The Social Security trust funds are invested entirely in U.S. Treasury bonds, which offer relatively low returns but are considered among the safest investments in the world.

By comparison, Chile's funds have delivered strong returns, despite some nerve-racking swings over the years. In 2008 alone, 60 percent of the growth obtained since the funds began was wiped out. Before it was regained the next year, it was a particularly bad time to retire in Chile. Many are angry that the funds aren't required to share their profits and lessen the impact of such devastating downturns on pensioners.

Other changes, in 2009, forced Chile's self-employed to participate, made it harder for people to take early retirement and exhaust their pensions before death, created government subsidies to cover housewives and other informal workers, and provided tax breaks for employers who voluntarily augment the contributions of low-wage workers.

The changes mean Chile's system is hardly the private plan it was billed to be: Two-thirds of all pensioners now get some kind of government support, which both increases taxes and enables private companies to profit more from government revenues.

---

U.S. Social Security Administration analysis of Latin American pension reforms: https://www.socialsecurity.gov/policy/docs/ssb/v71n1/v71n1p35.html

---

Michael Warren, AP's Southern Cone bureau chief, reported and wrote this story from Buenos Aires. Follow him at http://twitter.com/mwarrenap. Stephen Ohlemacher and Calvin Woodward contributed from Washington.