TENNESSEE TAX-EXEMPT GOODSBack-to-school items are exempt from state and local sales tax starting today through Sunday. Those items include:• Clothing items under $100, including belts, hats, neckties, jeans, shoes and underwear. Accessories, protective and sports equipment are still taxed.• School and art supplies under $100, including calculators, book bags, notebooks, drawing pads and clay. School computer supplies such are still taxed• Computers under $1,500. Computer parts, software and storage media are still taxedSource: Tennessee Department of RevenueGEORGIA SALES TAX HOLIDAYGeorgia's sales tax holiday on back-to-school goods is scheduled for next Friday and Saturday.Source: Georgia Department of Revenue

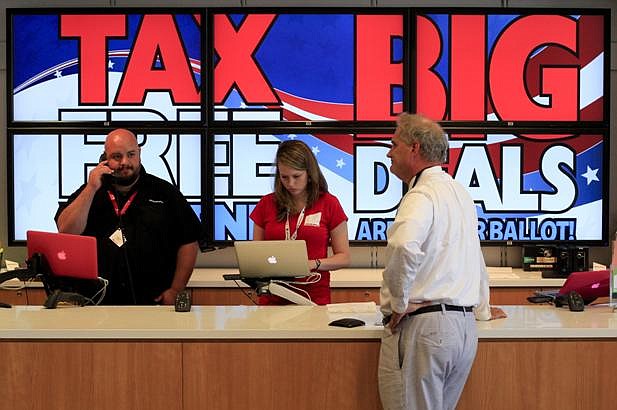

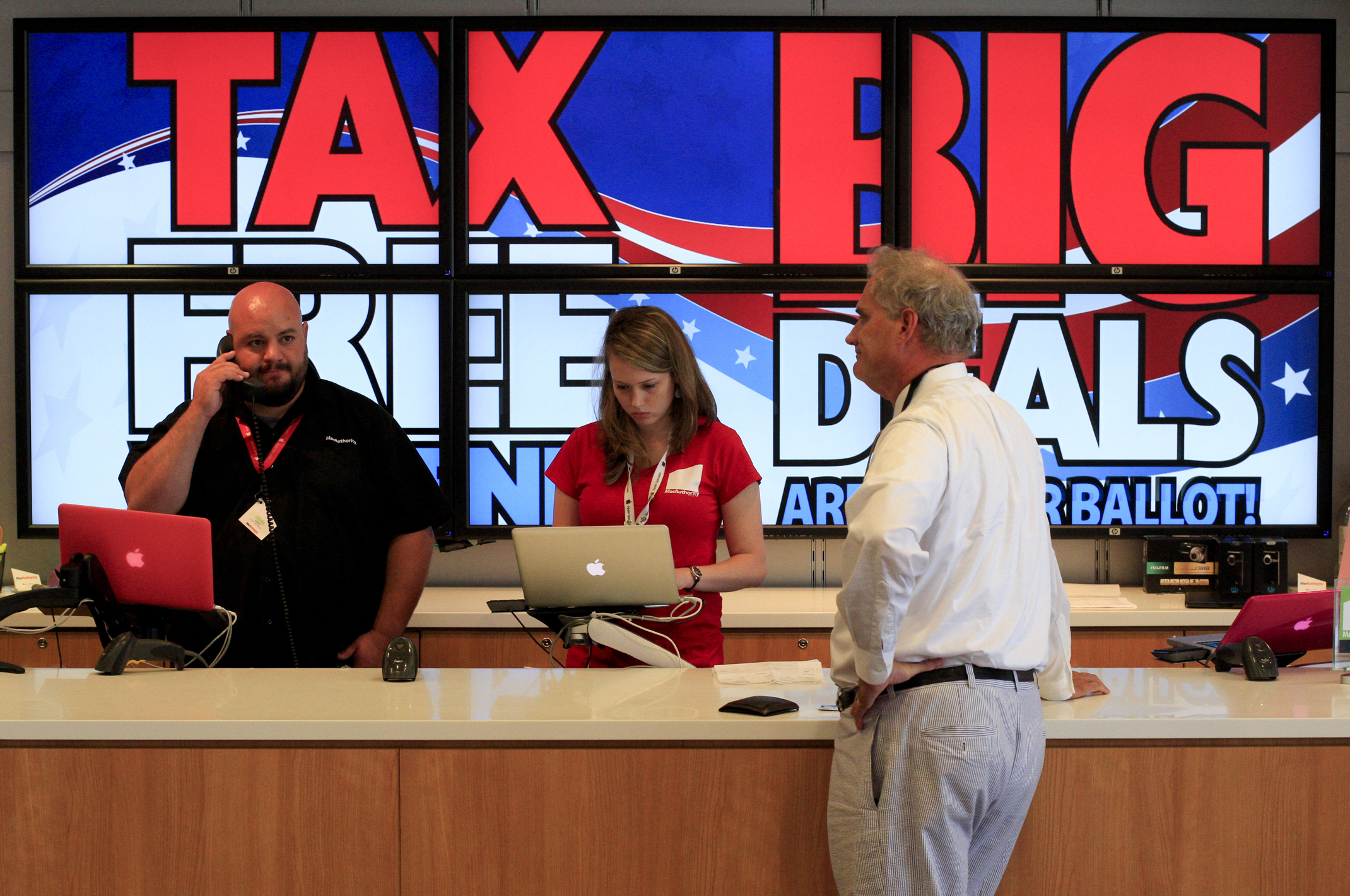

There's no snow on the ground, lights on the trees or a fat bearded man sitting in the mall, but at Hamilton Place's Mac Authority store, tax free weekend may as well be the end of December.

"This is our Christmas. It's bigger than Black Friday for us, too," assistant store manager John Whitely said as he prepared his store for the flood of customers he's expecting this weekend. "It's fantastic. We're really excited."

Whitely said the store had a line out the door as customers came in to order their new computers, one product eligible for a nearly 10 percent savings today through Sunday as Tennessee halts sales tax collection. The store finished Thursday well past its previous pre-sales record.

Whitely said his store's tax free Weekend sales numbers are unrivaled the rest of the year. Tennessee's three-day tax break on clothing, computers and school supplies, which will be repeated in Georgia next weekend, should bump sales at plenty of stores across the state.

But a recent report by the nonpartisan tax research group Tax Foundation suggests tax holidays have little benefit for states, businesses or individuals.

"These holidays are often pushed as a way to reduce cost for consumers or a way to stimulate the economy to get more spending," said Joseph Henchman, the foundation's vice president of state projects. "The evidence shows they don't really do any of those things."

Rather than inspire people to buy, Henchman said savvy shoppers simply wait to make purchases they would have made anyway. The tax break does help shoppers save money, he said, but not necessarily the low-income families who need help the most during the back-to-school shopping season.

Since adopting the holiday in 2006, the annual shopping weekend averages between $8 million and $10 million in tax savings for shoppers and lost revenue for the state.

"The real question is, is that the best use for that $8 million to $10 million?" Henchman asked. "Is there a better way to provide tax relief?"

Retailers certainly aren't complaining. Hamilton Place mall will open an hour early and stay open an hour late all weekend to accommodate retailers excited for a break from the typically slow summer retail season.

"This is a big stimulus for them, no question," said Jim Brown, state director for the National Federation of Independent Business.

Many customers go to stores for the tax-free items, but end up making several other purchases. At Mac Authority, about half the customers purchase taxable accessories and software.

Businesses near tax-exempt retailers also see benefits. The Hamilton Place Red Robin restaurant typically gets a 20 percent bump in customers on Tax Free Weekend.

"It has a huge impact," said Vince Seery, the chain's regional director. "They don't get 10 percent off the burgers, but they're out shopping and they get an appetite."

Victoria Cuervo and her son will be among those shoppers this weekend. The duo need some new clothes and school supplies, and Cuervo expects the tax break to save her about $50.

She's excited for the trip, and said she likely wouldn't buy most of what she'll be getting if it wasn't for help from the tax incentive.

"You've just got to take everything you can get," she said.