Mortgage ratesMortgage rates fell last month to the lowest levels in at least 60 years. On Thursday, however, mortgage buyer Freddie Mac said the rate on fixed-rate mortgages for 30-year loans rose for the second consecutive week to 3.59 percent, up form 3.55 percent last week. Two weeks ago, the rate fell to 3.49 percent, the lowest since long-term mortgages began in the 1950s.The average rate on the 15-year fixed mortgage, a popular refinancing option, rose to 2.84 percent. That's up from 2.83 percent last week and a record low of 2.80 percent the previous week.Mortgage rates are low because they tend to track the yield on the 10-year Treasury note. A weaker U.S. economy and uncertainty about how Europe will resolve its debt crisis have led investors to buy more Treasury securities, which are considered safe investments. As demand for Treasurys increase, the yield falls.

Chattanooga's relatively sluggish growth in home prices during the 1990s is paying off now for many owners and sellers in the Scenic City.

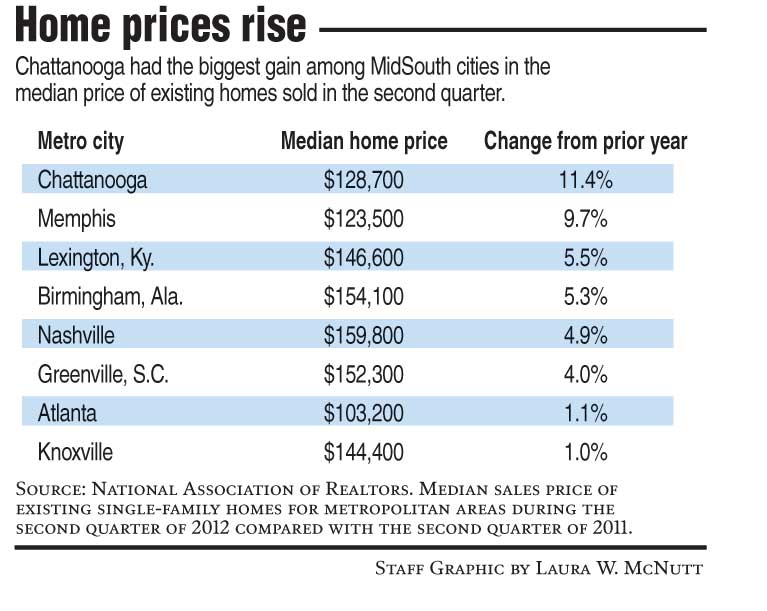

After being shaded from the Sunbelt growth around it a decade ago, Chattanooga appears to have found its place in the sun. The National Association of Realtors reported Thursday that Chattanooga now is leading the region in bouncing back from the home price declines spawned by the recent housing slump.

The median price of existing single-family homes sold this spring in Chattanooga was up 11.4 percent over a year ago, the biggest percentage gain among any MidSouth market and more than 50 percent faster than the U.S. average percentage gain.

"Chattanooga has always been a modestly priced market, and we didn't have the high inflation in home prices that Atlanta and many cities in Florida did in the past," Chattanooga real estate appraiser Henry Glascock said. "Chattanooga has been a more stable and consistent market, so we are enjoying a better recovery than markets like Atlanta because we simply didn't have the surplus inventory of new homes that many other markets had when the recession hit."

During the second quarter, the median price of Realtor-assisted homes sold in Chattanooga was $128,700, or $13,200 more than the median price of homes sold locally a year ago. Despite the above-average gain in prices, however, Chattanooga home prices still averaged 29.1 percent less than the U.S. average.

Lured by historically low mortgage rates, homebuyers are able to afford higher prices for the same monthly payment they would have paid with higher interest rates. Additionally, after years of slowing new-home construction, Realtors report the inventory of unsold homes has declined to less than a 10-month supply.

Nathan Walldorf, a residential real estate agent for Herman Walldorf & Co. Realtors, Inc., said he expects to close in the next month on both Lookout Mountain and Ooltewah houses that sold in less than a week. By June of this year, Walldorf said his sales already had bested all of last year.

"The inventory of homes on the market is going down and that is helping many houses to sell more quickly and closer to list price," Walldorf said.

The average home in Chattanooga now is selling for about 90 percent of the initial sales price, and Glascock said distressed properties are having to compete with many foreclosed or repossessed homes being sold by banks and other lenders eager to liquidate such holdings.

Dan Griess, general manager for the Chattanooga Region of Crye-Leike who oversees about 300 area real-estate agents, said the drop in mortgage rates and home starts combined to help boost home prices after declines from 2008 through 2010.

"I think we've seen the bottom and we're definitely moving in a positive direction," he said. "Consumer confidence is better and interest rates are lower than we ever thought they would be."