If you're like most folks this time of year, you're making a list and checking it twice, comparing prices between different stores and scouring the Internet, all in an effort to get the lowest prices on Christmas presents. And for good reason.

The average adult plans to spend $854 on gifts this holiday season, according to a survey performed by American Research Group, Inc. That means an average couple will see the total cost of their Christmas shopping list exceed $1,700.

You may not realize that one of the easiest ways to save big this holiday season could be to simply drive across county lines.

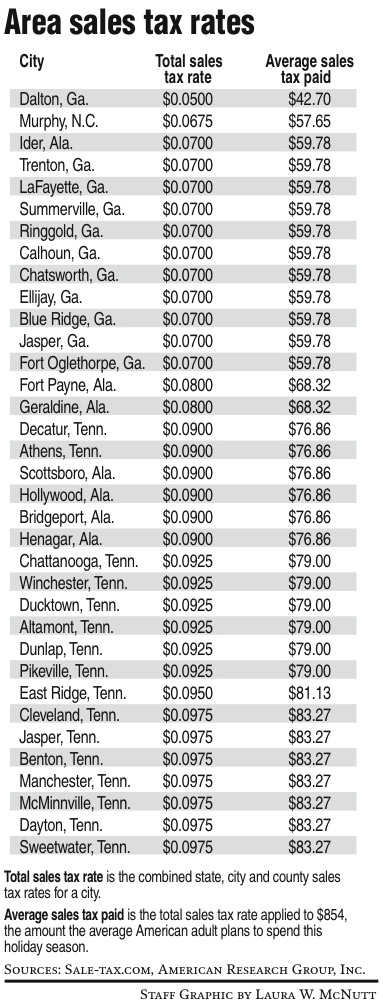

An analysis of the sales tax rates of every city and county in the Chattanooga Times Free Press circulation area found the sales taxes applied to retail purchases varied from as little as 5 percent to as much as 9.75 percent, depending on where you shop.

With the same stores (Wal-Mart, Target and Best Buy, for example) and the same prices, common to many towns in Southeast Tennessee, Northwest Georgia, Northeast Alabama and Southwest North Carolina, and so many retailers willing to match the price of their competitors, the only real way to save this holiday season might be to shop at stores in jurisdictions with low sales taxes.

The undisputed capital of bargain shopping, based on its low tax rate, is Dalton, Ga. Thanks to Whitfield County's commitment to maintaining the lowest sales tax rate in North Georgia, shoppers in Dalton are rewarded with a substantial price break on every item they buy.

In Dalton, spending the national average of $854 on Christmas gifts costs $42.70 in taxes. The next cheapest place to shop in our area, Murphy, N.C., levies a sales take that bumps the price of holiday shopping up by an additional $14.95.

For some shoppers in Chattanooga, the 60 mile roundtrip drive to Dalton may seem like more trouble than it's worth, especially if you don't plan to spend hundreds of dollars on Christmas gifts. Most bargain hunters in Chattanooga would agree, however, that simply crossing the Georgia state line to save nearly a third on sales taxes is a good trade-off.

By shopping at the Wal-Mart a few miles away in Fort Oglethorpe, Ga., rather than a Wal-Mart in Chattanooga, you would save almost $20 on the average $854 holiday spending spree.

The Free Press analysis of sales tax rates found that, no matter what, you'll pay less in sales taxes by doing your holiday shopping in Georgia, rather than in Tennessee or Alabama.

The cheapest places to shop in Northeast Alabama in terms of sales taxes - Fort Payne and neighboring Geraldine - have sales tax rates that are still a percent higher than the cities with the even the most expensive sales taxes in North Georgia.

Shopping in Tennessee is even more expensive. At 9 percent, Athens and Decatur have the lowest sales taxes of any Tennessee towns in the Times Free Press circulation area. Cleveland, Jasper, Benton, McMinnville, Dayton, Manchester and Sweetwater all share the embarrassing distinction of having the highest sales tax rates in our region. In those high tax towns, shoppers shelling out the national average in holiday spending will pay $83.27 in combined state and local sales taxes - $40.57 more than shoppers in Dalton pay for the same items.

Of course, as in years past, the easiest way to reduce your sales tax hit this holiday season might be to shop online. States have begun cracking down and implementing stronger procedures to enforce the collection of sales taxes by online retailers. If an online retailer has a physical presence in a particular state, it must collect sales tax from customers. So if you're hoping to buy your kid a Furby on Walmart.com, rather than in the store, in hopes of sneaking out of paying sales taxes, you're out of luck.

Even if a retailer doesn't charge you taxes on a product you purchase online, you're supposed to self-report the purchase to your state's department of revenue and write a check to cover the amount of the sales tax. Of course, the number of people who actually do that is roughly equivalent to the number of people who willfully poke themselves in the eye with a stick.

If you're not willing to risk going in front of a judge just to save a few bucks by buying a Holiday Barbie online and not paying applicable taxes, shopping in Dalton is the best bet for price-savvy holiday shoppers.

Dalton and Whitfield County should be applauded for their willingness to keep local sales taxes low. By purchasing your Christmas gifts in Dalton, you'll be giving yourself the gift of the lowest sales tax rates in the Chattanooga area.