Harry Tobin thought he made the right call.

Payments on land he agreed to buy in Dade County were going to the bank; in three years he would collect a portion of the profit from his lot's sale -- maybe as much as $26,000.

The 47-year-old Fort Lauderdale, Fla., salesman asked his church pastor and another friend if they were interested. They were, and he received a commission from both their purchases.

Things went well, at least on paper, for more than a year.

Then the payments stopped coming, and the banks started calling.

Nearly four years later, Tobin and possibly 60 other investors in five states have experienced ruined credit, entered bankruptcy or let their land at the foot of Lookout Mountain go into foreclosure.

The development company's founder, Joshua Dobson, and another employee face a federal indictment on fraud charges, and a related business is in bankruptcy, owing between $350,000 and $500,000 in delinquent taxes and facing separate civil lawsuits.

"What he did to me and my friends ... he ruined a lot of lives," Tobin said. "I hope the justice system will work. I don't think that it will. I don't think he'll spend a day in jail."

But one of the development company partners said Friday that investors understood the risks and that banks didn't thoroughly check buyers' credit and assets before approving property loans.

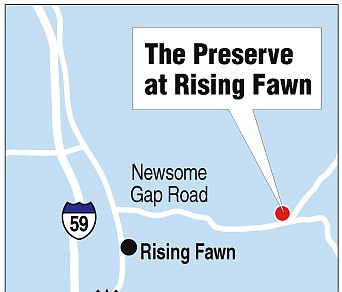

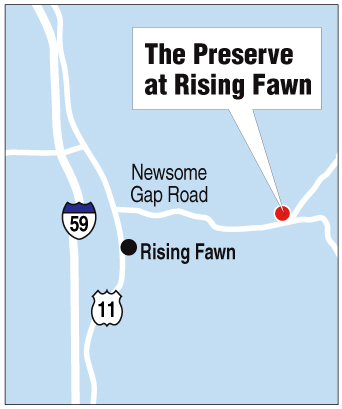

Travis Shields heads TAS Properties, which owned the Preserve at Rising Fawn, Ga., a tract of more than 2,000 acres at the center of investor woes. He is also partner with Dobson in Southern Group, the development company that sold lots at the Preserve, according to court documents.

Shields, 39, does not face criminal charges.

"These people bought the land, put up their own money as a down payment. Immediately after we bought an option from them to purchase the land," he said. "We would, in turn, make the mortgage payment, keep the land up and try to sell it. They signed a form saying they understood what an option was."

On May 10, Shields' brother-in-law, Dobson, 34, of Kimball, Tenn., and Paul Gott III, 39, of Jasper, Tenn., pleaded not guilty to the 12-count federal indictment against them. Prosecutors allege that the two men committed wire and bank fraud in a scheme involving the Preserve and as much as $45 million in losses and transactions from 2008 to 2010. Their trial date is set for July 9.

Dobson's attorney, Chris Townley, maintained that his client is innocent and declined further comment. Gott could not be reached.

Both Tobin and his friend, T. Robert Giese, 67, of Lakeworth, Fla., purchased lots at the Preserve in 2008. Tobin first signed for one 3.3-acre lot valued at $175,000. A few months later he told his pastor and Giese, who bought four lots.

Giese retired as he learned that what he thought was an investment had turned into a $500,000 anchor around his neck. He has since let all but one of the lots go into foreclosure and watched his credit rating spiral downward, preventing him from buying a home.

"It kind of ruined my life," he said. "I'm really up a creek."

As he and Tobin gradually learned that they would be losing money and not making it, Giese was mad at himself.

"I felt like an idiot. I didn't have any malice toward [the developers]."

But Tobin spread his anger around. First at Dobson and his partners, then at himself. Later he had the chance to tell an FBI agent every detail, name, email and communication he could recall from his dealings with Dobson and Southern Group.

Stress from the eventual bankruptcy sent him to the hospital multiple times and led to a tense home life, he said.

Mostly, he hurt for what had happened to his friends, he said.

"The pastor and I have a great relationship," he said. "Her husband has not and will not forgive me. And I can't say I blame him."

He had trusted work friends in the mortgage business who said they had checked the Preserve deal out and thought it was good so his friends had already bought lots.

One conversation he had with Dobson later resonated.

"This is where it should have been a red flag," Tobin said. "Josh specifically told me to tell my buyers, 'Do not tell the bank you're talking to that you are also purchasing properties through other banks.'"

Banks base their decisions on how much money to loan, in part, on factors such as other debt obligations.

Local developer Dale Mabee, who is not connected to this development or case, said it's common for investors to sign guarantees on property without putting money down.

"Developers do sometimes have investors who guarantee. They don't put up actual cash, but they do put their credit on the line," he said. "Typically those are people with substantial net worth that are vetted with lenders. In most cases they would have to submit financial statements."

The federal indictment alleges that Dobson and Gott deceived mortgage lenders by making it appear as though the buyers were making the payments when, in fact, his company was making the down payment and monthly payments on some of the lot mortgages.

Others have tried to make the same land profitable, at least since the 1980s, said Dade County Executive Ted Rumley.

In its most recent form, The Preserve was to be a cabin resort to draw visitors from Atlanta with an equestrian center, swimming pool, fine dining, trails and a luxurious spa, according to the company's website.

Shields said about 20 existing residences were remodeled and eight cabins and the equestrian center were built.

Dade County and at least two banks have filed objections to the sale of the land, which is an asset of TAS Properties. The company entered Chapter 11 bankruptcy in December, which stalled any sale of lots still held by TAS. The company owes $500,000 in delinquent taxes to Dade County, Rumley said.

"It's the largest [tax amount owed] probably in Dade County history as far as owing taxes directly to the county," he said.

Shields said the amount is $350,000 and will be paid once the land is sold. A Nevada-based company has been willing to buy the land for the past two years, he said, but until the bankruptcy case is resolved that can't happen.

"Even Dade County won't get out of their own way to get that," he said. "The only way these creditors are going to get paid are if these sales go through."

Shields believes the land will sell and creditors will be paid. That's what he and his partners are trying to do, he said.

Though he's reluctant to place blame, Shields said he and his partners trusted banks to check the buyers out before lending the money. He said he didn't learn about most of the buyers' backgrounds until the company started contacting them to let them know that Southern Group could no longer pay the mortgage.

"We figured if the banks were underwriting [the buyers], they were going through their personal finances, doing what a bank normally does," he said. "The economy went south, banks quit loaning, nobody would finance the buyers. Our revenue dried up."

At least two banks -- Cornerstone Community Bank and Community Trust and Banking Co. -- and three individual buyers -- Rita Watkins and Vincent and Anne Mihalik -- have sued Southern Group.

The bank cases, filed in Hamilton County Chancery Court, were moved to Dade County, and judges ruled that Southern Group must pay back the banks. Shields said payment in those cases is still being negotiated.

The Mihaliks, who bought lots and later were left to pay on a $270,000 mortgage, filed a Dade County civil lawsuit in May against Shields, Dobson and Southern Group. That case is set for trial next April.

Tobin has little recourse; he's already gone through a bankruptcy triggered when he was held responsible for the mortgage. During those proceedings he couldn't file a lawsuit and doubts there will be any money left anyway after the bankruptcy, criminal proceedings and remaining lawsuits.

He had thought his dealings with Dobson would help him earn extra money to pay down debt; instead they wiped out much of his income.

"I racked up a lot of medical bills because of that. My wife and I, we are still married; we have not been as close as we were," he said. "I try to look for any kind of blessing. I'm generally a very, very positive guy."