Couple charged in swindle face new charges

Friday, January 1, 1904

A couple facing criminal charges and a civil lawsuit in Georgia, accused of bilking an elderly woman out of her life savings, now faces criminal charges in Tennessee.

Christi and Roger Morgan also have filed for bankruptcy in Tennessee.

The family of Jackie Humphrey, 64, allege in court documents in Georgia that Christi and Roger Morgan spent nearly $1.3 million of Humphrey's life savings over a period of three years beginning in 2008. During that time Christi Morgan had access to the elderly woman's savings through a power-of-attorney agreement.

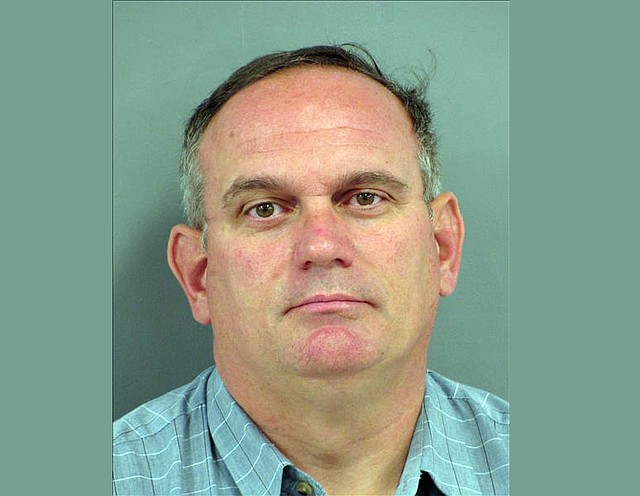

Georgia Bureau of Investigation agents arrested Christi Morgan, 45, last August and Roger Morgan, 50, in September on felony theft and embezzlement charges.

The Morgans, along with their son Christopher Morgan, 23, were arrested on charges of theft over $60,000 in Hamilton County on Feb. 20. Those charges stem from their use of Jackie Humphrey's debit card for at least $83,000 in purchases by the parents and $20,000 in purchases by the son.

Mike Humphrey, Jackie's cousin, said Tuesday that, when the Morgans filed for bankruptcy in Tennessee last year, that halted the civil lawsuit against them in Georgia. The criminal charges in Georgia still are pending and are scheduled before General Sessions Court Judge David Bales on June 21 for a preliminary hearing.

The Morgans could not be reached for comment, but they previously have denied taking Humphrey's money.

At the time of the arrests in Georgia, Roger Morgan was serving as a part-time pastor of North LaFayette Baptist Church. He was replaced as minister shortly after the charges became public, church officials told the Times Free Press.

Christi Morgan has been unemployed for three years, while her husband has worked for nearly 20 years at Dixie Industries in Chattanooga.

Mike Humphrey said he was disappointed the Morgans chose to try to get relief through bankruptcy.

"They had a chance to make some wrongs into some rights, and they chose not to do so," he said. "They turned my cousin's life upside-down, and it seems like they don't even care."

Bankruptcy records show the couple bought a 2,500-square-foot home in rural Chickamauga, Ga., for $165,000 in cash.

Roger Morgan claimed in a court deposition in Tennessee that his wife had saved $150,000 through investments while working as a secretary for two years.

He also testified that his wife handled Humphrey's account and he did not know if she had transferred money from that account to the joint account shared by the couple.

Christi Morgan declined to answer questions throughout her bankruptcy court depositions, citing her Fifth Amendment right not to testify.

The couple have since moved into a mobile home in Rossville.

Mike Humphrey said he anticipated more criminal charges because he's working with lawyers to track down where the Morgans used his cousin's money. Bankruptcy documents show that the couple spent money in Tennessee, Georgia, Florida and Texas.

"Any state, any county they've swiped a credit card in, we're going to come after them," Mike Humphrey said.

He said his elderly cousin, who is in an assisted living facility, is doing well but he had worried that she would have a nervous breakdown when she learned of losing the money that she had saved over two decades as a schoolteacher.

The Morgans filed for bankruptcy in October 2011, shortly after the criminal charges and civil court lawsuit. The Chapter 7 voluntary bankruptcy normally would allow a debtor some relief on their debts.

But after being challenged on her filing by the court, Christi Morgan waived her right to relief, meaning she still will owe money to creditors and not have that debt eliminated.

On March 29, the U.S. Trustee's office in Chattanooga filed an "adversary case" against Roger Morgan's petition for bankruptcy relief, requesting that U.S. Bankruptcy Court Judge Shelley Rucker not allow his debts to be cleared.

A date had not been set for that hearing as of Tuesday.