Elected officials acted rashly when they approved taxpayer financing for the Black Creek Mountain development, a former zoning executive has charged.

Helen Burns Sharp, who helped with a similar deal between PepsiCo and the city of Albany, Ore., said local officials here failed to extract important taxpayer protections from developers and entertained little public discussion.

"If taxpayers are subsidizing a mountain community for 20 years, there should be some type of public benefit like urban renewal or new jobs," Sharp said. "A residential development has neither of those."

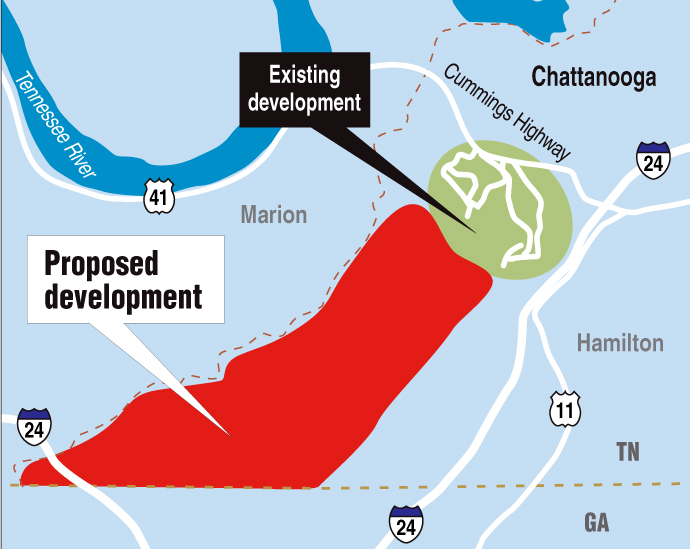

Under the current agreement, the Black Creek development group will spend $9 million of its own money to build a road to the top of Aetna Mountain, then taxpayers will repay the debt from future tax revenue over the next two decades.

The road will connect the unfinished residential development at the base of Aetna Mountain to the currently undeveloped top, in what proponents say will be a mixed-use project.

Neither city council members nor county commissioners properly vetted the proposal, Sharp said, and Black Creek may not meet the basic legal requirements for so-called tax increment financing (TIF).

Sharp's comments come just a week before the Industrial Development Board is set to approve financing on the project. A day after, the City Council plans to vote on a 90-day moratorium on TIF proposals in order to let guidelines be established first.

"They're talking about these amorphous jobs on top of a mountain that's zoned residential, but there's nothing to address what happens if the jobs don't materialize," Sharp said. "This idea that we're going to get this great tax base may be true, but we're going to spend a heck of a lot of money providing services."

Sharp is entitled to her opinion, but everything the developers and city officials did complies with state law, said attorney Mike Mallen, a spokesman for the development group.

"The reality is all those things may fit very nicely in some sort of theoretical policy conversation about public finance but they do not appear in the Tennessee statute," Mallan said.

While this may be the first TIF in Chattanooga, there are more than 40 such projects that have been launched across the state, Mallen said.

"She has enumerated multiple items that are not requirements under the statute, and she has drawn conclusions about the public meeting process that do not square up with reality," Mallan said. "Knoxville's got 20 TIFs going right now, and the sky's not falling there."

Public hearings

But the issue isn't whether developers and city officials may have followed state law, it's whether or not they acted in the best interests of taxpayers, Sharp said.

"There is no claw back clause in the development agreement," she wrote in her analysis. "Unless this issue is addressed now, the city could be responsible for costly fire, police, trash and road maintenance, while receiving precious little property tax revenue."

Though the state comptroller's office reviews any transaction in which a local agency issues debt, TIF laws don't specifically protect taxpayers from future losses, state officials said. It's up to individual municipalities to negotiate for what's in their best interest, said Kelsie Jones, executive secretary of the State Board of Equalization.

"It's likely that the council for the city or county which prepares the debt issuance will create that memorandum of understanding," said Jones.

For its part, the Chattanooga City Council debated the project at length, but ultimately approved the project 5-2 vote without agreeing on any guidelines.

Councilwoman Deborah Scott, who voted against the measure, warned the council that it was setting a precedent by acting without a hard and fast set of rules.

"Step through this door, and we will be stepping through a door to do TIFs for other developers," Scott said.

The council hopes to ratify that next week. In the meantime, John Bridger, executive director for the Chattanooga-Hamilton County Regional Planning Agency, said the agency is three weeks out from having a draft that could go public.

"We have a rough draft," he said.

Hamilton County Commissioners didn't discuss the Black Creek Mountain project with the public before unanimously voting in June to approve the agreement.

That's because developers met privately with each commissioner prior to the vote to assuage their individual concerns before the public meeting, said Commissioner Joe Graham.

Under the proposed TIF, the city is on the hook for services, while the county isn't. The county also continues to receive money for schools, which does not go toward paying back the bond.

"They explained and addressed all the concerns that I had," Graham said.

Reporter Cliff Hightower contributed to this report.