First Tennessee Bank grows market lead in Chattanooga

Friday, January 1, 1904

By the numbers

Metro Chattanooga2002:• Number of banks in the market -- 26• Number of offices -- 152• Deposits -- $5.43 billion2012:• Number of banks in the market -- 30• Number of offices -- 173• Deposits -- $8.66 billionSource: Federal Deposit Insurance Corp.

Shifts in the banking industry take place with all the urgency of a winter whale migration. But when changes happen, there's no question later that something seismic has occurred.

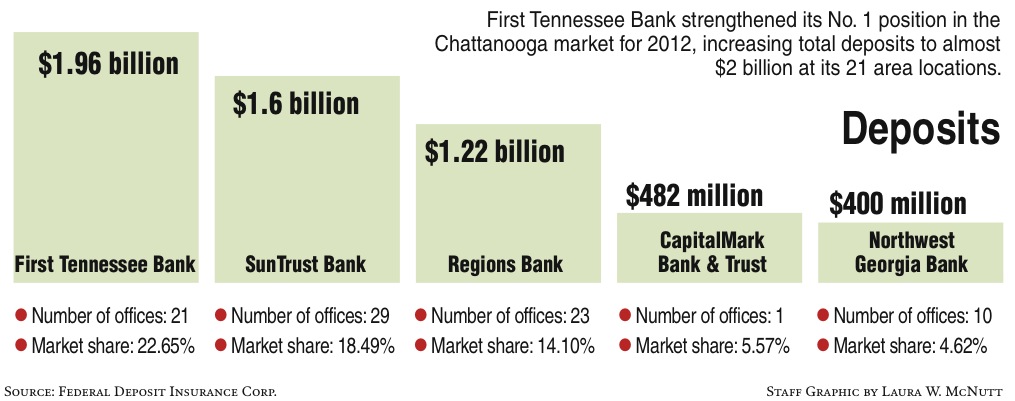

First Tennessee Bank widened its lead over SunTrust and Regions Bank this year in the Chattanooga metropolitan market, as the Memphis-based company grew both deposits and market share at its 21 local offices.

First Tennessee first seized the market lead in 2010, and managed to strengthen its local position despite closing one of its offices.

First Tennessee is dwarfed by both SunTrust and Regions across the United States. Combined, SunTrust and Regions have 3,356 total offices to First Tennessee's 153 locations, and $223 billion in deposits compared to just over $14 billion at First Tennessee.

But in the six-county Chattanooga metropolitan area, First Tennessee has grown its market share from 18.7 percent as recently as 2010 to 22.7 percent today.

"Our deposits are up locally about 10 percent year over year, which is great, and we're maintaining our strong No. 1 market share," said Keith Sanford, Chattanooga market president for First Tennessee.

The bank didn't just outperform SunTrust and Regions, it outperformed the entire market, said BJ Losch, chief financial officer at First Tennessee.

"Not only do we have the number one share but we grew it at three times the market rate, which is outstanding," Losch said.

Overall, 30 banks in the Chattanooga metro area had nearly $8.7 billion in deposits as of June 30, or 2.1 percent more than at the same time a year earlier. Collectively, the banks operate 173 branches in the Chattanooga market.

"Deposit growth is a function of the economic state that our country is in and we're in a period of slow and steady growth in Chattanooga and across Tennessee," said Brad Barrett, president of the Tennessee Bankers Association. "Interest yields are historically low, but that is true for most all type of savings and the alternative of the stock market carries a lot more risk."

Bank deposits grew in Chattanooga nearly 50 percent above the statewide growth of 1.4 percent in the past year, according to FDIC data.

In the past decade, the Chattanooga market has grown bank deposits at a brisk pace, even allowing for the massive mid-decade recession and adjusting for inflation.

Bank deposits in metro Chattanooga have grown nearly 60.4 percent in metropolitan Chattanooga since 2002, or more than twice the 28.6 percent inflation rate for the same period.

It's difficult to pin down exactly why consumers switch from one bank to another, though Sanford chalks it up to good service and long-term employees.

"I think we're a stable bank with good service, good capital and good long-term employees who are able to bring business in," he said.

Regions, which jumped to the area's third-largest bank with its acquisition of AmSouth Bank's assets in 2006, has seen its market share erode locally to 14.1 percent this year from 17.9 percent shortly after it absorbed AmSouth.

Regions lost deposits during that period, falling from $1.3 billion in 2007 to $1.22 billion today.

Though SunTrust's percentage of total deposits has fallen slightly, the Atlanta-based bank continues to grow deposits overall both in Chattanooga and throughout the southeast, according to the FDIC.

SunTrust grew deposits to $1.6 billion in Chattanooga for 2012, up from $1.15 billion in 2002. Though local deposits are down slightly from a high of $1.7 billion in 2008, deposits throughout SunTrust's entire service area have risen during the same period to $128 billion from $112 billion.

Mike Butler, president and CEO of SunTrust Bank in Eastern Tennessee, said the FDIC figures don't tell the whole tale.

"The FDIC market share data is a snapshot in time, and as a result, is an inexact measure of market presence," Butler said. "We have other tools and data we also use when looking at how we are serving our clients and meeting their needs, and based on our ongoing evaluation of serving Chattanooga we are pleased with our strategy and results."

Business Editor Dave Flessner contributed to this report.

Contact staff writer Ellis Smith at esmith@timesfree press.com or 423-757-6315.