Josh Dobson and Paul Gott III set up a mortgage fraud scheme in which they used buyers' good credit histories and signatures to get hefty bank loans, but then "bamboozled" the buyers with "lies and deceptions" and left investors holding expensive second mortgages with no way to pay, a federal prosecutor said Monday.

Not so fast, a defense attorney countered. A chief witness for federal prosecutors is to blame, he argued. This witness and others knew how they were to pay the bank but instead skirted the rules, broke the law and caused the mess that jurors will now evaluate over this week's trial.

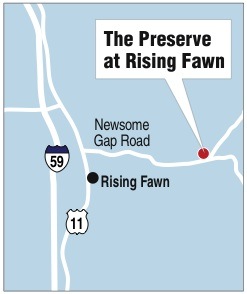

Dobson and Gott face a 12-count federal indictment on charges of conspiracy, wire fraud and money laundering. They are charged with bilking investors and banks in a $45 million land fraud scheme involving The Preserve near Rising Fawn, Ga.

Prosecutors John MacCoon and Perry Piper presented their case with detailed diagrams of alleged illegal money transactions in which Dobson and Gott told land buyers they didn't need down payments, that their companies, under the heading Southern Group, would take care of that.

Prosecutors detailed how money was doled out by Southern Group for buyers' down payments and the money that banks, thinking the down payments came from buyers, issued back to the company.

"If they were operating in good faith, you wouldn't have these cobwebs of money movement," MacCoon told the jury.

One case involved a $67,000 down payment from the company that became a $213,000 payment from the bank to Southern Group. Another started as a $47,000 down payment and returned as a $163,000 payment to the company. A third started as a $22,000 down payment that came back as a $95,000 payment.

Dobson's attorney, Chris Townley, took the prosecutors to task in his opening statement, asking the jury to remember the elaborate diagrams and claims. They would see by the end of the estimated six-day trial that prosecutors hadn't proven their case.

He pointed to Jim Tobin, a Florida broker who is scheduled to be called as a witness. Tobin worked deals with Southern Group and told the Chattanooga Times Free Press in a previous interview that he was scammed. He said in the process, he lost his livelihood, friends and his marriage suffered.

But Townley told the jury that it was Tobin and others who broke the rules by paying down payments that violated federal law.

"If [Tobin and other buyers] did what they were supposed to do, what they were expected to do, Mr. Josh Dobson wouldn't be sitting here," Townley said.

Townley also threw blame on bankers who were happy to take the down payments but, he said, were not very scrupulous in checking the money.

"Everyone wants to be pals with [Southern Group] as long as they're making money, and then you know what happens when the money ran out. It's time to point fingers," Townley said.

The trial is scheduled to resume in U.S. District Judge Curtis Collier's courtroom today.