2 men who sold Dade County, Ga., plots face prison time after federal fraud convictions

Friday, January 1, 1904

Two men who sold plots of land in a $45 million Dade County, Ga., real estate development deal face decades in prison after their convictions Tuesday for conspiracy, wire fraud and money laundering.

A jury found Marion County, Tenn., residents Joshua Dobson, 35, and Paul Gott III, 40, guilty on seven of 12 counts against them.

The pair face an Aug. 8 sentencing hearing. The fraud and money laundering charges carry a maximum prison sentence of 20 years each.

Attorneys for both sides in the case declined to comment or did not return calls for comment Tuesday.

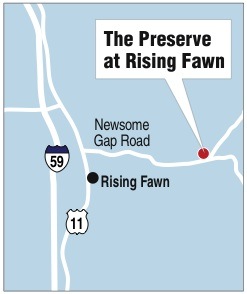

Dobson was one of the three heads of Southern Group, a real estate sales and development company that sold lots at the 2,500-acre area known as The Preserve near Rising Fawn, Ga.

Gott was an independent contractor who collected documents and facilitated loan work with land buyers, brokers and banks.

Throughout the two-week trial, prosecutors John MacCoon and Perry Piper called witnesses, including bankrupted land buyers, defrauded bankers and brokers, to explain the scheme.

Two major methods presented in the case were the "gift letter" process and the "buyback option."

In the gift letter process, Dobson and Gott would move money from Southern Group to accounts held by third parties, who then gave the money to land buyers.

Southern Group was paying the down payment and mortgage through gift letters, rather than the buyers.

Under federal law the property buyer must disclose if the person giving the money has any interest in the sale. On forms presented in court, this was not disclosed.

With few exceptions, the person giving the money should be a relative. That, too, was falsified on documents.

The gift letter scheme resulted in most of the guilty verdicts listed in the indictment.

During the trial Gott's attorney, John McDougal, pointed to fine print in the regulations that he said allowed for others to give the money. Gott testified that he relied on mortgage brokers and bankers' advice that the source of the money didn't matter.

The jury found Dobson and Gott not guilty on charges related to the buyback option involving a broker named Jim Tobin from Florida.

In that scheme Southern Group promised a no money down deal in which buyers signed with their good credit to obtain mortgages on undeveloped land plots.

The company promised to pay the down payment and monthly mortgage for three years, then exercise the buyback option, paying the buyer up to $20,000 as a form of a commission.

Dobson testified in the trial last week, and his attorney, Chris Townley, showed emails and letters that clarified the buyback was not guaranteed and was the option of the company.

For a few months in some cases and up to a year in others the mortgage payments were made by Southern Group.

Until they weren't paid.

That's when the responsibility fell back on buyers, who did not have the means to pay the mortgage.

Some went bankrupt.

The $45 million development went bankrupt soon after the payments stopped.