With the stock market showing its best January in nearly two decades, one of Wall Street's best-known prediction tools is signaling investors to buy stocks this year.

The so-called January Barometer suggests that as the first month of the year goes so goes the market for the entire year. If history is any guide, stocks should average double-digit gains again this year based upon the January bull market.

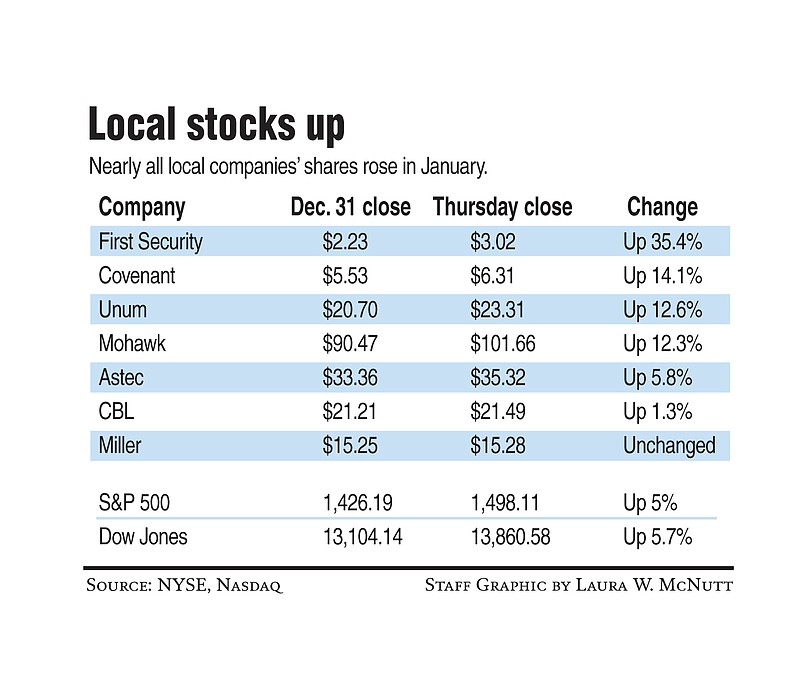

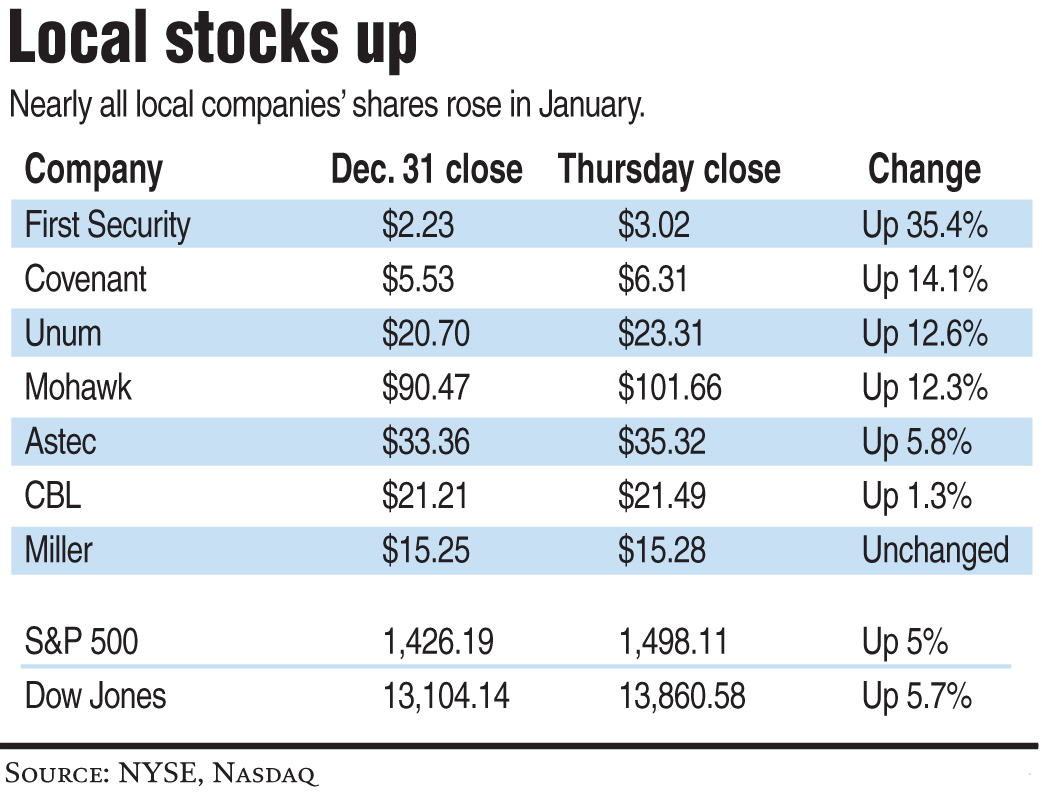

Despite a drop in stock prices Thursday, the Dow Jones industrial average ended the month up 5.8 percent, its strongest January since 1994, according to S&P Capital IQ data. The Standard & Poor's 500 finished the month 5 percent higher, its best start to the year since 1997.

Four of Chattanooga's publicly traded companies -- Unum, Mohawk Industries, Covenant Transport and First Security Group -- enjoyed double-digit gains during January and none of the major local companies declined in value last month.

Over the past half century, when stocks rise by more than 5 percent in January, the entire year has shown double-digit gains in the major stock indices 10 out of 11 times. Only the crash in 1987 blemished the usual January Barometer in recent history.

"On balance, barring some unforeseen events, this should be a positive year and could easily be better even than last year," said James Woods, chief investment officer for Southport Capital, which operates offices in Atlanta and Chattanooga. "If everything continues to be positive, this could easily be a year for a 15 percent gain in the Dow and S&P."

Stocks rallied in the first week of the year after Congress reached a deal to avoid the "fiscal cliff," and Wall Street has continued to be buoyed by low interest rates and an improving housing market.

Although some analysts fear the January rally may have gotten ahead of itself and could push stock prices down some in February, most forecast higher prices by the end of the year, barring some international oil disruption or disaster.

Z. Cartter Patten III, a principal partner in the Chattanooga investment firm of Patten & Patten, said the improving market is drawing more retail investors back into stocks.

"I think what we've seen in January is indicative of what should be a good year for the market," Patten said. "There's so much liquidity and there is a growing sentiment to be in equities."

By one measure, the monthly flow into stock funds was the largest in nine years in January.

About $51 billion in net deposits was moved into stock funds and so-called hybrid funds, which invest in a mix of stocks and bonds, consultant Strategic Insight said Thursday. That's the most since $56 billion flowed in during January 2004.

Jeremy Siegel, a professor of the Wharton School of Finance who studies the stock market, said Thursday he expects the Dow, which closed Thursday at 13,860.58, to top 15,000 by the end of the year.

"People aren't afraid anymore to open the envelopes for their 401(k) plans," he told CNBC Thursday. "This should be another double-digit year (for average stock gains)."

So far this quarter, 70 percent of companies have beat analysts' estimates and Siegel expects earnings for most companies to grow 5 to 8 percent this year. Higher price-to-earnings multiples should push stock prices up even more, Siegel said.

"There's not a whole lot of bears left here," said Jeff Hirsch, the editor of the Stock Trader's Almanac.

The Associated Press contributed to this report