Foreclosure share of all home sales• In 2011, there were 1,688 foreclosure or short sales through the Chattanooga multiple listing service, representing 30 percent of that year's total sales of 5,705 properties.• In 2012, foreclosure and short sales rose to 1,786 in the Chattanooga MLS, but with more conventional sales the share of foreclosure sales was only 27 percent of the total home sales of 6,646.Source: Chattanooga Association of Realtors

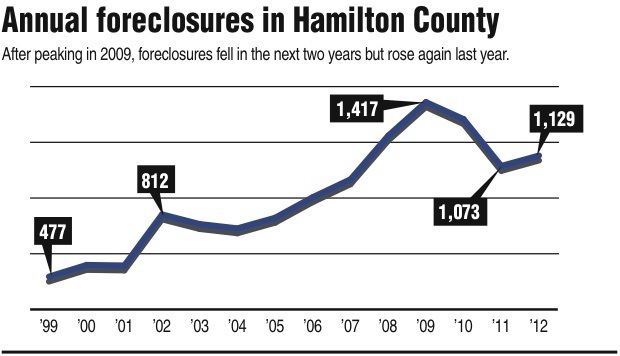

After two years of declining foreclosure activity, the number of Hamilton County properties reclaimed by lenders rose again last year.

But as a share of all home sales, foreclosures dropped to the lowest level during 2012 since the housing recession hit in 2009.

Despite agreements by banks to provide $25 billion to help distressed home owners across America, foreclosures in Hamilton County still hit 1,129 homes and other properties last year, or 5.2 percent more than the previous year, according to real estate filings with the county's Register of Deeds.

"We're still seeing a lot of homeowners struggling to keep their houses," said Jeremy Fitzsimmons, senior foreclosure prevention advisor for Chattanooga Neighborhood Enterprise. "Fortunately, the mitigation help that is available is getting a lot better."

Banks are more likely to write down the principal on many mortgages and the National Mortgage Settlement reached last February with major banks has helped fund the Hardest Hit Fund and other mortgage assistance programs, Fitzsimmons said. The program initially helped only unemployed or severely underemployed homeowners. But the program has since been expanded to aid those who have lost a spouse through death or divorce or have had a major medical hardship.

But as more aid is available, many banks are moving quicker to cut their losses and reclaim their debts by foreclosing on properties from delinquent borrowers.

"We had over 100 people come to our program for assistance in December alone and we seem to be seeing banks moving more aggressively now," Fitzsimmons said.

In one case, a borrower only three months delinquent on his loan was facing a foreclosure sale date the next month, Fitzsimmons said.

The number of foreclosure sales through Chattanooga's multiple listing service in the region was up from 1,688 in 2011 to 1,786 last year, according to the Chattanooga Association of Realtors. But because overall home sales were up even more, the share of local home sales coming from foreclosures or "short sales" made at a discount to avoid foreclosure were still a smaller share of the overall home market. Foreclosure sales last year were 27 percent of all sales, down from 30 percent the previous year and 33 percent at the height of the recession in 2009.

"Foreclosures obviously tend to depress sales prices and the market, but we saw a definite improvement in the local real estate market last year with quicker sales and higher median sales prices," said Mark Blazek, a Prudential Realty Center agent who is president of the Chattanooga Association of Realtors.

The median price of homes sold in Chattanooga last year was up 5 percent from the previous year, rising from a median price of $128,800 in 2011 to $135,200 in 2012, Blazek said.

"Foreclosures are not going away, but they're slowing down a little bit and I would expect that to continue this year," he said.

Dale Akins, president of the Market Edge, a Knoxville-based company that tracks building activity in the Southeast, said foreclosures have curbed building by depressing prices "sometimes below even the cost of building supplies."

But with home prices rising, interest rates down and incomes on the mend, Akins said home starts continued to rise last year and should increase further in 2013.

"We seem to be getting back toward more normal markets," Akins said.