Sen. Lamar Alexander courts support on Web sales tax

Friday, January 1, 1904

1) HOW MUCH MONEY?Gov. Bill Haslam and a top University of Tennessee at Knoxville expert agree: Tennessee stands to gain $410 million per year if sales tax is collected on online purchases made by Volunteer State residents.Well, what's $410 million to Tennessee?Nearly two-thirds what the state gasoline tax generates ($602 million)More than the state's combined annual tobacco, beer and mixed drink tax revenues ($365.2 million)(Note: Based on 2010-2011 figures.)It's unclear how the new money would be used. In Capitol Hill testimony last year, Haslam signaled he is keeping his options open."It could help cover federal mandates that states face," he said. "Or it could go back to the taxpayers in the form of further tax relief."Some conservatives in the Legislature's Republican supermajority would use the $410 million as an excuse to cut the same amount elsewhere.2) WHEN WOULD IT GO INTO EFFECT?Many fear that if Congress passes the Marketplace Fairness Act, consumers automatically will owe online sales tax.Not so: When a state decides to collect sales tax on all Internet purchases, it must wait six months before implementation.Within that timeframe, states must simplify their tax processes and create a single state entity for sales tax collection, according to the bill.3) WHAT IF INDIVIDUAL SALES TAX RATES CHANGE?States must provide online sellers and certified software providers 90 days notice of any rate change by the state itself or any locality in the state (Senate staffers said earlier drafts had the number at 30 days.)4) VICTIM OF BAD INFORMATION?Let's say you're an online retailer in Chattanooga selling to Alabama residents in a county that just raised its local sales tax rate. Your software company gives you the older rate, you charge too low and Alabama doesn't get the revenue it expects.The bill protects you. It relieves the online retailer from liability "if the liability is the result of an error or omission made by a certified software provider." (The reverse is also true. Software providers are protected from liability if they're victims of "misleading or inaccurate information" from an online retailer.)States are liable if the state provides "incorrect information or software" to online retailers or software providers.

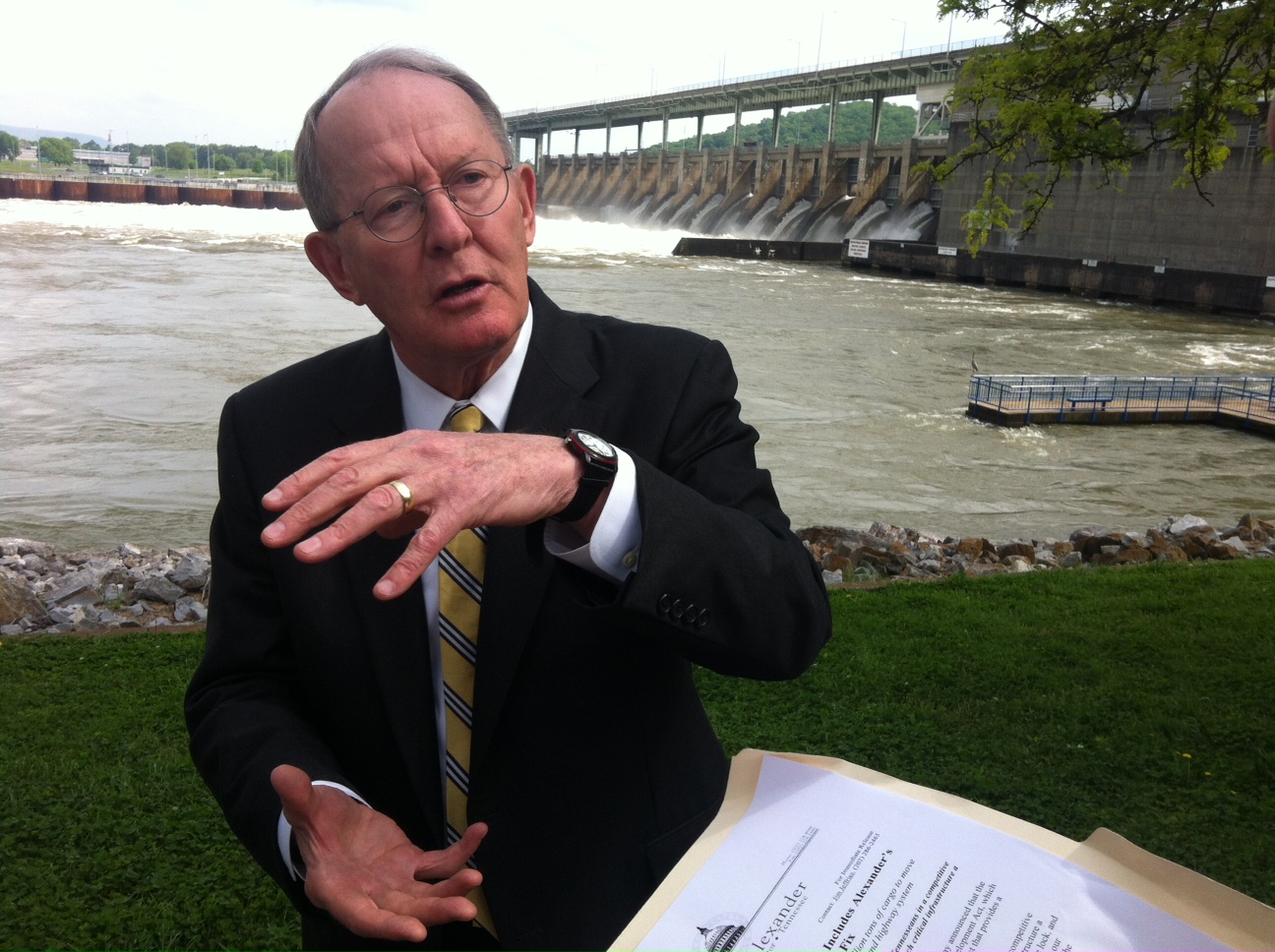

WASHINGTON - Speaking on Capitol Hill, U.S. Sen. Lamar Alexander boils down the debate as he argues for online sales tax collection.

"Two words," the Tennessee Republican booms. "States' rights."

State lawmakers, the 72-year-old former governor says, are better equipped to handle their coffers than Washington politicians. And beyond money management, he adds, the debate is about equal treatment: Why should a website dodge a rule the local mom-and-pop store must obey at the cash register?

Alexander's mission with the Senate-passed Marketplace Fairness Act:

• Give states the authority to force online retailers (only those making $1 million or more in annual sales) to collect sales taxes on Internet purchases made within that state.

• Make those online retailers remit sales tax proceeds to buyers' state and local governments.

"I trust Gov. [Bill] Haslam and [Lt. Gov.] Ron Ramsey and [House Speaker] Beth Harwell -- all of whom support this -- to make a good decision," Alexander said in an interview. "I think what they'll probably do is use the extra revenue to lower the tax rate."

Harwell has expressed general support for the online sales tax measure in the past. However, her office did not respond to requests for comment Thursday or Friday from the Chattanooga Times Free Press.

Alexander counts them and other "conservative lawmakers" on his side.

But in Tennessee, where experts estimate the state's annual windfall at $410 million, the truth is a little more complicated.

UNHAPPY LEGISLATORS

Several rank-and-file Republican lawmakers -- whose opinions may determine the bill's path -- cite major problems with the legislation.

"It needs to be revamped," said state Sen. Jim Tracy, a Shelbyville Republican and 2014 congressional candidate in the 4th District. "This is an example of where Congress messed up."

Other legislators attacked Alexander's claim that computer programs will allow online retailers to easily calculate tax rates in thousands of jurisdictions.

"Anybody who thinks that software can do that is crazy," said state Rep. Joe Carr, a Lascassas Republican running for the same seat as Tracy. (The 4th District incumbent, U.S. Rep. Scott DesJarlais, did not respond to a request for comment.)

Unfortunately, Carr and Tracy said, new revenue from an as-of-now-uncollected tax would give leaders an excuse to expand the scope of government.

The campaigning duo instead would make the bill "revenue neutral," meaning they wouldn't treat the fresh $410 million as new money to spend. Instead, they'd see it as an excuse to cut the same amount elsewhere.

Potential targets mentioned by Republicans include reducing Tennessee's 5.25 percent sales tax on food or the state's Hall income tax, which is limited to interest income and dividends from investments.

In Washington, the Senate passed the bill Monday. As the House begins picking over the legislation, the seven Tennessee Republicans in the U.S. House have been either noncommittal or publicly against the bill.

"We don't need the federal government mandating additional taxes on Tennessee families and businesses," said U.S. Rep. Marsha Blackburn, a Brentwood Republican.

HOW TO IMPLEMENT?

Questions of merit aside, some Nashville insiders don't even agree on how to implement the policy.

Senate Pro Tempore Bo Watson, R-Hixson, said Friday that Haslam could enforce it today with the stroke of a pen.

"The tax can be collected now," he said, "and I think the governor could do all this administratively. It's not a new tax, just a sales tax we haven't been collecting."

Others say the General Assembly should vote on it.

"I don't think we're willing to give up that power to one person," said Rep. Richard Floyd, R-Chattanooga.

Haslam spokesman Dave Smith described the legislation as "still evolving," adding that "we believe it would require legislative action." Department of Revenue spokesman Billy Trout said the General Assembly has to be involved.

But Rep. Vince Dean, R-East Ridge, said he didn't see the need for a vote.

"I would think the Department of Revenue could collect it without legislative action," he said. "I'm trying to think about it logically."

SUPPORTERS

Dean, Floyd and Watson support the legislation, along with several other Hamilton County Republicans.

"No one's for increasing taxes or new taxes," Sen. Todd Gardenhire, R-Chattanooga, said, "but we're a sales tax state and we don't want to be an income tax state."

They described as incorrect leaders such as Blackburn who say it's a new tax.

"Brick-and-mortar retailers are at an unfair competitive disadvantage," House Leader Gerald McCormick, R-Chattanooga, said. "Everyone ought to pay the same."

Haslam has said he'll begin attempting to whip up support in Tennessee's U.S. House delegation. McCormick and Dean joined that effort Friday, saying they would lobby U.S. Rep. Chuck Fleischmann, an Ooltewah Republican who remains undecided on the bill.

"If I ran into him," Dean said, "I'd give him my personal opinion."

Contact staff writer Chris Carroll at ccarroll@timesfree press.com or 423-280-2025.