Treasury watchdog says lax IRS management allowed tea party targeting

Tuesday, May 14, 2013

WASHINGTON - A government watchdog is blaming ineffective management at the Internal Revenue Service for allowing agents to improperly target tea party groups for extra scrutiny when they applied for tax exempt status.

In an upcoming report, the Treasury inspector general for tax administration says lax management allowed the practice to go on for 18 months. The Associated Press obtained a copy of the report ahead of its release.

The IRS on Friday apologized for targeting tea party as well as other conservative groups.

The report said that when asked by investigators, IRS supervisors said the criteria they used to decide which groups they examined were not influenced by people or organizations outside the IRS.

THIS IS A BREAKING NEWS UPDATE. Check back soon for further information. AP's earlier story is below.

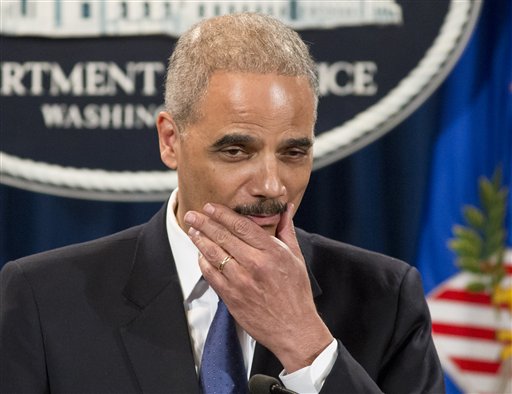

The Justice Department is investigating the Internal Revenue Service for targeting tea party groups for extra scrutiny when they applied for tax exempt status, Attorney General Eric Holder said Tuesday.

Holder said the FBI will investigate to see if any laws were broken. He said he ordered the criminal investigation Friday - the day the IRS publicly acknowledged that it had singled out conservative groups.

"Those (actions) were, I think, as everyone can agree, if not criminal, they were certainly outrageous and unacceptable," Holder said. "But we are examining the facts to see if there were criminal violations."

Numerous congressional committees already are investigating the IRS for singling out tea party and other conservative groups during the 2010 congressional elections and the 2012 presidential election. But Holder's announcement takes the matter to another level, if investigators are able to prove that laws were broken.

Holder said he wasn't sure which laws may have been broken.

Meanwhile, documents obtained by The Associated Press suggest the targeting of conservative groups could be more widespread than the IRS has acknowledged. The agency has said it was limited to low-level workers in a Cincinnati office.

But documents sent from the IRS to tea party groups show that IRS offices in California and Washington, D.C., also sought extensive information from tea party groups who requested tax-exempt status.

The IRS apologized Friday for what it acknowledged was "inappropriate" targeting of conservative political groups.

The agency started targeting groups with "Tea Party," ''Patriots" or "9/12 Project" in their applications in March 2010. The criteria later evolved to include groups that promoted the Constitution and the Bill of Rights. The practice ended in May 2012, according to a draft of an upcoming report by the Treasury Department's inspector general for tax administration.

In some cases, the IRS acknowledged, agents inappropriately asked for lists of donors. The agency blamed low-level employees in a Cincinnati office, saying no high-level officials were aware.

But in letters provided by the American Center for Law and Justice, which represents 27 tea party groups that have sought tax exempt status, IRS officials from two cities in California - El Monte and Laguna Nigel - as well as officials in Washington, D.C., and Cincinnati contacted groups seeking extensive information.

The law center's chief counsel, Jay Sekulow, said he was astonished the IRS said activity was limited to Cincinnati.

"To me, that was what was mind-boggling, they tried to create a narrative," he said.

Sekulow said 10 of the groups his organization represents are still without tax exempt status years after applying for it, while 15 others have been granted the status after long delays and two others decided to drop their effort because it was taking up too much time and required too much private information.

"Donor lists, conversations you've had with members of the House or Senate," he said. "They were so intrusive they violate the IRS manual."

Julia Hodges, a member of the Mississippi Tea Party, said she received a questionnaire from an IRS official in El Monte. She said she went back and forth with IRS officials for three years before her organization withdrew its application for tax exempt status because it was taking up too much time and effort.

She said the IRS requested all sorts of information she didn't think was relevant, including resumes of the group's members. The organization first sought tax exempt status in 2009 and abandoned its efforts in April 2012.

"The biggest thing was just the amount of time," said Hodges. "We would answer these questions on the side and thought this is never going to end. It's never going to cease."

The IRS did not respond Tuesday to questions about why agents outside Cincinnati had also questioned tea party groups.

In an opinion piece in Tuesday's editions of USA Today, acting IRS Commissioner Steven Miller conceded that the agency demonstrated "a lack of sensitivity to the implications of some of the decisions that were made." He said screening of advocacy groups is "factually complex, and it's challenging to separate out political issues from those involving education or social welfare."

These groups were claiming tax-exempt status as organizations promoting social welfare. Unlike other charitable groups, they can engage in political activity. But politics cannot be their primary mission.

That determination is up to the IRS.

Miller said the agency has implemented new procedures that will "ensure the mistakes won't be repeated."

On Monday, the IRS said Miller was first informed on May, 3, 2012, that applications for tax-exempt status by tea party groups were inappropriately singled out for extra scrutiny.

At least twice after the briefing, Miller wrote letters to members of Congress to explain the process of reviewing applications for tax-exempt status without disclosing that tea party groups had been targeted. On July 25, 2012, Miller testified before the House Ways and Means oversight subcommittee but again did not mention the additional scrutiny - despite being asked about it.

Miller's op-ed did not address why he did not inform Congress after he was briefed.

Miller was a deputy commissioner at the time. He became acting commissioner in November, after Commissioner Douglas Shulman completed his five-year term. Shulman had been appointed by President George W. Bush.

Sen. Charles Grassley, R-Iowa, questioned the timing of the IRS admission. It came days before the expected release of the inspector general's report. The IRS admission was made at an American Bar Association conference.

"This timing is curious," Grassley says in a letter Tuesday to Miller. "The IRS chose not to fully answer long-standing congressional questions on the issue, even though they had been posed months before this particular question was asked at the conference."

Grassley asked Miller to provide records relating to the agency's decision to disclose the targeting of tea party groups at a Friday conference rather than to members of Congress who had been asking about it for more than a year. He also asked for any communications on the issue between the IRS and the White House.

At least three congressional committees have made similar requests. The House Ways and Means Committee, chaired by GOP Rep. Dave Camp of Michigan, is holding a hearing on the issue Friday and Miller is scheduled to testify.

On Tuesday, Camp and Rep. Sander Levin of Michigan, the top Democrat on the committee, requested a trove of documents from the IRS on the issue.