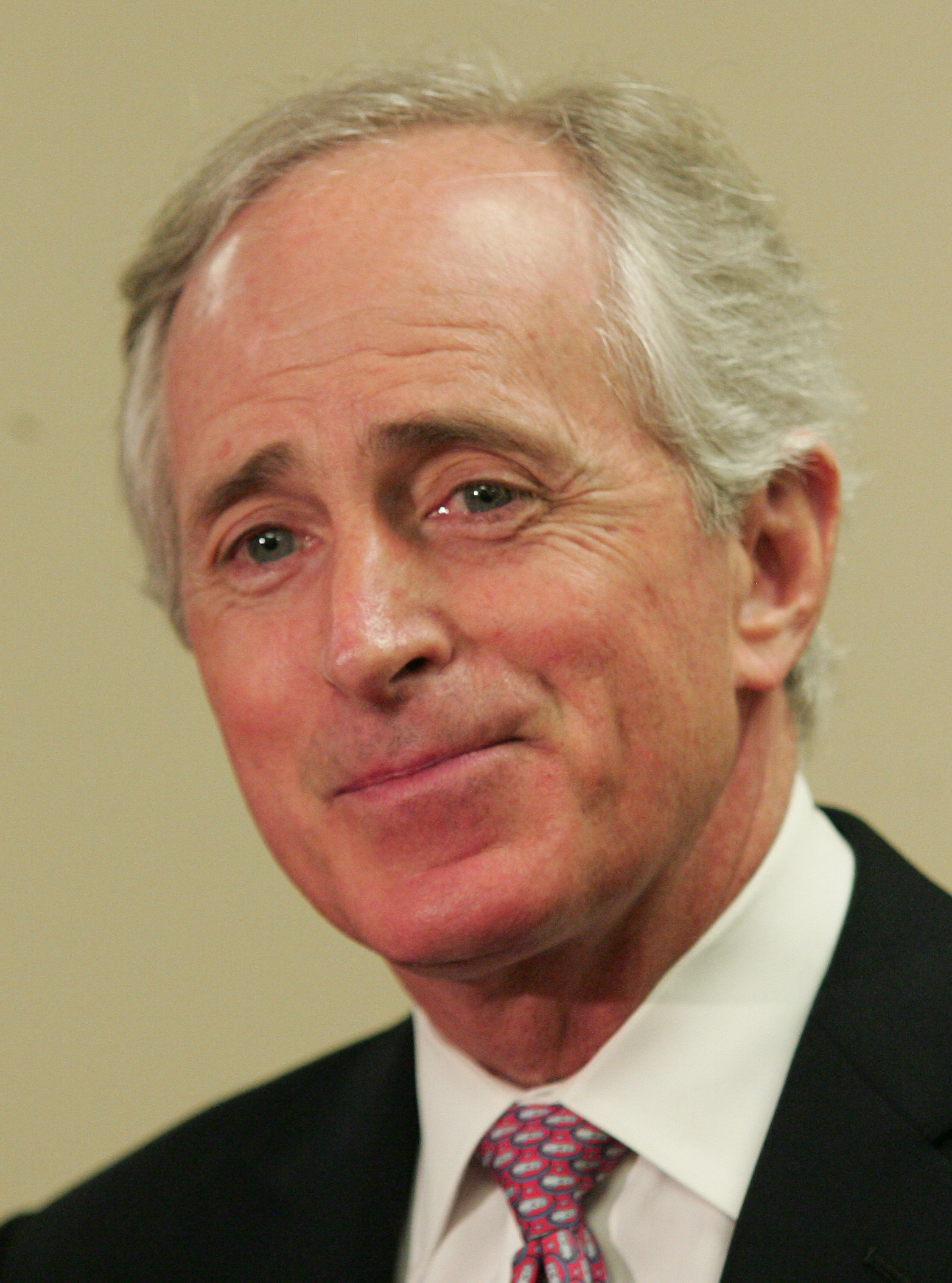

U.S. Sen. Bob Corker, R-Tenn., suggested today that America's central bank needs to get on a healthier, less fattening diet to help put the U.S. economy on a more sustainable path as a new Federal Reserve chairman takes office in 2014.

In an interview with CNBC, Corker said he is likely to oppose the nomination of Federal Reserve Vice Chairwoman Janet Yellen to become Fed chairman. But the Chattanooga Republican still expects she will still likely be confirmed by the Democrat-controlled U.S. Senate as the first woman chairman of the U.S. central bank.

Corker, a member of the Senate Banking Committee who opposed Yellen's nomination to the Federal Reserve Bank in 2010, has criticized Yellen for being too dovish in supporting easy monetary policies at the Fed. Corker wants the Fed to end its $85 billion-a-month bond buying program, which he worries is pumping too much money into the economy and risking a resurgence of inflation or an economic bubble.

"I am more of an "eat your vegetables" kind of guy," Corker said today during an interview on CNBC's Squawk Box. "I'm not a chocolate pie kind of guy and that's where we've been with the Fed for a long, long time."

President Obama is expected today to officially nominate Yellen to replace retiring Fed Chairman Ben Bernanke. But her appointment is subject to Senate confirmation.

Corker said it's still too early to judge the Fed's success with its interest rate reductions and quantitative easing during and after the recent recession. Supporters suggest the Fed's stimulative policy helped avoid an even bigger downturn and fears of inflation have yet to materialize with the consumer price index rising less than 2 percent in the past year.

"The trade is half way on and it's hard to say what the effects will be in the long run," Corker said. "It's kind of like half time in the national championship and we're handing off to a new player. The challenge is moving away from this (third phase of quantitative easing and bond buying by the Fed)."

Corker said Yellen's confirmation hearings this fall in the Senate "will probably be the most enlightening hearing in modern history" as Senators probe the nominee for her views on ending the Fed's bond buying program and ways the Fed will phase out its unprecedented stimulative monetary approach as the economy improves.

"She wasn't someone I could support in 2010 and I doubt that is going to change, but the president looks like he has consolidated his base and I don't know how tough her nomination will actually be," Corker said.

"I want to make sure that she doesn't see herself as an enabler of bad policy from the Congress itself," he said. "This ought to be an interesting hearing and I look forward to learning what her views are, but I've seen nothing to change my view of where she is relative to monetary policy in the past two or three years."