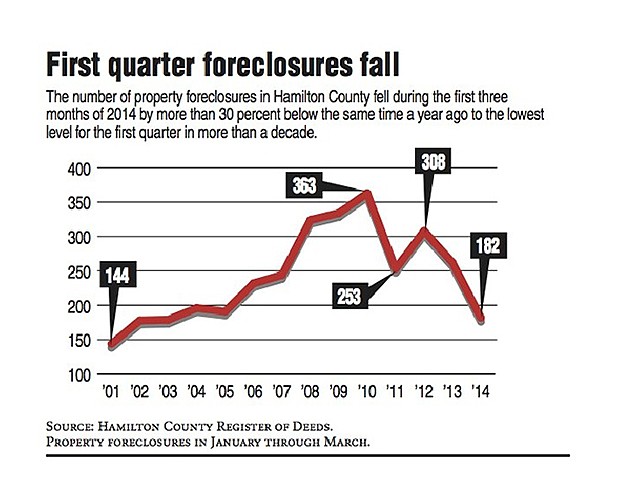

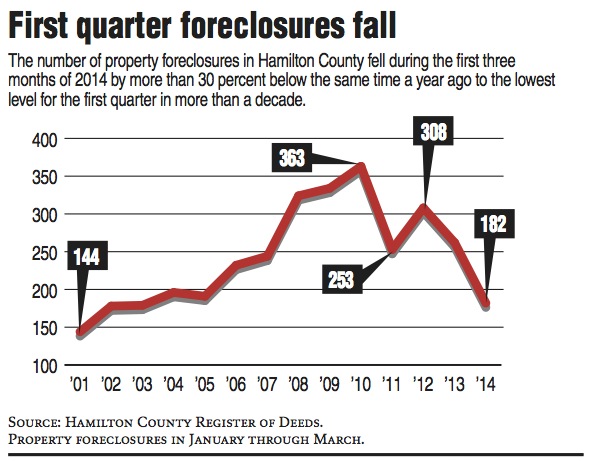

Chattanooga foreclosures drop 30 percent in first quarter

Tuesday, April 29, 2014

In the past decade of peddling foreclosed and distressed properties in Chattanooga, Realtor Travis Shipley said he has never seen the inventory shrink as low as it is now.

"Some foreclosed properties are selling above their listed price because there just aren't that many on the market compared to what we have seen in the past," Shipley said. "The pickings are so slim now that we've had as many as 25 offers for one of our properties."

After nearly five years of recovering home sales and tightened lending standards following the housing collapse in 2008-2009, the number of property foreclosures in Hamilton County during the first quarter of 2014 fell to the lowest level in a decade. Foreclosures were down 30 percent in the first three months of 2014 compared to the same period a year ago, according to filings with the Hamilton County Register of Deeds.

"We're definitely seeing an improved real estate market and home prices are starting to rise as a result," said Henry Glascock, a real estate auctioneer and appraiser in Chattanooga. "The inventory of foreclosed and bank-owned properties is declining and we're seeing more interest from home buyers as well as investors at our auctions these days."

Banks have worked through much of their unsold real estate inventory and more home owners are staying in their homes, aided by a better job market and improved home values and low interest rates to allow for more refinancing options.

At Cornerstone Bank in Chattanooga, for instance, foreclosed assets held by the bank plunged by nearly 41 percent in the past year.

"Now that the foreclosure deluge has dried up, banks are turning their attention back to properties that have been sitting in foreclosure limbo for some time," said Daren Blomquist, vice president at RealtyTrac.

ReatyTrac, an online real estate company that tracks home foreclosures nationwide, said March was the 42nd consecutive month where U.S. foreclosure activity decreased from a year ago, helping to drop first quarter foreclosure activity to the lowest level since the second quarter of 2007. A total of 341,670 U.S. properties had a foreclosure notice in the first quarter, down 3 percent from the previous quarter and down 23 percent from a year ago.

Vicky Trapp, president of the Greater Chattanooga Associaton of Realtors, said the drop in foreclosed properties on the market is helping home prices to maintain or increase in value.

"Definitely, foreclosures are down, which is a very good thing because that means our average home prices will come back up again," she said. "When you have a lot of foreclosures and they are selling $175,000 homes at distressed prices of $40,00 or $50,000 that hurt the prices of all homes."

The National Association of Realtors said Monday the improving housing market helped boost pending home sales last month by 3.4 percent from February - the first such monthly increase in nine months. The pending-sales index covers contracts signed but not closed.

Lawrence Yun, the group's chief economist, said a gain was to be expected after severe weather across much of the nation depressed sales in past months.

"Sales activity is expected to steadily pick up as more inventory reaches the market, and from ongoing job creation in the economy," he said in a statement.

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.