Something for nothing: Volatile bitcoin digital currency gaining support

Sunday, February 16, 2014

WHAT YOU CAN BUY WITH BITCOINAs an emerging form of wealth exchange, bitcoin is still building a community of businesses that accept it for transactions. However, it already is usable for a variety of purchases:[Note: Prices as of Feb. 12, 2014.]• A year's daily subscription to the Chattanooga Times Free Press. (about 0.496 bitcoins).• A Canon EOS 7D Digital SLR Camera and lens bundle from TigerDirect.com. (about 2.537 bitcoins.)• A foot-long sandwich from the Subway franchise in Allentown, Penn. (about 0.007 bitcoins.)• A Pow Skate Snowboard from Zoo York. (about 1.000 bitcoins.)• A tub of The Big Wigg moustache wax from Motown Moustache Wax. (about 0.038 bitcoins.)• An R1 3D Printer from Robo 3D Printers. (about 1.045 bitcoins.)• A case of six bottles of pinot noir from Pyramid Valley Vineyards. (about 0.149 bitcoins.)• A SuperNova Tooth Whitening Kit from NovaWhite on Broad Street. (about 0.245 bitcoins.)• A 65-inch LG 3D LED TV from Overstock.com. (about 8.955 bitcoins.)

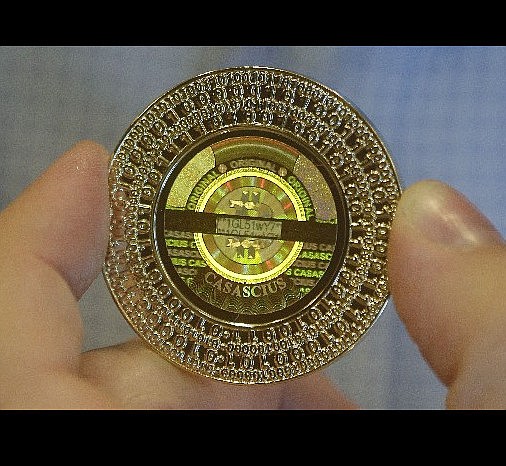

HOW IT WORKSTo those accustomed to traditional currency, a worldwide, non-government-backed, online alternative like bitcoin may seem baffling. Here's a guide to how it works:• Bitcoin is an online payment network whose transactions are dealt in an unregulated, all-digital currency. It was created by an anonymous programmer or group of programmers operating under the pseudonym Satoshi Nakamoto, who released the software and an initial crop of bitcoins to the Internet in January 2009.• New bitcoins are generated by "mining," a process in which software installed on users' computers helps to record and verify recent bitcoin transactions and add them to an official ledger known as a "block chain." Miners occasionally receive new coins as a reward for this contribution to the bitcoin economy.• Bitcoins can be exchanged for real-world currency - and vice versa - via online sites such as MtGox.com or 24Change.com as well as through local, in-person exchanges set up via services such as LocalBitcoins.com.• The value of bitcoins is determined by supply and demand. Compared to traditional currencies, a limited number of bitcoins are in circulation, which has helped to drive prices up dramatically in the last year as more people become aware of it.• New bitcoins are generated (or "discovered") at a fixed rate - currently 25 new coins every 10 minutes, on average - which decreases as more miners join the network. The rate halves over time and will cease entirely once 21 million have been created, at which point miners will continue to earn money through small transaction fees. At this point, about 12.5 million bitcoins are in circulation, and reaching 21 million is estimated to take about 100 years.• Bitcoin users store their coins in digital "wallets," software that can be located on a user's computer, mobile device or on a website. The wallets can be "hot" (Internet-connected) or "cold" (offline). The appeal of the latter is to prevent another user from hacking into the wallet.• Each bitcoin account is assigned a unique online address, and transactions are peer-to-peer exchanges in which a user sends coins from one address to another. Each user authorizes the transaction using a privacy cryptographic key that is unique to them.• Users who worry about the safety of storing their bitcoins digitally can print an access key and online address on a piece of paper (also known as a "paper wallet") or purchase physical bitcoins engraved with a private key.

Economic alchemy is the only way to describe it.

In January 2009, an anonymous programmer or group of programmers operating under the name Satoshi Nakamoto created bitcoin, the world's first digital "cryptocurrency." Having sprung, Athena-like, from the digital ether, bitcoins exist solely online but increasingly have become an accepted form of payment among retailers, both online and off.

As an unregulated currency, bitcoin's value is determined not by a bank but by the growing body of people who have put their faith - and real-world dollars - into it. Last year, rampant demand drove the price of a bitcoin from the tin basement of $13 in January to a golden height of $1,242 on Nov. 29.

Unlike government-sanctioned legal tender such as rupees, euros and British pounds, bitcoins' growth isn't controlled by a centralized institution. They are in a limited supply - currently about 12.5 million are in "circulation" - that grows at a predictable rate determined by a mathematical formula. As a result, bitcoins function as a kind of hybrid of traded commodities like precious metals and "fiat," or faith-based, currencies such as the dollar, which lack intrinsic value.

After its enormous surge late last year, bitcoin prices since have decreased and currently hover at about $670, which is still 50 times its value a year ago. At those prices, the current estimated value of the bitcoin market is more than $8 billion.

Bitcoin's rapid growth may be a sign that it's just another in a long line of bubble markets in imminent danger of popping, says John R. Garrett, a professor of economics at the University of Tennessee at Chattanooga.

"Bitcoin has everyone who is a professional economist either perplexed or opinionated about it, and the opinions are running, I'd say, pretty negatively," says Garrett, who specializes in monetary theory and financial market structure and regulation.

"[Bitcoin] looks like it falls under the category of a classic speculative outbreak, which are very common throughout history."

Garrett likened the bitcoin boom to that of the so-called "Tulip Mania" of the 17th century, when the flowers became so explosively popular in the Netherlands that a single bulb could sell for a decade's worth of wages earned by a skilled laborer.

While bitcoin has yet to reach such astronomically high levels, Garrett's concerns are echoed by others in the financial sector. Economic analyst Jesse Colombo suggested in a Dec. 19 article for Forbes.com that bitcoin's meteoric rise could be a sign of its undoing.

"Eventually, greed became the dominant driver ... as speculators clamored in to take advantage of the price mania," Colombo wrote. "No matter how virtuous the underlying market is, greed-driven manias always end the same way - with a price implosion."

A MATTER OF FAITH

Despite its naysayers, bitcoin is gaining some legitimacy as more people become aware of what it is and how it can be used.

After years of being criticized as a currency that couldn't buy anything, bitcoin now is accepted by a number of major online retailers, including TigerDirect.com and Overstock.com. In the first 24 hours after Overstock began accepting bitcoins, users spent about $130,000 worth of the digital currency on 840 orders, according to a tweet by Overstock CEO Patrick M. Byrne.

Locally, bitcoin is spinning its wheels a bit more. According to Coinmap.org, which locates businesses that are bitcoin-friendly, only three Chattanooga companies accept the digital currency: NovaWhite Teeth Whitening on Broad Street, website design company Nooga Labs on Tremont Street and the Chattanooga Times Free Press.

"We saw that bitcoin was becoming a cultural phenomenon, one that our own development team had been watching and talking about for some time," says Times Free Press IT Director Micah Young. "We also thought it would have some level of cool ... but we don't expect it to become the way most people pay for their subscriptions."

The cachet of cool associated with being an early bitcoin supporter also fueled its adoption by Nooga Labs owner David Hunter.

Based on its rapid rise in price, however, Hunter says he wishes he'd moved more quickly. When he first became aware of bitcoin more than a year ago, prices were still at about $8 or $9, but when bought his first coin last spring, he paid $200.

"I hadn't been paying it much attention," he says, laughing at the cost of his procrastination. "In April or March, it had its first boom and went from $20 to about $100, and that got my attention."

Hunter says he's not concerned by the current lack of bitcoin support in the Gig City. If anything, he says, it has helped him to stand out.

About three months ago, he posted to online social news site Reddit that he would begin accepting bitcoins for his work. The post attracted attention from clients in Chicago, California and Australia. Only one of them, the Californians, paid in bitcoins, but the others cited his support for the currency when they reached out to him.

Even if the move hadn't drummed up new business, Hunter says he would still accept the currency because he thinks it offers many benefits over payments made through major credit cards and PayPal, including lower transaction fees and the ability to transfer money to anyone in the world for next to nothing.

Besides, he adds, he has faith in it.

"Bitcoin is insanely new so the average American, if they've heard of it, have only heard about it through the media and haven't dug into it themselves," Hunter says. "I think it will continue to grow. It's had its ups and downs, but I believe, long term, the value will be there over the next four or five years."

DIGITAL DEALING

Those like Hunter who are invested in the digital economy point to the ability to exchange their bitcoins for real currency - transferred to their bank account - as security against losing money by accepting them.

Exchanges between bitcoin users can be done purely online via exchanges such as MtGox.com or arranged in person via local dealers. LocalBitcoins.com currently lists two bitcoin dealers in Chattanooga. Matt Josef is one of them.

A mechanical engineer by day, Josef says he became interested in bitcoins after reading an article about them. Last summer, he bought his first coin for $200 from a dealer in Washington, D.C., whom he found on LocalBitcoin.com.

At first, Josef was selling his coins on the major online exchanges but recently began offering his services locally to Chattanoogans. So far, he says, the business isn't brisk. Earlier this week, he sold a bitcoin for $720. It was his first in-person sale in weeks.

But bitcoin adoption is just a matter of time, he says.

"Every day, [new] businesses are accepting it. I'm almost positive it's going to be around for a long time," he says. "It's payment freedom.

"Just yesterday, I went to transfer some money into my bank account from a broker's account, and it takes four days. I was like, 'Why does it take so long? It should be instant, like bitcoin.' You control your own money. I like that aspect of it."

IN THEIR SIGHTS

In the short amount of time bitcoin has been in the public eye, it has been heavily critiqued, its every success and misstep analyzed and covered by the media.

Largely due to its anonymity and lack of government oversight or regulation, bitcoin was a popular payment method on Silk Road, an online black market for illegal drugs that was shut down by the FBI in October. During their investigation of the site, authorities seized about 30,000 bitcoins, a cache currently worth about $19.5 million.

As a purely digital currency, bitcoin occupies a gray area in many countries, which are struggling on whether to address it and how to regulate it. Some, such as Germany, Singapore and Japan, have chosen not to regulate bitcoin dealers and exchanges by requiring them to register for business licenses.

In the U.S., bitcoin is seeing some governmental support. Last November, officials with the Financial Crimes Enforcement Network, U.S. Department of Justice and Secret Service spoke in favor of bitcoin at a congressional hearing, arguing that it had "legitimate uses," that traditional currencies were still more appealing than virtual ones for conducting illicit activities, and that regulation could actually push its growth overseas or underground.

Some countries, however, are worried by the implications for virtual currency. In December, China tightened the reins and issued a ban preventing its banks from taking part in bitcoin transactions, citing concerns of money laundering and a desire to safeguard the official state currency: the renminbi (also known as the yuan). Russia, too, has issued an outright ban of bitcoin, also citing concerns that it could be used for money laundering and for financing terrorism.

BEAR? BULL? BUCKING BRONCO?

Another major criticism of bitcoin is actually the one that helped it gain so much attention in the mainstream: its rollercoaster-like rise and fall in value.

On Feb. 7, major online bitcoin exchange MtGox.com ceased withdrawals for several hours after discovering a bug in the way transactions were processed that could allow a user to spend their coins twice, the equivalent of bitcoin counterfeiting. The cessation caused the price of bitcoins to plummet 35 percent from $831 on Feb. 6 to $538 on Feb. 10. On Wednesday, Bitstamp, another major bitcoin exchange, also ceased withdrawals, citing the same glitch.

Informal bitcoin oversight group The Bitcoin Foundation issued a statement that "transaction malleability" has been a known issue since 2011 and that a fix is in the works, but the instability is troubling to economists. The market for bitcoins, UTC's Garrett says, appears to be less bear or bull than bucking bronco.

"Bitcoin looks kind of flimsy because the theory of money is that money has to have stable value if you want to use it as currency, and this clearly has unstable value from day to day and week to week," he says.

In normal currency markets, Garrett says, a change of just a few percentage points in the value of the dollar to the euro would make headlines on financial services around the world. Bitcoin's value can sometimes experience that degree of fluctuation in 90 minutes or less. That lack of stability is one of the primary reasons why economists say bitcoin isn't likely to take over for established currencies any time soon.

"The problem is that some people in [the bitcoin] market ... buy a lot of the available supply, which tends to drive the price higher," says Sebastian Galy, a currency strategist with French banking and financial services company Societe Generale, in a Feb. 10 interview with CNN Money.

"The price rises very brutally because of a limited supply," he adds. "It's really a function of the way they created that market; it's very artificial."

As a still-developing form of wealth exchange, bitcoins are appealing to some, just not economists, Garrett says.

"There are a lot of people in the modern libertarian and anarchist wing, which is quite popular among students, for example, who want to have everything divorced from any form of government," he says. "That, I suppose, would make bitcoin attractive to them."

Bitcoins early adopters say reaping its rewards means being willing to tough it out through the highs and lows. Given time, they say, the market hopefully will reach an equilibrium and speculation will dwindle, but it's hard to predict when that might happen.

"As people become more informed, they'll realize what bitcoin is and the larger picture as it continues to grow," Hunter says. "I don't think any of us know how bitcoin is going to evolve and develop.

"We're all speculating."

Contact Casey Phillips at cphillips@timesfree press.com or 423-757-6205.