VIEW MORE

Read the report.

You can get a lot of house for not a lot of money in northern parts of Alabama and Georgia.

That's a general way to put it, and in some cases the homes are dirt cheap and kind of look that way. Wooden stumps prop up air conditioners. Ceilings bulge with water damage, and the rooms they (almost) cover smell of mold. Wallpaper peels away from half-century-old walls.

But still, some beauties are for sale in Jackson County, Ala., and Chattooga County, Ga., the most affordable places to live in the United States, according to RealtyTrac, the real estate data company. They look just as lovely and have just as much to offer as their counterparts in more expensive locations throughout the nation - or even a few counties away.

That said, though, those who live in them might travel a couple dozen miles for work or a night of fine dining.

An immaculate four-bedroom, two-bathroom brick-and-stucco house with newly installed slate floors and oak cabinets is on the market for $99,900 in Bridgeport, Ala. It's listed for more than the median home sale price in Jackson County this spring - an astonishing $22,195 - but less than the median during spring three years ago, still low at $118,000.

Tip the shopping scales toward the cheaper end of Jackson County's market, and buyers can contemplate a $35,000 serious fix-me-upper from the 1940s with one closet and worn orange carpet - but it's sitting on more than an acre and has a secluded backyard.

"This is dated," real estate agent Becky Hamblin said. "I've had a few people interested."

In Chattooga County, the median sales price this spring was a scant $20,000, even less than in Jackson County. If buyers go that low, they are probably investors looking to add life to a skeleton of a house, then resell it, real estate agents said.

To wit: $26,900 is the price tag for a three-bedroom, one-bathroom vinyl-sided house of 1,176 square feet on an acre in Summerville, Ga. For that sum, a buyer gets walls, a roof and floors - though some are sagging from water damage. There's pretty much nothing else to the structure, and most of what's there needs to be overhauled. But the location is quiet and one mile from the local high school.

"This isn't a horrible place to live," said Realtor Michelle Meacham. Her prediction: An investor will buy it, put about as much money into improvements and then sell it for double his cost.

In early September, only three homes in Chattooga County were on the market for less than $39,000. Under $40,000 you "get some funky stuff," said Dwayne Richardson of Henderson Real Estate, in Summerville. The most expensive, an equestrian estate in Lyerly, was listed for $799,000.

But if you get closer to median sales prices in Chattooga County for the past few years, about $50,000, quaint and livable homes are there for the taking. Richardson estimated his average sales price has been about $55,000. For close to that sum, you can get almost 1,000 square feet, remodeled, with two bedrooms and one bathroom in a tree-lined neighborhood in Summerville. The white-faced home has an open format and the feel of a summer cottage.

"It looks a little bigger than it really is," Richardson said.

RealtyTrac's methodology to come up with affordability rates that shot Jackson and Chattooga counties to the top was fairly simple. The affordability rate is the percentage of median household income required to make monthly house payments on a median-priced home. The lower the rate, the better.

RealtyTrac included sales prices for houses, condominiums and townhouses, even if they were foreclosures. Sales for undeveloped lots and valuations for homes custom built on them were not. RealtyTrac assumed buyers made a 20 percent down payment, had a 30-year fixed-rate mortgage based on rates from Freddie Mac and that insurance combined with property tax would be 1.39 percent of the value of the home, which is the national average.

The historical affordability rate, going back four years, for Chattooga County was about 7 percent. For Jackson County it was 16 percent. The nationwide rate, which in many counties went back to 2000, was 19 percent. For Hamilton County, going back that far, it was 17 percent. (RealtyTrac could not get data for all months in all counties.)

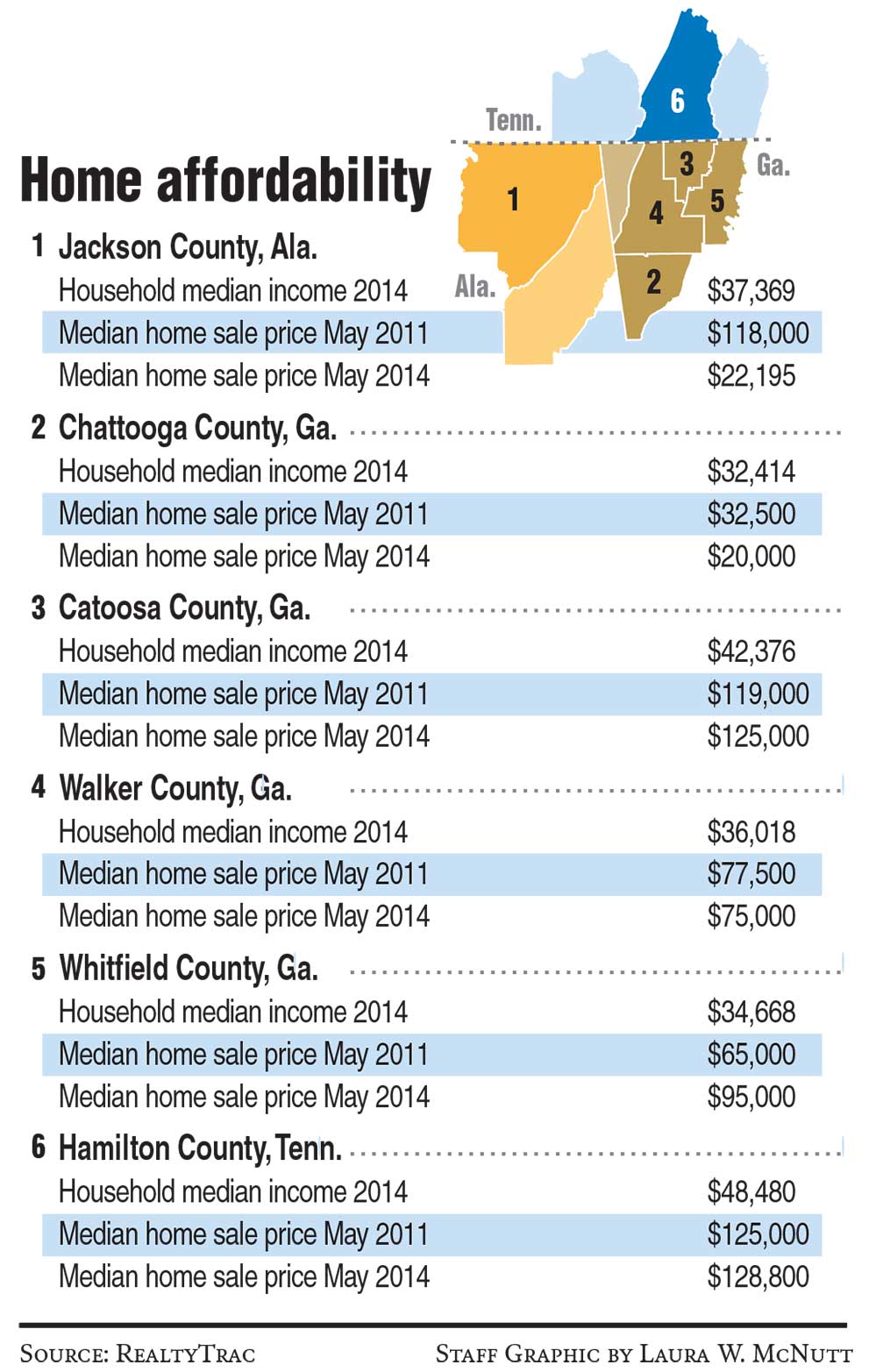

Looking at just this past spring, May in particular, Jackson County had the absolute lowest rate nationwide, 3.6 percent, and Chattooga County was right behind at 3.75 percent. Jackson County's median household income for 2014 was $37,369, and Chattooga County's was $32,414.

Still, the bargains are not all that known, coast to coast. In comparison, the median sale price of homes in Hamilton County, Tenn., has been about $128,000 for the past few years. Its May 2014 affordability rate was 16 percent.

"I haven't had anybody call and say, 'I want to move here because it's cheap,' " Richardson said.

Most moving to Chattooga County are retirees, and many out-of-towners opt to buy land and build on it, particularly if they have more than $200,000 to spend, real estate agents said. Summerville, the county seat, is about 35 miles from a highway. The city of about 4,500 has some commerce: CVS, a Subway sandwich shop, Edward Jones. Mount Vernon, in nearby Trion, employs some residents.

"We've got fast food, a slower pace, and a good cost of living," said Rick Wyatt, who owns a namesake real estate agency in the city.

Still, "there's not a lot of young people people moving in," said Wyatt, a Chattooga County native. "That's a fact."

Same goes for Jackson County, real estate agents said.

"A lot of people grew up here and stayed and think the kids will move back, but they don't," Hamblin said.

Hamblin herself, though, is a perfect example of someone typically moving to these affordable counties. Internet searches led her to potential homes in North and South Carolina. "We'd been looking all over," she said. Then she came across Bridgeport. Her brother lived in Jasper, Ala.

"You can't beat the taxes, and it's not far from Chattanooga," he told her.

In 2007, Hamblin, 60, and her retired husband bought a 2,300-square-foot house in Bridgeport with five bedrooms, three bathrooms and an attached three-bay garage on almost an acre for $165,000. Homes in her subdivision range from $150,000 to $300,000 these days.

"We downsized," she joked. The couple moved from Daytona Beach, Fla., where they had lived in a 2,000-square-foot house with three bedrooms and two bathrooms on lot a fraction the size of their Alabama one.

In Florida they paid $1,900 in annual property taxes, compared with $400 now. Homeowner's insurance in Florida was $2,400, compared with $800 now. The utility bill is less than a quarter of what it used to be. Which is all to say, the cost of living also made Jackson County more affordable.

"I can't get over it," Hamblin said.

Contact staff writer Mitra Malek at mmalek@timesfreepress.com or 423-757-6406.