NASHVILLE - Tennessee members of the National Federation of Independent Business are giving "decidedly mixed" reviews regarding Republican Gov. Bill Haslam's proposed IMPROVE Act, which seeks an increase in state gas and diesel taxes coupled with tax cuts in non-highway fund sources of revenue.

Jim Brown, NFIB-Tennessee's state director, said in a news release that when members of the independent business group surveyed members this month, "there really was no clear consensus, at least on the question of a tax increase."

According to Brown, 55 percent of members responding to the survey were opposed to Haslam's call for boosting gas taxes by 7 cents per gallon and diesel by 12 cents. Forty percent said they supported it while 5 percent were undecided.

But survey respondents were more definitive about the proposal to "index" future gas tax increases to changes in the Consumer Price Index, Brown said. Seventy-five percent of respondents oppose, while 19 percent support, and 5 percent are undecided.

"Small business is decidedly mixed about the IMPROVE Act," Brown said. "Small business owners, though, are clearly opposed to indexing because they believe it would bypass future legislatures and increase revenues automatically without making the case for specific infrastructure needs."

The Tennessee Chamber of Commerce & Industry, meanwhile, recently said it backs "moderate fuel and diesel tax increases" with a number of "stipulations." The list includes Tennessee's continued practice of funding highway and bridge maintenance and new construction on a "pay as you go" basis without issuing bonded indebtedness.

Other Tennessee Chamber position is the state utilize existing revenue surpluses in the general fund in areas like corporate taxes and sales taxes to "extend certain responsible offsets to any fuel tax increases by extending tax relief to businesses and manufacturers."

Haslam says his plan does that by moving to cut the state's 5 percent sales tax on grocery food sales by a half percentage point, cutting corporate franchise and excise taxes on manufacturers and accelerating the phase out of an existing tax on personal interest and dividend income.

If approved by the General Assembly, Haslam's plan would be Tennessee's first fuel tax increase since 1989.

The governor says the state's 21.4 cents per gallon on gas and 18.4 cents on diesel isn't enough to get the job done in today's world with existing levies worth half or less than they were nearly 28 years ago due to inflation. Meanwhile, Haslam says, construction costs and a growing population have put strains on the system.

Haslam said additional revenues are needed to tackle an estimated $10.5 billion backlog of projects, including a number road and bridge projects in Southeast Tennessee.

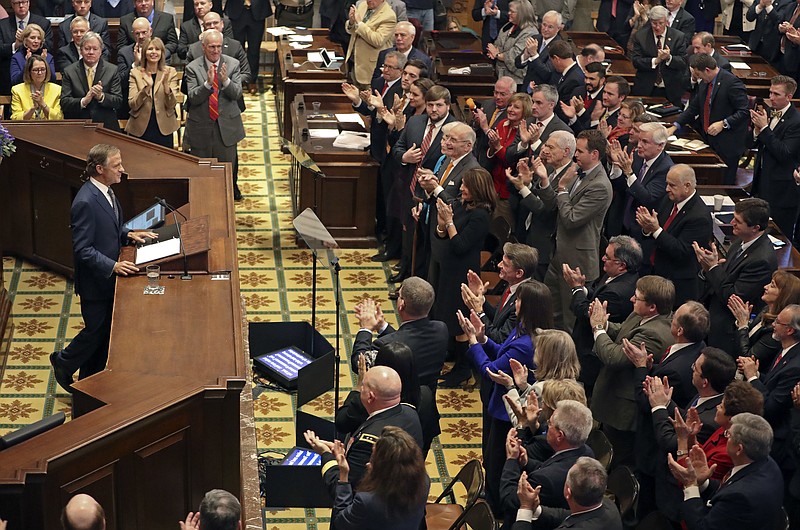

The governor's approach is scheduled to come up for a presentation Tuesday before the House Transportation Committee.

Brown said a few parts of Haslam's proposal registered modest or mixed support.

- Sixty-two percent support the proposed $100 annual fee on electric vehicles and increasing charges on vehicles using alternative fuels, while 30 percent oppose.

- Fifty-four percent support a 3 percent charge on rental vehicles while 35 percent oppose.

- Fifty-three percent support a $5 increase in the car registration fee, while 42 percent oppose.

- Fifty-two percent support a local government referendum option to impose a sales-tax surcharge used solely for public transit projects, while 36 percent oppose.