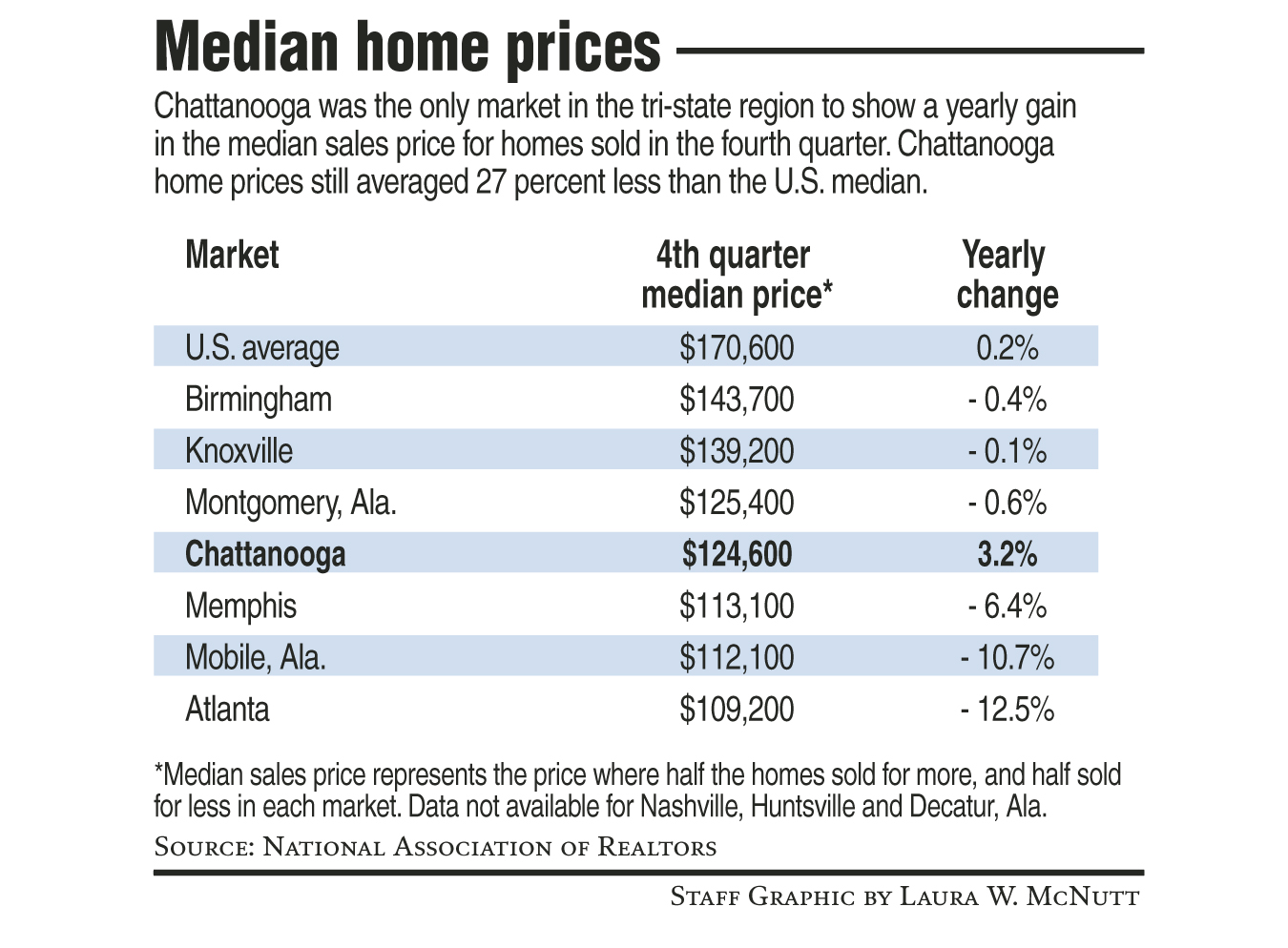

Despite a year-end drop in housing sales, Chattanooga was the only market in Tennessee, Georgia or Alabama to show an increase in the median price of single-family homes sold in the fourth quarter of 2010.

The National Association of Realtors reported Thursday that the median home price in Chattanooga rose 3.2 percent in the past year to $124,600, reversing a 3-year decline in local home prices.

The fourth quarter gain in Chattanooga easily exceeded the modest 0.2 percent yearly increase in home prices nationwide, although the median price of homes in Chattanooga still remained 27 percent below the U.S. median price of $170,600.

"Home prices have begun to stabilize or even increase slightly, so hopefully the worst of the decline is behind us," said Jennifer Grayson, president of the Chattanooga Association of Realtors.

Home prices rose despite a drop in sales in the fourth quarter for Chattanooga Realtors. In the final three months of 2010, Realtor-assisted sales in the Chattanooga area totaled 1,258 homes, down nearly 18 percent from a year ago.

The average home in Chattanooga was on the market for 136 days in the fourth quarter of 2010, or 16 more days than in the same period a year earlier, according to figures released Thursday by the Chattanooga Association of Realtors.

Tax credits for first-time home buyers and historically low mortgage rates boosted home sales in early 2010, but the housing market slowed by year end, Grayson said.

"As the year progressed, we knew that the expiration of the tax credit would mean a decrease in sales, but we had hoped for a less severe decline than what has actually taken place," she said.

Dan Griess, president of the Chattanooga Multiple Listing Service, said Realtors "are still very hopeful that we've seen the worst, and that an economic breakthrough is not too far away on the horizon.

"But like a complex math equation, so many diverse elements must come into play economically, politically and socially within a framework of a slowly recovering business environment to get our industry back on a consistently positive track," he said.

Grayson said Realtors will work to fight proposals like what was proposed by the National Commission on Fiscal Responsibility and Reform to limit the mortgage interest rate deduction.

The interest paid on home mortgages is now deductible from federal income for people who itemize their taxes. Critics of the mortgage deduction claim its $130 billion cost benefits primarily wealthier Americans.

But Grayson said ending the deduction could reduce property values for all Americans.

"That could severely hurt home values and damage our industry just as we are beginning to see some signs of improvement," she said.

Follow Dave Flessner on Twitter by following this link.