The market value of Chattanooga's stock-traded companies increased by more than $4 billion in the first quarter of the year as investors confident in the economic recovery continued to bid up stock prices.

The Standard & Poor's 500 stock index, one of the most widely followed benchmarks for the overall market, ended the first quarter last week at a record high, surpassing its previous record set in 2007 before the economic collapse. The S&P 500 close last week at 1562.15 brought the gains for the stock index to more than 9.7 percent so far this year. The Dow Jones Industrials Average, which eclipsed its previous 2007 record high three weeks ago, ended the quarter up 11.2 percent. The winter gains for the 30-stock Dow index are the best start of any year since 1968.

"The market probably is a bit ahead of itself in the short term, but economic conditions have clearly improved and company balance sheets are the best they have been in a long time," said Mickey Robbins, portfolio manager for the Chattanooga investment firm of Patten & Patten. "There's also the old adage not to fight the Fed, and in this case, you also don't want to fight the central banks in Europe and Asia."

With interest rates hovering near record lows, investors are drawn to the equity markets to gain some return on their savings. Economists expect that low borrowing costs, combined with the greater paper worth of those with stock holdings, should give the recovering economy an extra jolt of economic confidence, which should propel even more growth. Higher stock values also give companies more equity to buy and invest in new business ventures.

"Even if you don't own stock, these highly publicized market highs help consumer confidence," said David Penn, director of the Business and Economic Research Center at Middle Tennessee State University. "You see these gains in the stock market every day and it makes you feel better about the economy and more willing to spend money."

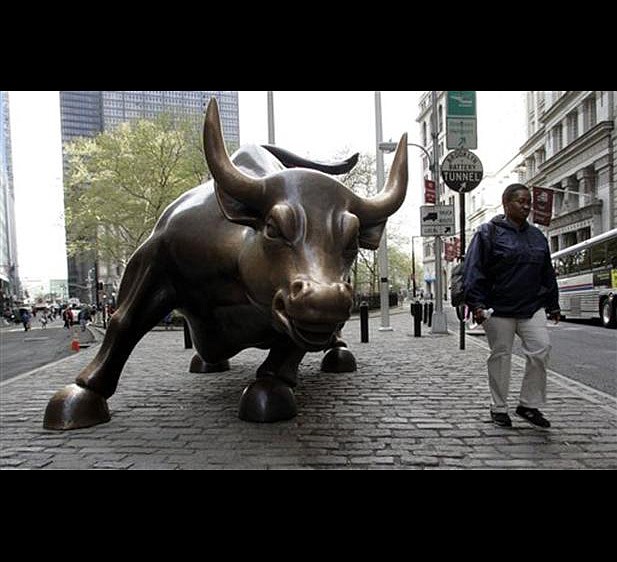

The bull market rally so far this year offers more evidence that investors believe the economy is on the mend, said Sam Stovall, chief equity strategist at S&P Capital IQ.

"The low-flying recovery is gaining altitude," Stovall said, citing a truism among investors that rising stock prices come first, then the economy catches up.

But while the U.S. economy is growing, employment growth has been anemic. Unemployment is 7.7 percent, versus 4.7 percent, the last time the S&P notched a record. The European debt crisis is far from resolved. And some investors are concerned that the market's gains are being fueled by the Federal Reserve's easy money policy and will disappear once the Fed reverses course.

"If you're a bull or a bear, you could find enough news out there to convince you of your position," said Jim Lauder, CEO of Global Index Advisors in Marietta, Ga., and co-portfolio manager on Wells Fargo Advantage Dow Jones Target Date Funds.

Investors are bullish on Chattanooga's biggest companies, most of which outperformed the broader market in the first quarter.

Unum Corp., the world's biggest disability insurer and Chattanooga's biggest publicly traded company, added more than $2 billion of market value in the first three months of the year. Unum's stock price soared by 36.5 percent in the first quarter to close at its highest level since the spring of 2001. With the economy on the mend and investment returns improving for the company's nearly $50 billion investment portfolio, Unum's earnings rose 5.7 percent last year and analysts are expecting similar gains this year.

The biggest market gainer among local companies in the first three months was the Chattanooga-based Dixie Group. The stock price of the carpet manufacturer jumped by nearly 71 percent in the first quarter as investors saw signs of the housing recovery and a turnaround in Dixie's earnings performance.

Mohawk Industries, the world's biggest floorcovering company based in Calhoun, Ga., enjoyed a 25 percent jump in its stock price during the first quarter.

Other local companies outperforming the market so far this year include First Security Group, the Chattanooga bank holding company which announced a recapitalization plan earlier this month, and CBL & Associates Properties Inc., the shopping center firm that is benefiting by improving sales and property values.

Stock prices rose for all eight of the biggest publicly traded companies with headquarters in the Chattanooga area.

"Stocks are not cheap, but they are not necessarily expensive either," Robbins said. "There are certainly reasons to worry, but America's increasing energy self-sufficiency and technology innovation seems to be sparking a real manufacturing renaissance that bodes well for our economic future."

The Associated Press contributed to this report.

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.