Wall Street wrapped up its sixth consecutive quarter of higher stock prices on Monday - the longest streak for stock market gains in 14 years.

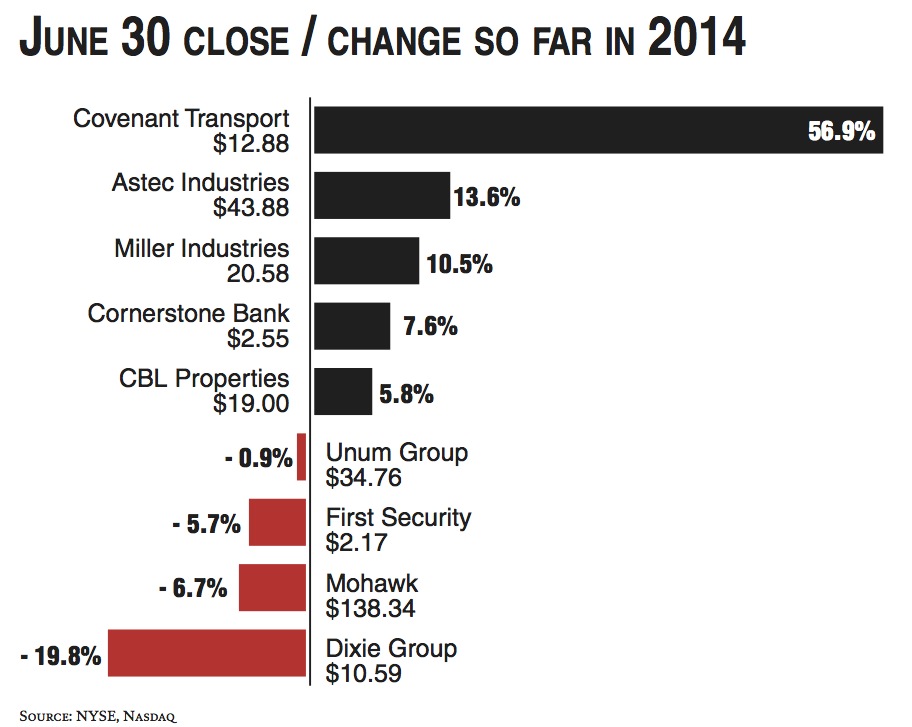

Only half of Chattanooga's publicly traded stocks showed increases in the first half of the year. But investing in trucking and industrial companies in Chattanooga so far this year has proven profitable for many investors.

At the midpoint of 2014, shares in trucking giant Covenant Transport have jumped nearly 57 percent so far this year after Covenant bounced back some from its prevous market decines. Paving equipment maker Astec Industries and wrecker maker Miller Industries also had double-digit gains in the first six months of the year.

Despite those gains outpacing the overall market, two of the region's biggest publicly traded companies -- Unum Group and Mohawk Industries -- showed market declines in the first half of 2014 after strong gains through 2013.

After the S&P 500's 30 percent gain last year, many investors had expected a halt to an equity bull market that is now in its fifth year.

But the Nasdaq has now recorded its longest streak of quarterly gains since 2000. For the S&P 500, this is the best run of quarterly gains since 1998. The Dow also marked its fifth positive quarter of the last six.

"We are overextended in the short term, and I do see a bit of a near-term correction, but the dips are seen as opportunities to put cash to work," Randy Frederick, managing director of trading and derivatives at the Schwab Center for Financial Research in Austin, Texas, told Reuters news service. "I think the third quarter of the year will be very much like what we just experienced, which is not that much of a move, and I see volatility picking up from the last quarter of the year."

The S&P 500 set 22 record closing highs so far this year, which has increased concerns among some investors that the market might be due for a technical pullback. Yet the CBOE Volatility Index .VIX, Wall Street's fear gauge, has held near multi-year lows.

A recent Reuters poll showed market participants expect the benchmark S&P 500 to hit 2,000 for the first time before the year ends. That milestone would mark a gain of about 8.2 percent from 2013.

For the second quarter, the Dow gained 2.2 percent, the S&P 500 rose 4.7 percent and the Nasdaq shot up 5 percent.

For the first half of the year, the Dow rose 1.5 percent while the S&P 500 jumped 6.1 percent and the Nasdaq climbed 5.5 percent.