Edna Weekley is 92.

For the past 11 years, she's lived in Creekside at Shallowford, in independent living. When she moved in in 2003, Weekley paid $2,600 in monthly rent, which included a once-a-week cleaning visit by Creekside staff and all her meals.

She loves living there.

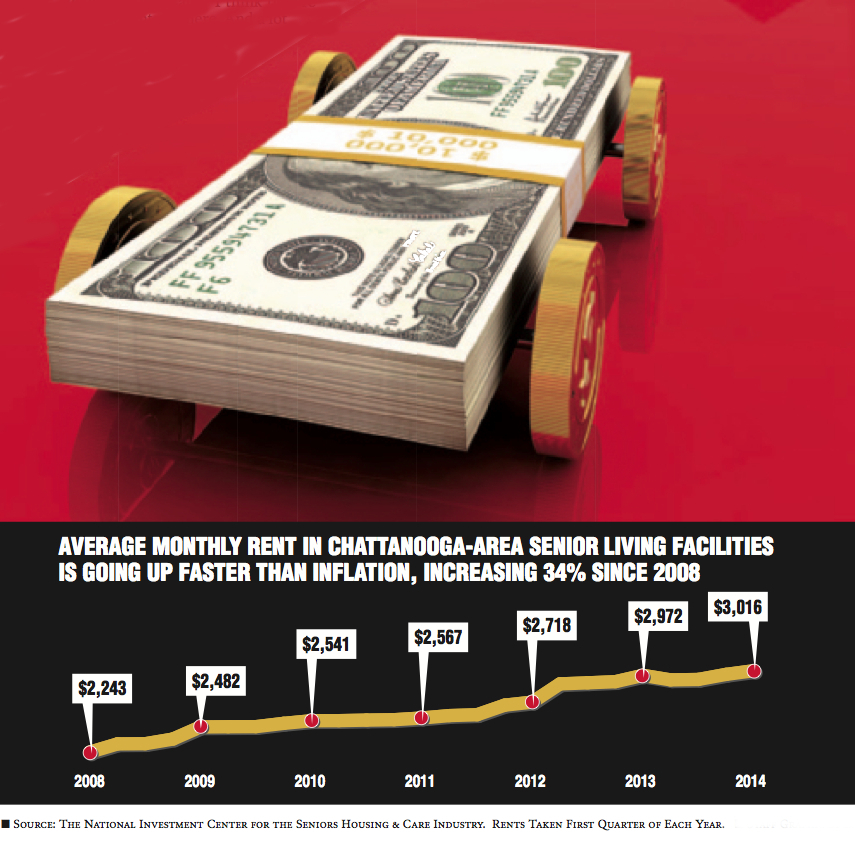

But over the years, the rent has gone up and up, even faster than inflation. $2,700, $2,800, $2,900, $3,200, $3,400. In December 2013, Creekside sent Weekley a letter stating that her monthly rent in 2014 would be $3,600.

That's when her daughter, Sherry Church, jumped in. Based on the consumer price index, she negotiated a 1.5 percent increase instead of the 4.6 percent increase Creekside initially demanded. They settled at $3,466 a month.

"I think they assume they can just raise this and what can you do? These people are in their 80s and 90s. Are they going to move again?" Church said. "I think they're taking advantage there. And a lot of people don't know to fight that."

But it's not just Creekside. Rents at senior living facilities are going up across Chattanooga and across the nation, the rise driven in the Tennessee Valley by increased demand, plateauing supply and high occupancy rates.

Rodney Harrell, senior strategic policy advisor at the AARP, said Weekley's experience is not unique.

"That basic story is happening in places all over the country," he said. "Housing costs are going up, and people's incomes just aren't rising to match that. And sometimes the owner of the building is dealing with higher property taxes on their side."

In 2000, 40 percent of Tennessee renters ages 50 and older were paying at least 30 percent of their household income on housing, Harrell said. By 2009 -- the most recent data the AARP has collected -- that had jumped to 47 percent.

A full 25 percent of 50-plus renters in Tennessee were spending half of their income on housing in 2009.

"Everything that I'm seeing, on the national level, shows that these rises are going to continue," Harrell said. "There have been slights ups and downs over the years in rents, but the overall path is they're getting more and more expensive."

A major driver of the rising prices is occupancy rates at senior living facilities, which are especially high in the North Georgia and the Chattanooga area, according to the National Investment Center for the Seniors Housing & Care Industry.

Nationally, most senior living facilities are about 90 percent occupied, senior research analyst Chris McGraw said. Chattanooga's average is slightly higher, at 91.6 percent. But Alexian Village is 95 percent full and Creekside is 96.7 percent occupied, facility managers said.

The NIC tracks 24 assisted living, independent living and continued-care retirement communities in North Georgia and the Chattanooga region. And McGraw said the area's market has been strong since 2010.

"Current occupancy is above where it was pre-recession," he said. "So it's fully recovered as far as occupancy is related. Higher occupancy is indicative of a tight market, and tighter markets mean there are generally less [price] concessions because demand is high."

Church said the almost 5 percent hike at her mother's place felt like a strong arm from Creekside, perhaps a push to move her mom out in order to bring in a new resident and charge more. But manager Tom Winfree said the annual rate increases aren't targeted at any one resident.

"Our home office does a market analysis of all the communities in Chattanooga, and that's how they determine the rate increase each year," he said.

Winfree added that Creekside's 300 nationwide locations have just started a new program that allows residents to freeze their monthly rent rate for life. Residents in any facility that is more than 95 percent occupied can choose to pay a one-time fee that's equal to a month's rent in order to freeze their rate for life.

"All these communities go up 3 to 4 percent a year with electricity and food, this is something that is going over really well with our company worldwide," Winfree said.

Church said her mom won't have a problem paying this year's higher rent -- thanks to Church's late-father's investments and pension -- but there are steps more cash-strapped seniors can take to mitigate rising rents.

First, seniors can try to sign longer-term leases, Harrell said. Property owners are often willing to trade the stability of a long lease for a lower monthly rent. And planning is key, he added. Try to anticipate rising costs.

Kim Goodwin, regional marketing and sales director at Alexian Village, said it's also important for seniors to understand exactly what is and isn't covered under the monthly fee.

"Find out the specifics about what's included and what is extra that they would be charged for," she said.

She added seniors should look for facilities with audited financial statements, and check to see whether the facility has a positive cash flow.

Another solution is to look at a wide range of living arrangements -- anything from living at home with an aide to moving in with a younger person -- before making a commitment, Harrell said.

"Living in a place that doesn't meet your needs can cost you a lot in other ways, besides rent," he said. "Rent is not the only bottom line."

Contact staff writer Shelly Bradbury at 423-757-6525 or sbradbury@timesfreepress.com with tips and story ideas.