Chattanooga's highest-paid CEO earned a record high $13.3 million in his final year as head of the city's biggest publicly traded company, helping to boost the average pay for the top bosses of Chattanooga's publicly traded companies by more than 16 percent during 2014.

But only half of the CEOs of Chattanooga's top companies got raises last year, according to company proxy statements filed this spring ahead of company shareholder meetings. The change in CEOs at some companies, and improved stock prices and company earnings combined to boost the pay for some but cut the compensation packages for just as many others in the corner office last year.

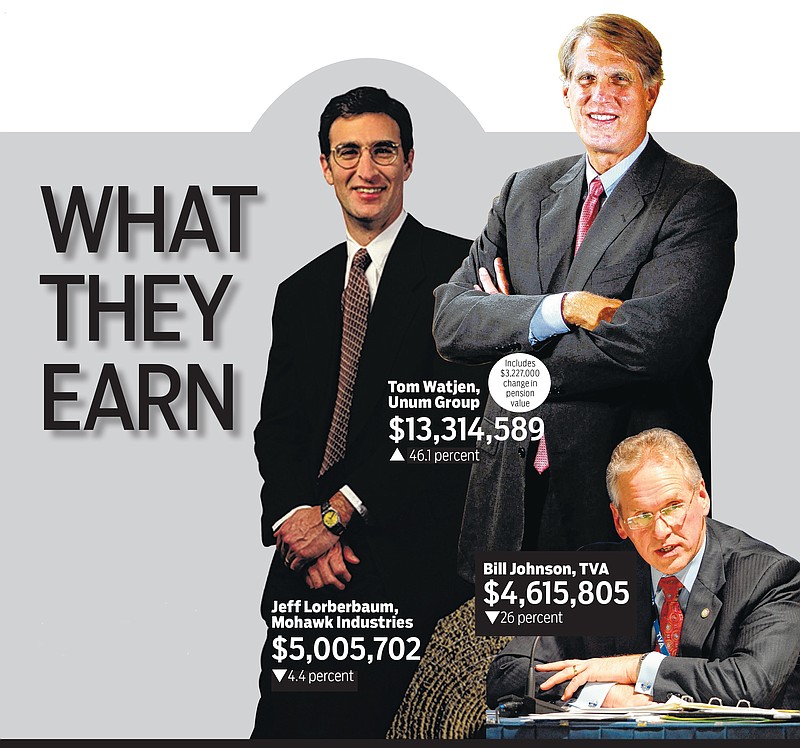

Tom Watjen, the 59-year-old chairman of the Unum Group who will step down as the company's CEO in May, received a 46.1 percent increase in his total compensation package last year during his final year as head of the world's biggest disability insurer. The $13.3 million compensation package for Watjen -- the biggest yearly pay ever for a Chattanooga CEO -- included more than $3.2 million from a gain in the value of his pension, and more than $8.2 million in stock and cash bonuses for his performance over time at Unum.

Richard McKenney, the Unum president last year who will succeed Watjen as CEO, was paid nearly $3.7 million in compensation during 2014.

Six CEOs of major Chattanooga companies were paid six-figure compensation packages in 2014, although three of those took home less pay and benefits last year than they did in 2013.

The compensation package for Stephen Lebovitz, the 54-year-old CEO of CBL & Associates Properties Inc., was nearly cut in half last year. But the drop reflected a one-time award of more than $3.2 million in stock in 2013, not any reduction in salary or bonuses last year.

Jeff Lorberbaum, the 60-year-old CEO of Mohawk Industries, also took home $232,266 less in total compensation last year than he did in 2013. But the Mohawk CEO probably didn't notice. Lorberbaum, who has a home in Chattanooga, still received more than $5 million in CEO compensation and Forbes magazine estimates Lorberbaum's holdings make him worth $1.87 billion.

Bill Johnson, who became CEO of the Tennessee Valley Authority two years ago, also reported a $1.6 million drop in compensation in 2014 compared with his first year on the job in 2013. But the decline was entirely due to one-time retirement and pension payments made by TVA to help lure the former Progress Energy CEO to the federal utility in 2012. Johnson was the highest paid federal employee in America with a compensation package worth more than $4.6 million, but he was still paid less than the average for CEOs at comparably sized investor-owned utilities and only a fraction of the $44 million package he got on his way out at Duke Energy before joining TVA.

David Parker, the 57-year-old CEO of Covenant Transportation Corp., got the biggest percentage boost in compensation during 2014 among Chattanooga CEOs due to the stellar results from the Chattanooga trucking giant. Covenant earnings and stock price tripled in value during 2014, boosting Parker's compensation by more than 53 percent to nearly $1.4 million.

Better earnings and stock gains also helped boost the compensation for Dixie Group CEO Dan Frierson, whose compensation rose more than 46 percent to $1.4 million last year.

In company reports to shareholders, the compensation committees of the company boards that set pay levels for their CEOs said the compensation packages are based upon comparisons with other companies in their industries and how well the executives met pre-established performance measurements for company earnings, stock price appreciation and other financial criteria. Compensation is designed to help attract the best executives and to reward company performance and return to shareholders.

Overall CEO pay rose more rapidly last year than it has in recent years, according to the Hay Group analysis for The Wall Street Journal of 50 major publicly traded companies that filed early proxy statements.

CEO pay rose last year by 6.9 percent to a median $12.2 million for the 50 major firm studied. That easily outpaced the 4.3 percent median gain in CEO compensation in the previous year.

Shareholders did better, with a total return of 23 percent in 2014 among the companies that were analyzed.

But the AFL-CIO, which is pushing for legislation to raise the minimum wage, has criticized what the union calls excessive pay for America's top bosses.

In 1980, CEO pay, on average, was 42 times the average pay for blue-collar workers. By 2013 -- the most recent year for which all data is available -- the CEO-to-worker pay ratio had grown by nearly eight-fold and the typical CEO of major publicly traded companies made 331 times as much as the typical blue-collar worker.

"America is supposed to be the land of opportunity, a country where hard work and playing by the rules would provide working families a middle-class standard of living," the AFL-CIO's Executive Pay Watch study concludes. "But in recent decades, corporate CEOs have been taking a greater share of the economic pie while wages have stagnated and unemployment remains high."

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.