The Tennessee Valley Authority is proposing a 20-year plan to replenish its underfunded pension through a combination of higher contributions by TVA and new limits on future cost-of-living increases and benefit options for the nearly 35,000 employees and retirees covered by the plan.

The changes outlined to employees Wednesday are projected to save TVA $700 million of its $6 billion unfunded liability in the retirement system. For its part, TVA would commit as part of the changes to contribute at least $275 million a year - or $5.5 billion over the next 20 years - into the pension plan even as it shifts most of the future benefits for existing employees to a separate 401(k) matching program.

In a letter sent to TVA employees on Wednesday, TVA President Bill Johnson said the changes "would put us on a path to create a stronger, better-funded system over the next 20 years." Most of the changes would impact TVA employees and not the 23,700 retirees, although future inflation-adjusted increases in benefits for retirees would be capped at no more than 3 percent.

TVA is proposing to freeze the pension benefits for employees hired in the past 20 years and shift those employees to a matching 401(k) plan for future benefit payments. TVA already quit offering its defined benefit pension plan to new employees hired after July 1, 2014, providing such workers had a matching 401(k) plan instead.

Any amendments to the retirement system and payments by TVA must still be approved by both the TVA board and an independent board that oversees TVA's retirement system.

TVA Chief Financial Officer John Thomas said the benefit changes and annual contributions, combined with expected investment earnings, should restore the retirement plan to full funding over the next two decades.

"It took us a long time to get in this situation and it's going to take time to get back to a fully funded status," Thomas said. "We've been working for some time to get to what we believe is a fair and balanced approach to address the long-term health of the pension plan, which has been a concern of management, the board and our employees and retirees."

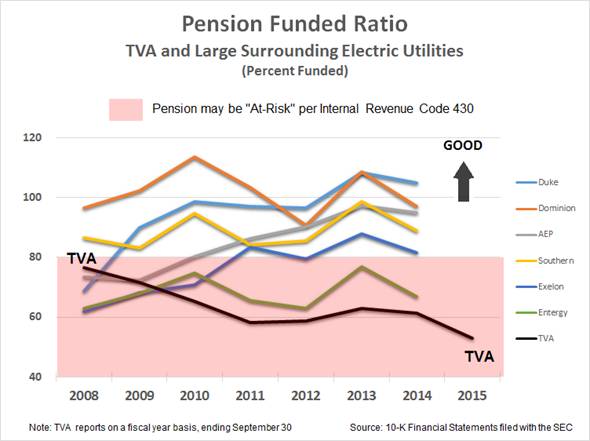

In its most recent annual report, TVA said the retirement program had only $6.8 billion of the $12.8 billion actuaries estimate is needed to cover all of the current promised benefits for retirees and the nearly 10,000 active TVA employees by plan. TVA's retirement plan is only 53 percent funded - well below the level of investor-owned utilities who have similar defined benefit plans in the South.

But Thomas said even with the changes, TVA will remain competitive with its retirement benefits. The median age of employees retiring from TVA is 55 years old and most enjoy benefits above the average for the typical worker in the Tennessee Valley.

Retirees of TVA sued the utility when promised cost-of-living increases were suspended as part of changes adopted in 2009. A federal judge dismissed the lawsuit, but plaintiffs have appealed to a higher court.

TVA suffered a $762 million investment loss in its pension during fiscal 2015, but the agency projects it should still earn a healthy 7 percent annual return on its investments in the future. TVA contributed $275 million to its pension last year, which was below the $350 million requested by the TVA Retirement System board but above the $209 million minimum required contribution, Thomas said.

"We're increasing our commitment over and above what is required today to fund the plan," Thomas said, noting the proposed changes would boost TVA's matching contributions to employee-directed 401(k) plans by about $50 million a year.

TVA will contribute up to 12 percent of employees' pay for those who were under the cash balance plan and were hired by TVA between 1996 and 2014. Employees won't get as big of a promised return on investments, but they will have greater individual control of their retirement investments, Thomas said.

As part of the change, TVA also is proposing to change the governing authority of the seven-member TVA Retirement System board to help give TVA more control over the panel, which is now equally comprised of managers and employees with the seventh member jointly picked by the other six.

Johnson outlined the changes earlier this week to leaders of the TVA Retirees Association, who wrote to Johnson last week to express their concerns about "exorbitant TVA management salaries" being given at the same time TVA has a $6 billion shortfall in its pension plan. TVA earned a record $1.1 billion in fiscal 2015, but Thomas said TVA opted not to make a major additional contribution to the pension plan because officials were still working out details of the changes ultimately unveiled last week to the TVA Retirement System board and on Tuesday to leaders of the TVA Retirees Association.

Suzan Bowman, president of the TVA Retirees Association, said retirees "are very troubled" and "extremely worried" about the future status of their retirement benefits. After meeting with Johnson on Tuesday, Bowman said the association board wants to meet directors of the TVA Retirement System and others to study the proposed changes before developing any position on the changes.

The changes would limit future cost-of-living increases to no more than 3 percent a year, even if inflation picks up above that level.

"Whether or not this is a good plan, I don't now. But I would hate to see any retirees' benefit reduced," said Larry Hancock, the president of the Northeast Alabama chapter of the TVA Retirees Association and one of those briefed on the changes this week.

Contact Dave Flessner at dflessner@timesfree press.com or 423-757-6340.