Photo Gallery

Making the grade…Chattanooga near top in low-cost ranking for food, beverage processing

COST RANKINGS

A new study shows the Chattanooga-Collegedale area trails just the Florence, S.C., region in national low-cost rankings in the food and beverage processing industry:* 1. Florence-Myrtle Beach-Cheraw, S.C.* 2. Chattanooga-Collegedale* 3. Tampa, Fla.* 4. Portland, Maine* 5. Dallas-Fort Worth* 6. Omaha, Neb.* 7. Raleigh-Durham, N.C.* 8. Charlotte, N.C.* 9. Richmond, Va.* 10. Scranton-Wilkes Barre, Pa.Source: The Boyd Co. Inc.

The Chattanooga-Collegedale area is the second most cost-effective place in the nation for the food and beverage processing industry, a new study shows.

The Chattanooga area sits just behind the Florence-Myrtle Beach-Cheraw, S.C., region with an annual total operating cost of $22.8 million for a plant, according to a report by New Jersey-based location consultant The Boyd Co. Inc.

The South Carolina area came in lowest at $21.5 million in annual operating cost. Boston was highest in the study at $27.7 million annually.

The study focuses on 20 locations with current or emerging concentrations of food and beverage manufacturing and areas increasingly on The Boyd Co.'s radar for new investments.

John Boyd Jr., a principal for the Princeton, N.J., company that works with businesses searching for sites on which to place projects, said Chattanooga is one of the nation's most cost-effective markets because of its cheaper labor, lower taxes and less expensive power.

Boyd said Chattanooga's standing gains new importance with President Donald Trump's efforts to keep jobs in America.

"Re-shoring is a big issue," he said. "Companies are buying into the idea that America's business climate will be more friendly for manufacturing under President Trump."

Business executives foresee new tax cuts, elimination of onerous environmental regulations and the possibility of tariffs making countries such as Mexico less desirable, Boyd said.

"Mexico has been a competitor in this segment," he said. "There's going to be some more re-shoring happening. It's a cost-sensitive industry."

While Chattanooga ranks well on costs, one area that Hamilton County has seen challenges is shovel-ready locations for companies.

A recent report by NAI Charter Real Estate Corp. said the greater Hamilton County area is "totally lacking" in industrial acreage that meets the needs of new and expanding businesses.

"Only a handful of sites exist that possess the characteristics which today's manufacturers need," the NAI Charter report.

David DeVaney, president of the Chattanooga commercial real estate broker, said the shortage of industrial sites which are 20 acres or more is "painful."

Boyd said that's "a great problem" for an area to have. Chattanooga and other like markets have become "victims of their own success."

In addition to re-shoring in the food and beverage processing sector, Boyd said he's also seeing companies moving from high-cost states in the West to low-cost states in the Southeast.

He cited California-based Ruiz Foods' opening of a new plant in Florence, S.C., that's slated to bring 500 jobs and a $55 million investment.

Meat processor Premium Colorado, based in Greeley, Colo., also has chosen Carrollton, Ga., for a new plant, Boyd said.

"That illustrates the types of projects we believe Chattanooga will be game for," he said. "You see food companies leaving California because of the expensive cost of doing business and high regulations. That's good news for Chattanooga."

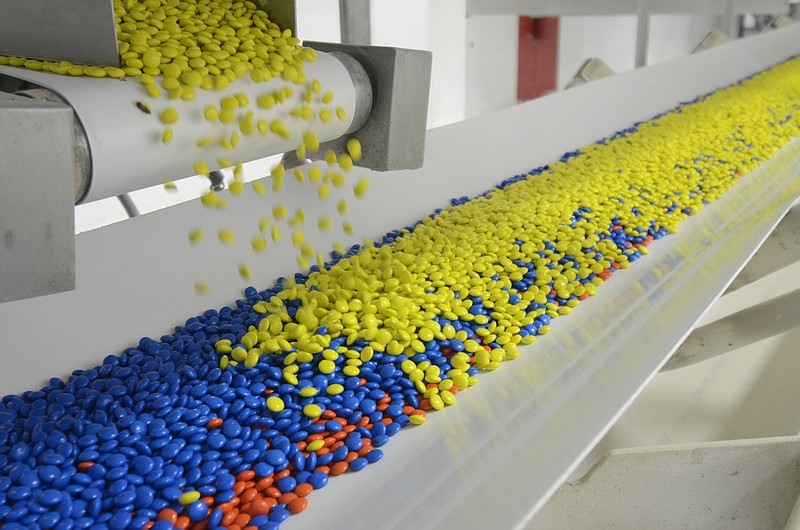

Boyd said the Chattanooga-Collegedale area already has a critical mass of food processors in McKee Foods Corp., Coca-Cola Co., Chattanooga Bakery, Wrigley Co., and the Mars' M&M plant in Cleveland, Tenn.

Also, Tennessee as a right-to-work state is key, he said, as well as the availability of training programs and the state's low-tax status, he said.

"The tax structure is pro-business," Boyd said.

South Carolina boasted the top ratings for food processing businesses, in part, because it has the lowest rate of union membership of any state, and its workforce training is "the Cadillac" of such initiatives, Boyd said.

Contact Mike Pare at mpare@timesfreepress.com or 423-757-6318.