Both parties must give ground to craft a compromise bill shoring up the nation's individual health insurance markets or they'll be blamed for hurting millions of consumers, the chairman of the Senate health committee said Wednesday.

U.S. Sen. Lamar Alexander, R-Tenn., spoke as his panel held the first of four hearings in its effort to see if Democrats and Republicans can forge a modest bill aimed at curbing premium increases and preventing insurers from fleeing some marketplaces. The effort will show whether divided Republicans are willing to pivot from trying to obliterate the Obama health care law to helping it survive, and if both parties can overcome lingering raw feelings over that battle.

Alexander said he wants a bipartisan bill produced by the end of next week. By late September, insurers must decide whether they will sell policies in the government's Healthcare.gov online exchanges in 2018, and he and top panel Democrat Patty Murray of Washington state hope to quickly produce a bill that would ease companies' anxieties.

Failure to produce legislation will hurt millions of Americans buying individual insurance who'd face big premium boosts and less competition.

"The blame will be on every one of us, and deservedly so," Alexander said.

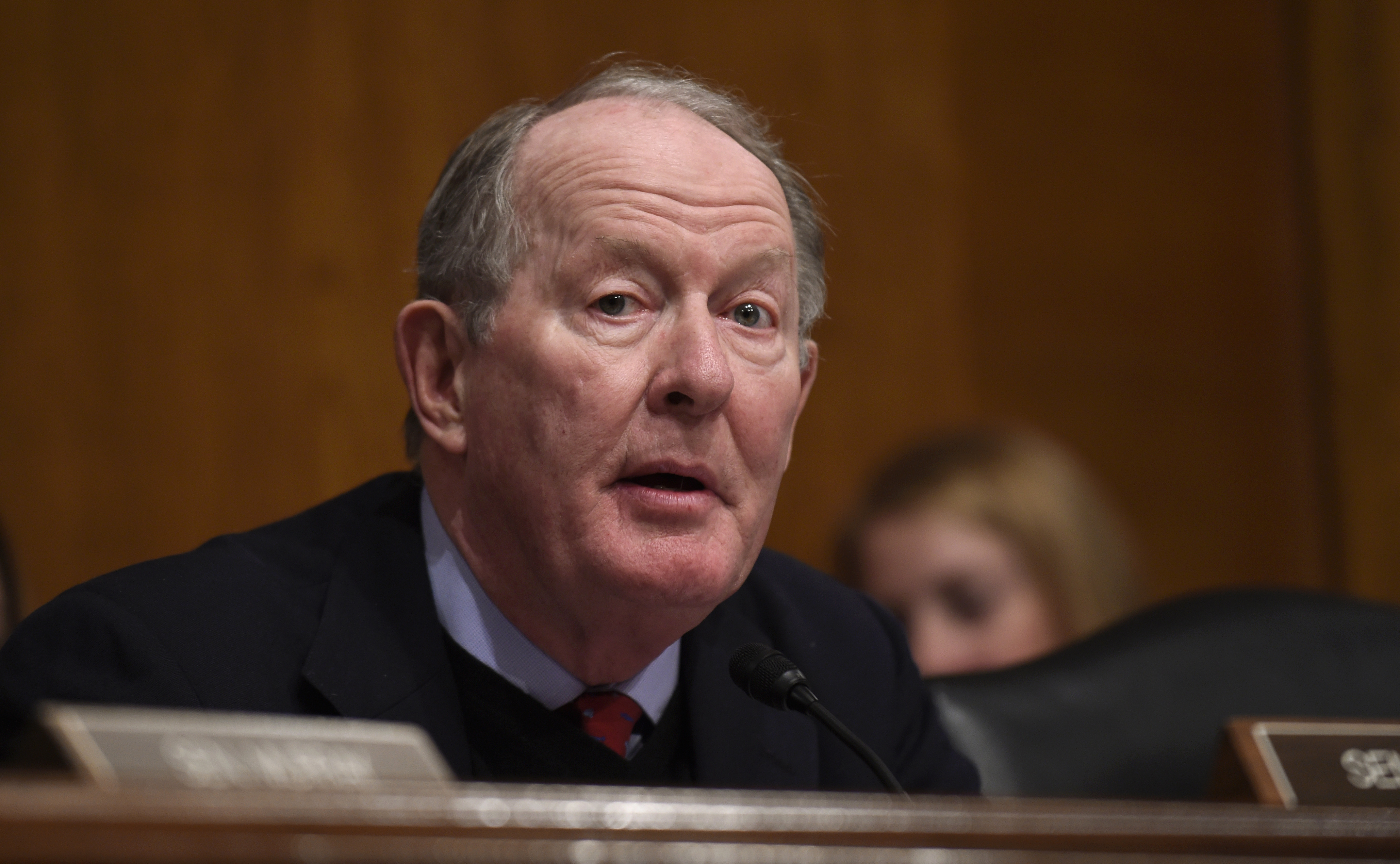

In this Jan. 12, 2016 file photo, Senate Health, Education, Labor and Pensions Committee Chairman Sen. Lamar Alexander, R-Tenn. speaks on Capitol Hill in Washington. A bipartisan Senate effort to continue federal payments to insurers and avert a costly rattling of insurance markets faces a dicey future, underscoring that last week's wreck of the Republican drive to repeal the Obama health care law hasn't eased the issue's fraught politics. (AP Photo/Susan Walsh, File)

In this Jan. 12, 2016 file photo, Senate Health, Education, Labor and Pensions Committee Chairman Sen. Lamar Alexander, R-Tenn. speaks on Capitol Hill in Washington. A bipartisan Senate effort to continue federal payments to insurers and avert a costly rattling of insurance markets faces a dicey future, underscoring that last week's wreck of the Republican drive to repeal the Obama health care law hasn't eased the issue's fraught politics. (AP Photo/Susan Walsh, File) From left, Washington State Insurance Commissioner Mike Kreidler, Alaska Division of Insurance Director Lori Wing-Heier; Insurance Commissioner of Pennsylvania Theresa Miller and Oklahoma Department of Insurance Commissioner John Doak, testify during a Senate Health, Education, Labor, and Pensions Committee hearing on the individual health insurance market for 2018 on Capitol Hill in Washington, Wednesday, Sept. 6, 2017. (AP Photo/Manuel Balce Ceneta)

From left, Washington State Insurance Commissioner Mike Kreidler, Alaska Division of Insurance Director Lori Wing-Heier; Insurance Commissioner of Pennsylvania Theresa Miller and Oklahoma Department of Insurance Commissioner John Doak, testify during a Senate Health, Education, Labor, and Pensions Committee hearing on the individual health insurance market for 2018 on Capitol Hill in Washington, Wednesday, Sept. 6, 2017. (AP Photo/Manuel Balce Ceneta) From left, Tennessee Department of Commerce and Insurance Commissioner Julie Mix McPeak, Washington State Insurance Commissioner Mike Kreidler; Alaska Division of Insurance Director Lori Wing-Heier; Insurance Commissioner of Pennsylvania Theresa Miller and Oklahoma Department of Insurance Commissioner John Doak, testify during a Senate Health, Education, Labor, and Pensions Committee hearing on the individual health insurance market for 2018 on Capitol Hill in Washington, Wednesday, Sept. 6, 2017. (AP Photo/Manuel Balce Ceneta)

From left, Tennessee Department of Commerce and Insurance Commissioner Julie Mix McPeak, Washington State Insurance Commissioner Mike Kreidler; Alaska Division of Insurance Director Lori Wing-Heier; Insurance Commissioner of Pennsylvania Theresa Miller and Oklahoma Department of Insurance Commissioner John Doak, testify during a Senate Health, Education, Labor, and Pensions Committee hearing on the individual health insurance market for 2018 on Capitol Hill in Washington, Wednesday, Sept. 6, 2017. (AP Photo/Manuel Balce Ceneta)Alexander is offering to extend billions in federal subsidies to insurers who reduce out-of-pocket costs for lower-earning customers for a year. In exchange, he wants Democrats to make it easier for states to let insurance companies sell policies with lesser coverage requirements imposed by President Barack Obama's health care law.

Murray said President Donald Trump is trying to "sabotage" Obama's statute by repeatedly threatening to halt the subsidies to insurers and slashing federal spending for outreach aimed at persuading people to buy policies. She's said she wants the cost-reduction payments to be extended for multiple years, not just one, and favors creating another federal fund states could tap to help insurers contain premiums.

"Threading this needle won't be easy," Murray said. "But I do believe an agreement that protects patients and families from higher costs and uncertainty" is possible.

Senators' remarks underscored the differences lawmakers must overcome.

Conservative Sen. Rand Paul, R-Ky., said the individual insurance market - where about 18 million people buy policies - is "non-functional" and said lawmakers should create ways for those customers to instead join more efficient group plans. Sen. Michael Bennet, D-Colo., warned against easing coverage requirements, saying it was crucial consumers not be forced to buy "lousy insurance."

Tennessee Insurance Commissioner Julie Mix McPeak urged Congress to continue federal cost-sharing payments to insurers, arguing the subsidies "ensure that some of our most vulnerable consumers receive assistance for copays and deductibles that are required to be paid under federal law."

McPeak must decide on the premium rate requests in Tennessee by Sept. 20 and by late September, insurers must decide whether they will sell policies in the government's Healthcare.gov online exchanges in 2018.

"Unfortunately, our market is not any more stable than it was late last year," McPeak said. "Tennessee in 2017 has continued to see health insurance carriers flee the market due, in large part, to the tremendous uncertainty surrounding the 2018 plan year as to substantial losses in recent years."

In 78 of the 95 counties, there is only a single insurer offering individual plans on the health exchange market, which McPeak said does not represent an ideal marketplace competition.

Chattanooga-based BlueCross BlueShield of Tennessee, the state's biggest health insurer, tentatively agreed to offer coverage in Knoxville after Humana announced plans to pull out of that 16-county region in 2018. But BlueCross, which has already doubled its rates since 2014 when the insurer offered some of the cheapest ObamaCare policies in the nation, has asked for another 21 percent rate increase for 2018. Cigna is asking for twice as big of a rate hike next year for its individual plans.

Nationwide, analysts expect 2018 premium increases to match or exceed the average 25 percent boosts on mid-level plans sold this year on the government's Healthcare.gov online marketplace. Insurers say additional upsurges are possible due to uncertainty over actions by the Trump administration.

Nearly half the nation's roughly 3,000 counties are expected to have only one insurer offering coverage on government insurance exchanges next year. Republicans say that lack of competition shows a failing of Obama's law. Republicans also had asserted that a handful of mostly rural counties would have no insurers selling policies in 2018, but the latest federal figures project that will not happen.

The payments to insurers cost around $7 billion this year and compensate companies for lowering out-of-pockets costs for customers' deductibles and co-payments, which Obama's law requires. Almost 7 million lower-earning people benefit from the reductions.

The subsidies are also legally required, but they're the subject of a federal court case over whether Congress properly approved the payments. Trump has threatened to halt them, calling them bailouts for insurers. Insurance companies and nonpartisan budget analysts say blocking that money would prompt insurers to raise premiums even further, and lawmakers from both parties want the payments to be approved.

Each of the five state insurance commissioners who testified Wednesday, from states governed by Republicans, Democrats and an independent, backed continuing payments to insurers.

Hardened partisan positions might be tough to overcome after the two parties fought bitterly all year over the GOP repeal drive. And Republicans are split: While Trump and conservatives want the GOP to revive a full-fledged drive to erase the law, Senate Majority Leader Mitch McConnell, R-Ky., has resisted doing so without the votes to prevail.

Failure to produce legislation will hurt millions of Americans buying individual insurance who'd face big premium boosts and less competition, Alexander said.

To get a result, Democrats will have to agree to something – more flexibility for states – that some may be reluctant to support," Alexander said. "And Republicans will have to agree to something – additional funding through the Affordable Care Act – that some may be reluctant to support. That is called a compromise."