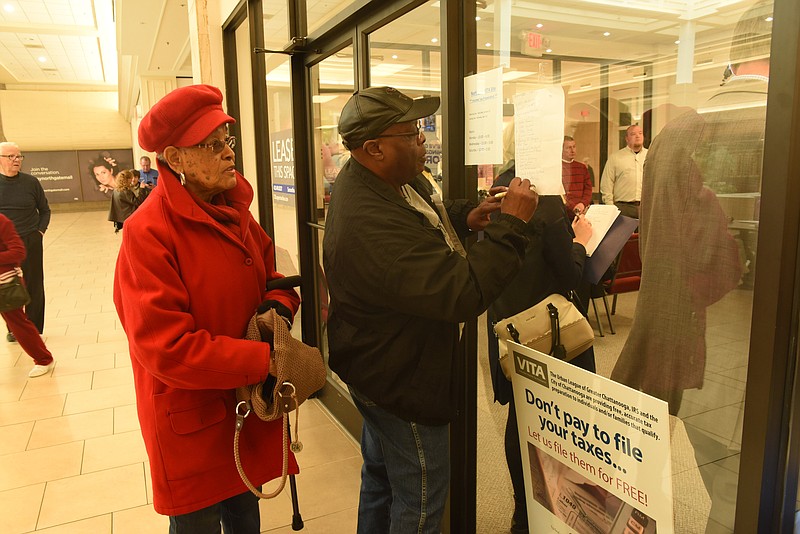

George McKenzie filled out his own taxes for most of his life, but after making what he described as a "boo boo" on his return a few years ago, the 78-year-old retiree has turned to volunteers with the Urban League and the VITA (Volunteer Income Tax Assistance) program for help filling out his return for the past five years.

McKenzie was among dozens of taxpayers who lined up Wednesday for the opening of the VITA office at Northgate Mall on Wednesday morning.

What to bring for tax help

› For married filing a joint return, both spouses must be present› All Forms W-2 and 1099, along with self-employed income (Form 1099-MISC) limited and gambling winnings (Form W-2G)› Information for other income› Information for all deductions/credits› A copy of last year's tax return› Proof of account for direct deposit of refund› Social Security cards or Individual Taxpayer Identification notices for you, your spouse, and/or dependents› Other relevant information for health care, child care, education and other eligible deductions

"These folks really help you out and can file your return electronically so you get your refund quickly," McKenzie said. "And the best thing it is free."

For the past 15 years, the Urban League of Greater Chattanooga and its volunteers have helped thousands of low- and moderate-income families and senior citizens prepare their taxes and annually receive a total of more than $1.6 million in refunds, much of it from the federal earned income tax credit program.

The Volunteer Income Tax Assistance program run locally by the Urban League offers free tax help to people who generally make $54,000 or less, persons with disabilities and limited English-speaking taxpayers who need assistance in preparing their own tax returns.

"Taxes are something that affects everyone in our community and to the extent you can have your taxes prepared for free it is a real value add," said Warren Logan, president of the Urban League of Greater Chattanooga. "Families who are already stretching their dollars shouldn't have to worry about how they are going to afford help with doing their taxes."

Logan said the local VITA program saves East Tennessee taxpayers about $1.3 million in fees they would otherwise have to pay to tax preparation services.

The Urban League is using 197 tax volunteers at 22 sites across East Tennessee this year for its VITA program, which the Urban League expects will serve about 10,000 people, including more than 5,000 in Hamilton County. The Urban League helps train the volunteers, who are tested by the Internal Revenue Service before they consult with tax payers.

Jim Casey, a retired engineer from Kimberly Clark and Honeywell, said he was looking for something to do to help others and began working as a VITA volunteer four years ago.

"Between the two sites I coordinate at Northgate and Orange Grove, we helped out more than 1,400 people last year and it's always rewarding to see people come back year after year because they really appreciate this service," Casey said.

The Urban League tax assistance program in Chattanooga is sponsored by the Greater Chattanooga United Way and the SunTrust Foundation, which SunTrust Chattanooga Market President Jim Vaughn said "aligns so well with our goal of leading the way for financial well being as well as helping to provide a level of financial confidence in our community."

"As a bank, we believe in helping people to make better financial decisions and we're very honored to be a long-term partner with the Urban League for this valuable service," Vaughn said.

The average tax refund last year was $1,483 per taxpayer. The University of Tennessee's Extension Service works with many of the taxpayers getting refunds to help them improve their financial standing by paying down debt or adding to their savings.

"We offer a number of programs and assistance efforts to encourage people to save at least a portion of their refunds," said June Puett, a Hamilton County extension agent who works on personal finance education and outreach. "My heart is in this because we know that 27 percent of Americans have no emergency savings and 50 per- cent have less than three months in savings."

Last year, 1,638 of those who used the local VITA program said they planned to either pay off debt, save for college and save for a home purchase with their refunds, Puett said.

Chattanooga Mayor Andy Berke applauded the VITA program, which he said the city's 311 operators will refer taxpayers to for assistance, as needed over the next couple of months.

"We want to take down the barriers that people in our community face," Berke said. "We know that for people who are low income or in need, it can be expensive for them or confusing sometimes to fill out their tax returns and this program is a tremendous help to many people."

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.

VITA sites for free tax help

› Urban League of Greater Chattanooga at 730 E. M.L. King Blvd., Tuesdays and Thursdays, 9 a.m. to 2 p.m.› Southern Adventist University/Samaritan in the Fleming Plaza Mini Mall in Collegedale, Tuesdays, 8 a.m. to 6 p.m.; Fridays 8 a.m. to 3 p.m., and Sundays, 8 a.m. to 5 p.m.› The Highland Center, 104 N. Tuxedo Ave., Tuesdays, 10 a.m. to 8 p.m.; Wednesdays, 10 a.m. to 6 p.m.; Thursdays, 10 a.m. to 6 p.m.; and Saturdays, 10 a.m. to 6 p.m.› Georgia United Credit Union in Dalton, 605 Calhoun St. in Dalton, Ga., Fridays, 5:30 p.m. to 8:30 p.m.; Saturdays, 9 a.m. to 4 p.m.› University of the South at 735 University Ave. in Sewanee, Saturdays and Sundays, 10:30 a.m. to 4 p.m.› Northgate Mall at 2217 Hixson Pike, Mondays, 10 a.m. to 6 p.m.; Wednesdays, noon to 5 p.m; and Saturdays, 10 a.m to 2 p.m.› Brainerd Recreation Complex, 1010 N. Moore Road, Thursdays, 4 p.m. to 8 p.m.; Saturdays, from 10 a.m. to 2 p.m.› Signal Crest United Methodist Church, 308 Laurel St., Tuesdays, 2 p.m. to 7 p.m.› Scottsboro TCE, 701 S. Houston St. in Scottsboro, Ala., Thursdays, 9 a.m. to 4 p.m.With appointments, VITA assistance also available at:› Northside Neighborhood House at 211 Minor St., 423-267-2217› Second Missionary Baptist Church VITA at 2305 E. Third St., 423-805-2926› Soddy-Daisy Center at 190 Depot St., 423-332-1702› South Pittsburg VITA at 2017 E. 10th St., 423-580-0042› Lee University, 1120 N. Ocoee St., 423-614-8160› Crossnet Baptist Network, 2707 N. Ocoee St. in Cleveland, 423-476-5493

AARP tax aid sites

› Bessie Smith Hall at 200 E. M.L. King Boulevard, Tuesdays, Wednesdays and Thursdays from 10 a.m. to 4:30 p.m.› Fort Oglethorpe United Methodist Church, 1733 Battlefield Parkway in Fort Oglethorpe, Wednesdays 9 a.m .to 3 p.m.› Tyner United Methodist Church, 6805 Standifer Gap Road, Tuesdays and Thursdays from 9 a.m. to 4 p.m.› Seventh Day Adventist church, 4829 College Drive E in Collegedale, Mondays 9 a.m. to 4 p.m.› Cherokee Regional Library at 305 S. Duke Street in Lafayette, Ga., Tuesdays 10 a.. to 4 p.m.› Dalton Regional Library, 310 Cappes Street in Dalton, Ga., Mondays and Fridays 10 a.m. to 3 p.m.› Mack Gaston Community Center, 218 N. Fredrick Street in Dalton, Ga., Saturdays 9:30 a.m. to 2 p.m.› McMinn County Senior Activity Center at 205 McMinn Ave., in Athens, Tenn., Mondays, Wednesdays, Thursdays and Fridays from 8:30 a.m. to 3 p.m.