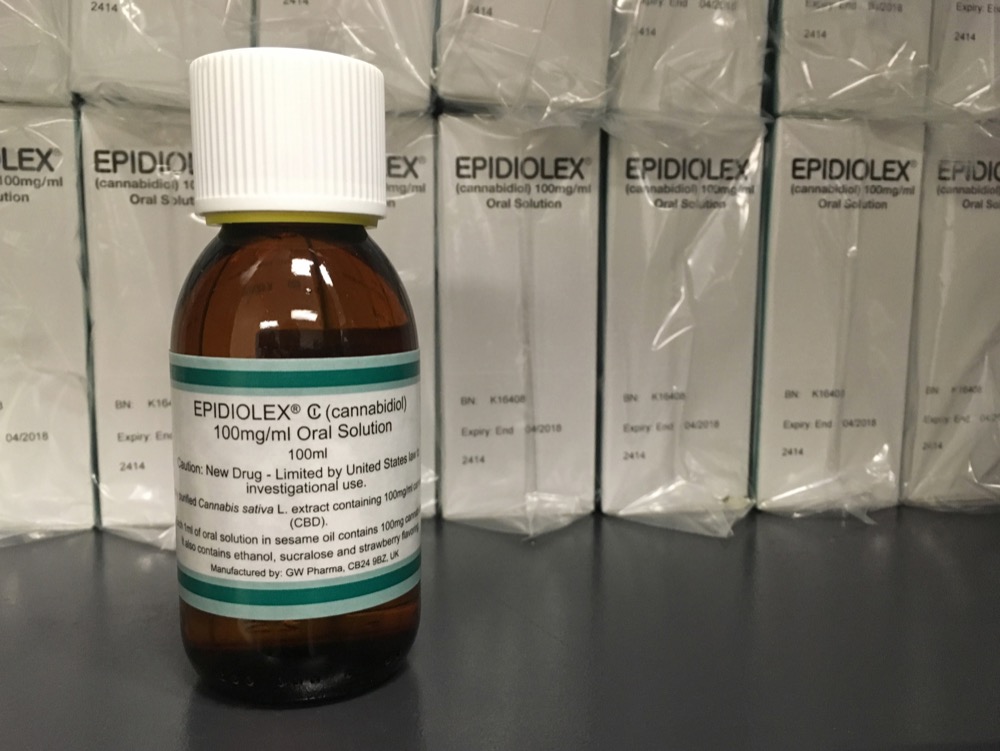

FILE - This May 23, 2017 file photo shows GW Pharmaceuticals' Epidiolex, a medicine made from the marijuana plant but without THC. Investors are craving marijuana stocks as Canada prepares to legalize pot next month, leading to giant gains for Canada-based companies listed on U.S. exchanges. (AP Photo/Kathy Young, File)

FILE - This May 23, 2017 file photo shows GW Pharmaceuticals' Epidiolex, a medicine made from the marijuana plant but without THC. Investors are craving marijuana stocks as Canada prepares to legalize pot next month, leading to giant gains for Canada-based companies listed on U.S. exchanges. (AP Photo/Kathy Young, File)

Fortunes were made and lost over the course of two days in September on the latest investment mania: marijuana stocks. Fans of Canadian producer Tilray, perhaps sampling the merchandise, sent the stock soaring on Sept. 19, nearly doubling overnight. But alas, the buzz inevitably wears off, and the stock came down from its high. Over the course of the week, Tilray's stock price soared from $117 to $300 and crashed back to $123 by Friday. Bad trip.

Not unlike the Bitcoin craze, MJ stocks have become the investment fad du-jour. Other cannabis-related shares rallied in sympathy but also returned to earth by week's end. So what caused all the excitement?

The immediate interest in grass stocks was sparked by impending legalization in Canada. Medical marijuana has been legal since 2005, but on Oct. 17 recreational use will be decriminalized subject to regulation by the various provinces in Canada. This has created something of a frenzy among would-be speculators eager to toke up on the Canadian legal pot market. And as in most manias, eager beavers rushed in before understanding the underlying fundamentals. At its peak, tiny Tilray, with estimated 2019 sales of $150 million, was valued at a whopping $30 billion. That's roughly the size of Taco Bell parent Yum Brands (helpfully open until 2 am).

But excusing the premature exuberance, the landscape is definitely shifting and investing in marijuana is becoming more mainstream. Most of the companies whose stocks have rallied are primarily producers of cannabis extracts for medicinal applications, which are gaining acceptance and are now covered by some Canadian insurance companies. Analysts estimate that legal sales of marijuana and its derivatives will exceed $50 billion globally this year and are likely to surpass global soda sales within a few years.

The picture in the United States is complicated. At least 30 states have legalized medicinal use, 9 have decriminalized recreational ganja, and 4 states have pot measures on the ballot. But the DEA classifies the substance as a Schedule I drug, so possession and distribution are still federal crimes. As a result, banks are reticent to lend to cannabis firms, and U.S. pot companies are prohibited from trading on stock exchanges, making it difficult to raise capital.

But the times they are a-changin'. Medical research into the effects of cannabis in the late '80s discovered a previously unknown neural pathway dubbed the endocannabinoid system, believed to act as a stabilizer of important biological systems in the body. The primary ingredient responsible for getting lit, THC, has been proven effective for pain control and suppressing nausea. Meanwhile, a non-psychoactive component called cannabidiol or CBD is showing promise in clinical studies and does not create the high of THC.

Drugs derived from CBD are coming to market in the United States. The DEA has reclassified FDA-approved CBD-based compounds as Schedule V, equivalent to cough suppressants. This cleared the way for GW Pharmaceuticals' new cannabis treatment for pediatric epilepsy.

Congress in stepping in as well. A bill in the U.S. Senate would legalize medical marijuana use for veterans and direct the Veterans Administration to conduct additional research. And the House Judiciary Committee recently approved a measure to expand federally-approved research into potential medicinal benefits of cannabis.

Major corporations are salivating. Constellation Brands (maker of Corona) recently acquired a 38 percent stake in Canadian weed company Canopy Growth, with an eye on the market for pot-infused beverages, and Coke is reportedly in early talks with Aurora Cannabis.

The buzz in pot stocks is one toke over the line, but the ground is shifting and the opportunities for conventional investors will continue to emerge.

Christopher A. Hopkins, CFA, is a vice president and portfolio manager at Barnett & Co. in Chattanooga