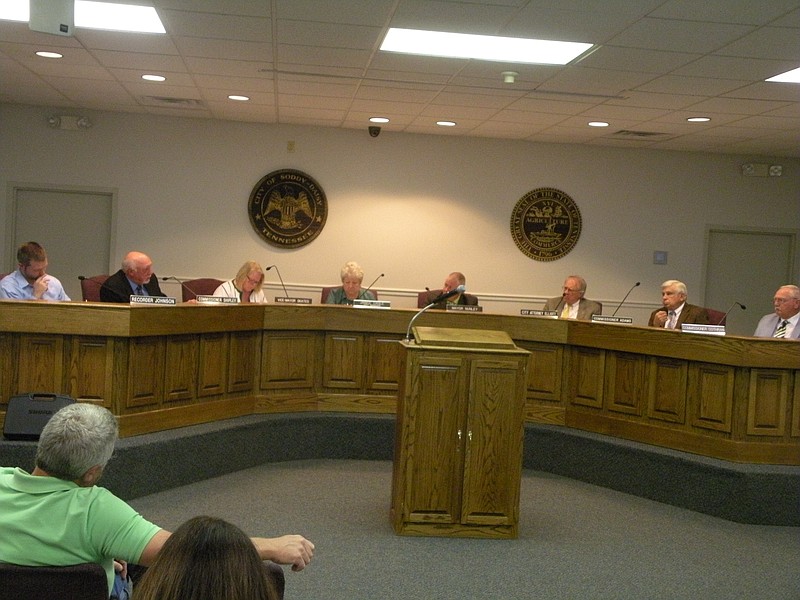

Many residents in Soddy-Daisy will likely be paying more in property taxes following city commissioners' unanimous vote at their Aug. 3 meeting to keep the city's tax rate the same as last year's: $1.3524 per $100 of assessed value.

The final vote to establish the city's tax rate is scheduled for Aug. 17, when the city commission will again meet at city hall at 7 p.m.

During a public hearing on the matter Aug. 3, no residents spoke.

Following this year's countywide reassessment, property values in the city went up by an average of 7.14 percent, and by 10 percent in the county overall.

State law requires all counties to roll back their certified tax rate by about the same amount property values increase. Based on the reassessment, Hamilton County's certified rate of 2.7652 has been decreased to 2.4976 per $100 of assessed value, so most homeowners in unincorporated parts of the county won't pay any more in taxes. That doesn't include homeowners whose property value increase was higher than the average.

Red Bank properties

In nearby Red Bank, which at 12.4 percent had the highest increase in property values of any municipality in the county, city commissioners chose to accept the county’s certified rollback rate of $1.1826 per $100 of assessed value. Though the city’s previous rate was $1.35, most property owners there will see very little change in their tax bills. However, owners of properties with higher-than-average increases in value will pay more.

Hamilton County's property assessor also lowered Soddy-Daisy's certified rate, to 1.2559, based on residents' average property value increase of 7.14 percent. But city commissioners decided on first vote not to accept that rate, instead keeping the 2016 rate, which equates to a small tax increase for homeowners whose property values rose.

"We're not changing our tax base; it's staying the same. We're just not reducing it for the assessment," said Commissioner Geno Shipley. "If your assessment went up, then your taxes might go up."

If commissioners vote on second reading to keep the 2016 rate, the owner of a home valued at $150,000 will pay $36 more per year. According to Zillow, the city's median home value is $140,200. For commercial properties, the owner of a building valued at $500,000 will pay $193 more a year.

Keeping the 2016 tax rate will net the city an additional $250,000 over what it would bring in if it accepts the county assessor's most recent certified rate, said City Manager Janice Cagle. She pointed out that the city is entirely losing the state Hall Tax revenue this year, which brought the city $125,000 last year.

Mayor Robert Cothran said he believes the board is making the right decision to keep the same tax rate, as it allows the city to maintain the level of services it currently provides that citizens rely on, such as brush pickup.

"That's a big service we give the people of Soddy-Daisy, on top of garbage service," he said.

Shipley said he wants the board to look into freezing the property tax rate for citizens ages 65 and older, a measure that the city of Chattanooga is currently considering.

Staff writer Tim Omarzu contributed to this story.