A common theme emerged when high school seniors at the Chattanooga School for the Arts & Sciences recently took part in Reality Check, a financial literacy program of the Chattanooga Area Chamber of Commerce.

"This is hilarious. They want to put their spouse to work," laughed Nicole Brown, a communications professor at the University of Tennessee at Chattanooga who was one of the volunteers who helped bring the Reality Check event to the K-12 magnet school.

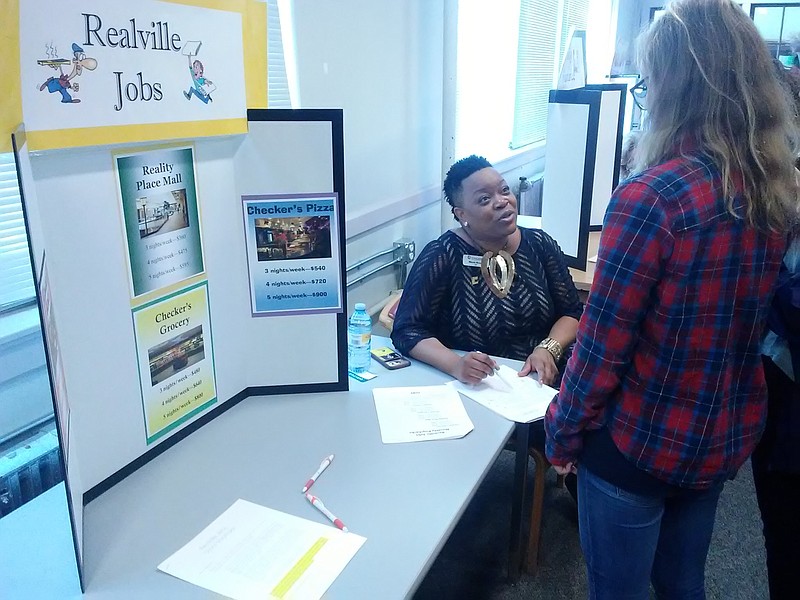

Brown was at the "You Need a Job" table in the upper school's library. It was one of a number of stations where seniors - who were given a pretend life situation such as low-paid single mom or highly paid engineer - stopped by to take on the multiple, financial burdens and opportunities of grown-up life.

Tables dealt with such real-life expenses as grocery shopping, insurance, banking and real estate. Plus, students had to visit a table called "That's Life," where participants had to pick from a stack cards that dealt out such unexpected expenses as a car break-down.

Students' faces light up with understanding - and even appreciation for their parents - as they grapple with all the expenses that ordinary life entails, says Darian Scott, an outreach coordinator at the Chattanooga Area Chamber of Commerce, which offers the Reality Check program to all of Hamilton County's public high schools.

"I call them 'light bulb' moments," Scott said.

Tennessee leads nation - in bankruptcies

The Chamber's Reality Check program is just one of a number of efforts to boost financial literacy in Chattanooga, the fourth-largest city in a state that regularly leads the nation when it comes to personal bankruptcies.

And things are tough all over: 38.1 percent of all U.S. households carry some sort of credit card debt, according to the credit card-comparison website, ValuePenguin.com, and the median debt per American household is $2,300, while the average debt stands at $5,700.

Also, many Americans aren't financially ready for retirement. In a 2011 research paper from the National Bureau of Economic Research, three simple questions were posed to approximately 1,500 adults. They required no computations, but tested conceptual familiarity with investment returns, inflation and risk. The results were less than encouraging: fewer than one third of respondents got all three simple questions correct.

This matters more today than ever with the transition away from traditional defined-benefit pensions toward defined contribution plans, such as 401(k)s that place all the responsibility directly on the worker to understand and direct his or her own investments. According to the study, the share of private retirement contributions going to self-directed plans has ballooned from 40 percent in 1980 to 90 percent in 2011. Clearly, the need for individuals to plan for retirement has never been greater. And yet, only 43 percent of those surveyed have ever made any attempt to estimate how much they must save.

But you can buck the trend of being broke, according to the leader of a local organization that has participated in Chattanooga's Money School, a free financial education day put on by the nonprofit organization Chattanooga Neighborhood Enterprise (CNE) that recently had hundreds of people show up for its third annual Money School.

"Any person can save money, regardless of their income," says June Puett, who runs the Chattanooga Chapter of Tennessee Saves, the local offshoot of America Saves, a Consumer Federation of America campaign to help individuals save money, reduce debt and build wealth.

Cooking at home - instead of eating out - is one way a family can save thousands of dollars a year, says Puett, who works at the University of Tennessee Extension Service office in Chattanooga, which offers a free cast-iron cooking and food preservation classes so would-be savers can "rediscover grandma's secrets."

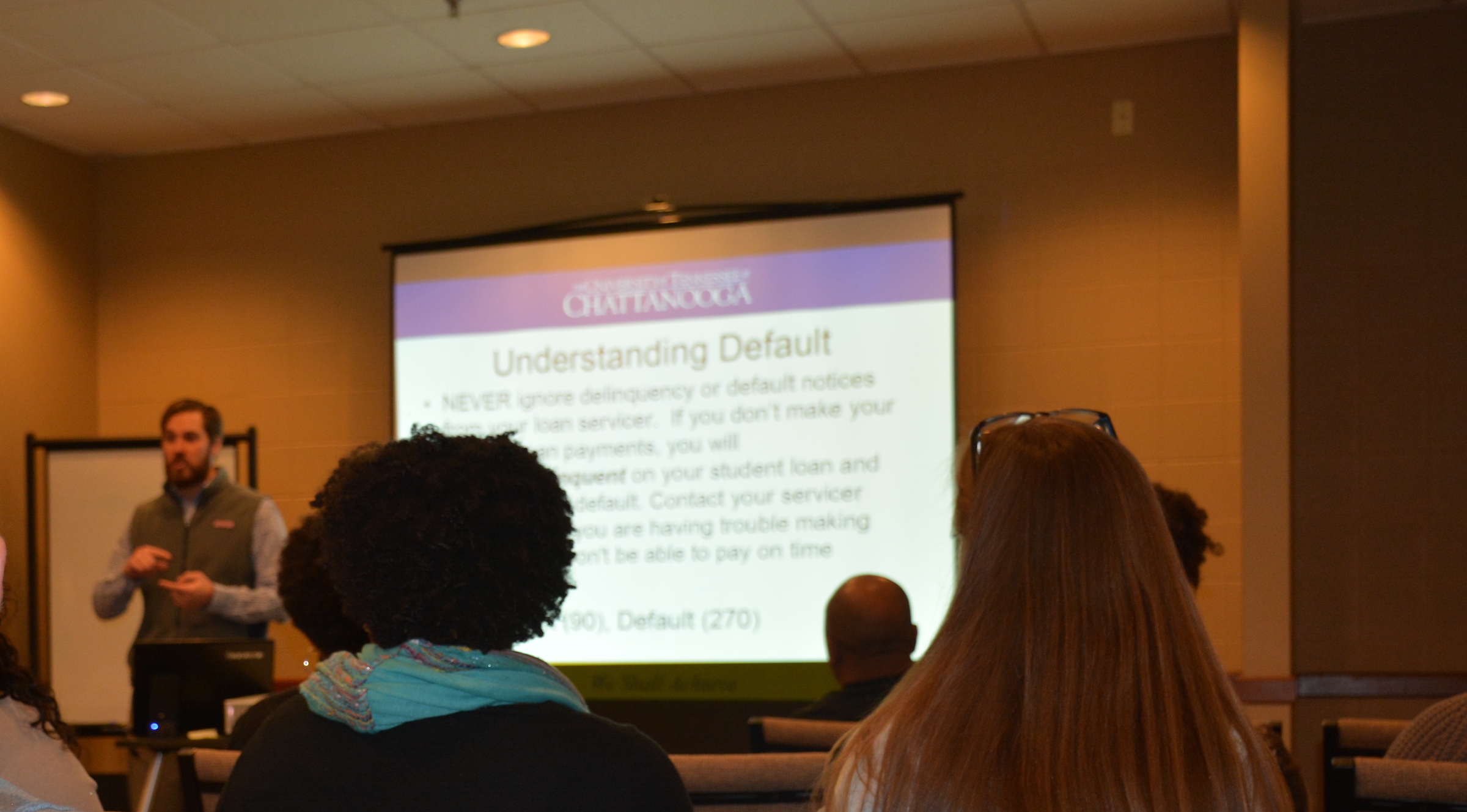

Speakers and exhibitors at Money School offer hands-on learning opportunities regarding money management, debt elimination, increased savings, as well as retirement and estate planning.

"I absolutely believe that people can climb out of a financial mess," says Jennifer Harper, a Chattanooga certified financial planner who founded Common Cents Financial Literacy, a nonprofit education program for 16- to 22-year-olds that has a booth at Money School. "The city of Chattanooga has a higher poverty rate than the national average. But income isn't the only thing that causes people to make bad financial decisions."

'People can change finances'

Part of Common Cents' curriculum is a video of a Baltimore man who never made more than $12 an hour while working 44 years as a parking lot attendant - yet was able to pay off his home, send his three children to Catholic school and parlay the dollars he saved here and there into an investment portfolio worth $500,000.

"I've worked in the private wealth management world for a while now, and I've had clients that made a lot of money but were always broke because they didn't make good financial decisions," says Harper.

"People can change their finances," says Jennifer Holder, communications and special projects manager for CNE. "They just need the tools and resources to do so."

Those as young as age 13 were invited to this year's Money School held at Brainerd Crossroads, a multi-use fitness and recreation facility operated by Brainerd Baptist Church.

If you start investing early in life, thanks to the "miracle" of compound interest in which an investment's interest is reinvested, small beginnings can yield huge returns at retirement age.

"If you're talking about saving for 40 years versus 45 years, those extra five years make a massive difference," says local financial blogger and speaker, Nick True of Mapped Out Money, who gave a teen-oriented talk titled "How Long Will It Take You to Become a Millionaire: The Power of Savings."

Chattanooga Neighborhood Enterprise's mission is to create economically diverse neighborhoods filled with financially empowered citizens and housing for all. CNE was organized by then-mayor, now U.S. Sen. Bob Corker, R-Tenn. three decades ago. CNE's programs include homebuyer education and counseling, home improvement loans, affordable mortgage products, foreclosure prevention services and affordable homes for sale and rent.

Resources

There are a number of resources for those adults who need a financial literacy refresher — or don’t know where to start.• The American Institute of CPAs has rolled out a great website in conjunction with their “Feed the Pig” savings campaign. The program known as 360 Degrees of Financial Literacy (available at 360FinancialLiteracy.org) offers basic education in a clear, well-organized format according to stage of life (students, parents, couples, workers, retirees etc.).• For a deeper dive, visit the Future of Finance site at the CFA Institute (CFAInstitute.org) for articles and educational resources targeted at individual investors. Check out the Statement of Investor Rights and ask if your financial adviser is willing to abide by it.• The government offers a number of sites covering the basics of investing. Start with MyMoney.Gov for an overview of recommended materials for children, youth and adults.• The U.S. Federal Reserve also has an excellent financial primer at FederalReserveEducation.org. Many of the regional Fed banks also host superb investor education sites.• Most large banks and brokers offer informative literacy resources. For example, Bank of America has partnered with KhanAcademy to present Better Money Habits, an introduction to a range of basic financial topics such as debt, saving, home ownership and personal banking that many individuals have had to learn about the hard way (BetterMoneyHabits.BankofAmerica.com).• A number of independent websites specialize in personal financial planning and education. NerdWallet.com is a helpful website dedicated to educating individuals on savings, investing and credit. It offers advice and guidance on selecting credit cards, managing debt responsibly, and protecting your credit score. Frequent articles on a variety of common questions are helpful.• Mint.com, a subsidiary of Intuit (of QuickBooks and TurboTax fame) offers similar resources, leaning toward assistance with creating and following a budget.Source: Christopher A. Hopkins, CFA, a vice president and portfolio manager for Barnett & Co., in Chattanooga.