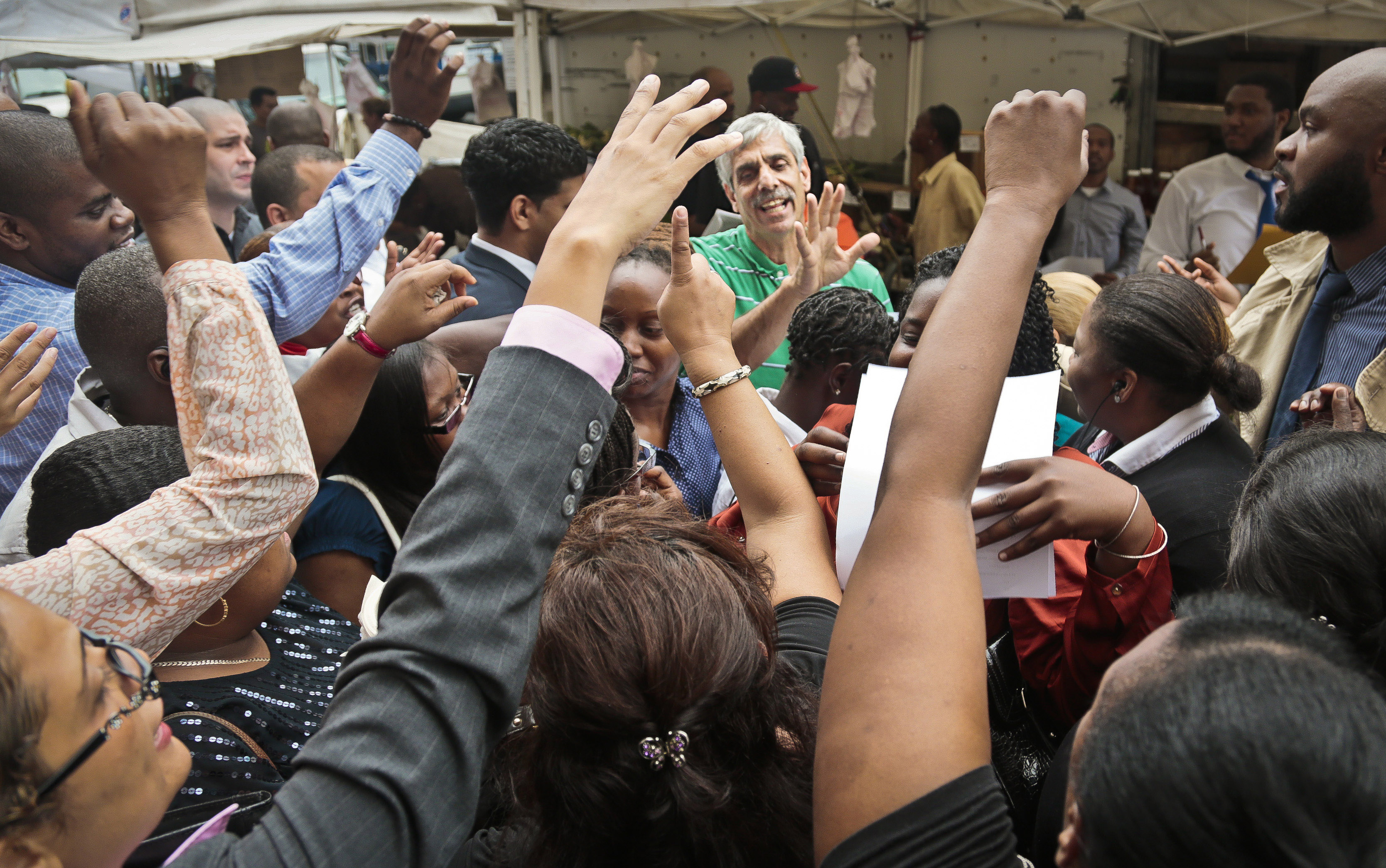

Applicants reach for registration forms to attend a combined Metropolitan Transportation Authority and Harlem Week job and career fair at Columbia University in New York. The drop in the unemployment rate in August to a 4½-year low was hardly cause for celebration. The rate fell because more people stopped looking for work.

Applicants reach for registration forms to attend a combined Metropolitan Transportation Authority and Harlem Week job and career fair at Columbia University in New York. The drop in the unemployment rate in August to a 4½-year low was hardly cause for celebration. The rate fell because more people stopped looking for work.WASHINGTON - Employers are sketching a hazy picture of the U.S. job market for the Federal Reserve to weigh in deciding this month whether to reduce its stimulus for the economy - and, if so, by how much.

The economy added 169,000 jobs in August but many fewer in June and July than previously thought. The unemployment rate fell to 7.3 percent, the lowest since 2008, but only because more people stopped looking for work and were no longer counted as unemployed.

All told, Friday's report from the Labor Department pointed to a lukewarm job market: Hiring is steady but subpar. Much of the growth is in lower-paying occupations. And many people are giving up on their job searches in frustration. The proportion of Americans working or looking for work reached its lowest point in 35 years.

The sluggish jobs report reflects a U.S. economy that's still struggling to accelerate. The economy grew at a modest 2.5 percent annual rate from April through June, and most analysts think it's weakened since then.

The Fed has been buying $85 billion a month in Treasury and mortgage bonds to try to keep home-loan and other borrowing rates low. Many economists have expected the central bank to taper its monthly purchases after it meets Sept. 17 and 18. Friday's data may lead the Fed to slow its bond buying more gradually than it might have otherwise.

"Soft employment gains only muddied the waters," said James Marple, an economist at TD Economics. "While the data did not take September tapering off the table, it does suggest that the Fed will use a lighter touch."

Marple and some other economists say they now think the Fed may announce this month that it's trimming its bond purchases by $10 billion rather than earlier expectations of $20 billion.

The revised job growth for June and July shrank the previously estimated gain for those months by 74,000. July's gain is now estimated at 104,000 -- the fewest in more than a year and down from a previous estimate of 162,000. June's was revised to 172,000 from 188,000.

In the past three months, employers have added an average of just 148,000 jobs. For the first five months of the year, they had added an average of 199,000.

Stock prices rose and fell through the day as traders pondered the job report's impact on the Fed and tensions over the prospect of U.S. military action against Syria. The Dow Jones industrial average finished down nearly 15 points. Broader stock averages closed essentially flat.

The yield on the 10-year Treasury note slipped to 2.93 percent, from 2.95 percent before the jobs report was released.

One possible concern for the Fed is that most of the hiring in August was in lower-paying occupations. This continues a trend that emerged earlier this year.

For example, retailers such as clothing stores, groceries and electronics outlets added 44,000 jobs. Hotels, restaurants and bars added 27,000. Temp hiring rose by 13,000.

Dean Baker, co-director of the Center for Economic and Policy Research, says lower-wage industries have been generating a disproportionate role in hiring because many unemployed people have become desperate enough to take such jobs.

Aside from their low pay, many of those workers are being limited to fewer hours than they'd like.

"In a weak labor market, workers can't find anything better," Baker said.

Phillip Bailey, 39, took a job three months ago in kitchen prep at a McDonald's in Detroit after his unemployment benefits ran out. But his new job pays just $7.40 an hour, and he's usually scheduled for only about 15 to 20 hours a week.

He's working many fewer hours than he did in previous jobs. Bailey used to conduct home energy audits, which found ways for people to reduce utility bills.

"This is a lot less than I'm used to making," he said of his current job. "It's impossible to get by."

The August jobs report showed that hiring in higher-paying fields was more mixed.

Manufacturers added 14,000 jobs in August, the first gain after five months of declines. But that was more than offset by downward revisions that shaved off 26,000 jobs from June and July's figures. That left overall factory jobs in August 12,000 lower than the previous month.

Auto manufacturers added 19,000 jobs. Americans are buying more cars than at any time since the recession began in December 2007. Some of the jobs also likely reflected workers who were rehired last month after being temporarily laid off in July, when factories switched to new models.

But construction jobs were unchanged in August. And the information industry, which includes high-tech workers, broadcasting and film production, cut 18,000 jobs. The biggest losses were in the film industry.

Hiring in construction has slowed drastically from earlier in the year despite a recovery in the housing industry. The construction industry has added an average of just 2,500 jobs a month in the past six months. That compares with an average 25,500 gain in the previous six months.

Employers might have turned cautious last month as the economy slowed. And the downgraded job totals for June and July reflected a loss of government jobs that wasn't picked up initially and was likely related to federal spending cuts that kicked in earlier this year.

Government job cuts were much steeper in June and July than previously estimated. All told, they were revised lower by 38,000. That more than offset a gain of 17,000 in August. Layoffs at government contractors likely also contributed to the decline in manufacturing jobs in those two months.

The percentage of adults working or looking for work, known as the participation rate, fell to 63.2, the lowest since 1978. The rate for men, which has been declining gradually, fell last month to just below 70 percent -- its lowest point on records dating to 1948.

Doug Handler, chief U.S. economist at IHS Global Insight, said the decline in the male participation rate suggests that many men who once worked in areas such as manufacturing and construction are giving up on finding work rather than transitioning to another industry.

"It seems they feel that they're never going to get another job in their sector or in any other sector," Handler said.

Still, some economists suggested that an increase last month in hours worked and average hourly pay provided important boosts to Americans' pay and could support stronger consumer spending in coming months.

Average hourly earnings rose 5 cents to $24.05. Hourly pay has risen 2.2 percent in the past 12 months. That's slightly ahead of the 2 percent inflation rate over the same period.

The average hourly workweek ticked up to 34.5 from 34.4, a sign that companies needed more labor. That can lead to larger paychecks.

Earlier this week, some signs had suggested that the economy might have strengthened. Surveys of manufacturing and service firms, for example, showed that they expanded at a healthy pace in August. But Friday's jobs report dampened such optimism.

"We've lost momentum, which is disappointing," said Diane Swonk, chief economist at Mesirow Financial. "But we may regain it. That's why (the jobs report) is not a slam-dunk pushing the Fed one way or the other."

A tale of 2 employment surveys, at a glance

The U.S. economy added just 169,000 jobs last month. And the unemployment rate fell from 7.4 percent in July to 7.3 percent, a nearly five-year low.

But the unemployment rate fell because more people stopped looking for work -- and not because of the modest job gains.

How come the job gains weren't credited with lowering the unemployment rate? Because the government does one survey to learn how many jobs were created and another to determine the unemployment rate. The two surveys can sometimes produce different results.

One is called the payroll survey. It asks mostly large companies and government agencies how many people they employed during the month. This survey produces the number of jobs gained or lost. In August, the payroll survey showed that companies and government agencies added 169,000 jobs.

The other is the household survey. Government workers ask whether the adults in a household have a job. Those who don't have a job are asked whether they're looking for one. If they are, they're considered unemployed. If they aren't looking for a job, they're not considered part of the workforce and aren't counted as unemployed. The household survey produces each month's unemployment rate.

In August, the household survey showed that nearly 200,000 fewer Americans were unemployed. But the decline was because those people stopped looking for work, not because they found jobs. That lowered the total number of unemployed Americans to 11.3 million, which pushed the unemployment rate down.

Unlike the payroll survey, the household survey captures farm workers, the self-employed and people who work for new companies. It also does a better job of capturing hiring by small businesses.

But the household survey is more volatile from month to month. The Labor Department surveys just 60,000 households, a small fraction of the more than 100 million U.S. households.

By contrast, the payroll survey seeks information from 145,000 companies and government agencies. They employ roughly one-third of non-farm employees. The employers send forms to the Labor Department or fill out online surveys, noting how many people they employ. They also provide pay, hours worked and other details.

Most Americans focus more on the unemployment rate, which comes from the household survey. But economists generally prefer the jobs figure from the payroll survey. They note that the surveys tend to even out over time.