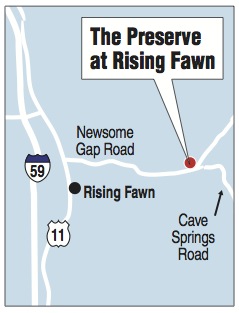

The Preserve at Rising Fawn, Ga.2,500 acres 301 lots at 2 to 3 acres soldOriginal lot value: $6,000 to $9,000Sold during 2008 to 2010 scheme for: $150,000 to $200,000Average value now: $3,000 acre for undeveloped lotsA 435-acre tract donated to The Georgia Land TrustSource: Court documents, testimony

"No money down."

"It seems like a guarantee."

"Too good to be true."

"That sounds like fraud."

And it was, but in the rush to sell two- and three-acre lots at the 2,500-acre The Preserve at Rising Fawn, Ga., from 2008 to 2010, hundreds of buyers believed what Josh Dobson and Paul Gott were selling. Dobson's Marion County-based company, Southern Group, promised in many instances to pay the down payment and mortgage payments for buyers in exchange for using buyers' credit to obtain loans. He even promised to buy back the property in three years for the price or more.

Sales brought in $44 million of loans, at least $40 million of which was likely obtained fraudulently, lead investigator FBI agent Stan Ruffin testified.

That was illegal.

The nationwide real estate market crash exposed the scheme sooner rather than later, Assistant U.S. Attorney Perry Piper said in a sentencing hearing for the pair Thursday.

"It all works well until it doesn't," Piper said. "Then it spreads like wildfire."

That fire finally ended in the hearing when U.S. District Judge Curtis Collier sentenced Dobson, 36, to 10 years, six months in prison and Gott, 40, to six years, three months. The two were convicted last year of conspiracy, wire fraud and money laundering.

Dobson originally faced 12 to 15 years. Gott faced six to eight years. But arguments in sentencing reduced both to at or below the initial range. Both men were ordered to pay $3.1 million in restitution.

Neither man wished to comment after the hearing. Both are due to report to prison on July 28.

Very few of the buyers were from the area. That was exactly the point, Piper told Collier. People living states away thought properties between Atlanta and Chattanooga would only grow in value as they were developed for second homes, vacation homes and retirement homes.

A few structures went up. A pool sits empty. Lots valued at $6,000 to $9,000 in 2007 were selling for $150,000 to $200,000 undeveloped during the scheme.

Of the 301 lots sold, each sized from two to three acres, most remain vacant. Hundreds more lots could have been sold. Nearly all the sold lots were foreclosed upon by the dozen banks involved. A 435-acre area was donated to the Georgia Land Trust by banks because it sits upon a cave system and cannot be developed.

As Southern stopped making mortgage payments on the lots that investors from seven states bought, the phone started ringing. At some point Dobson stopped answering. Banks were calling buyers for payments; buyers were calling Dobson.

A Florida pastor set on retiring lost her life savings. A 70-year-old retired doctor in California declared bankruptcy.

Jim Tobin, a Florida man who lost $175,000 that contributed to his bankruptcy, watched a mortgage broker buy lots and see the payments made for months. He bought one lot and saw the same for six months. So Tobin talked with his pastor and a friend, and they, too, invested after monitoring the progress for nearly a year.

All went bankrupt.

"I feel that Mr. Dobson got off light," Tobin said when reached by phone Thursday.

The sentencing hearing, complex and hotly contested, was held on six days over three weeks, beginning May 7.

Dobson's attorneys, Jerry Summers and Marya Schalk, along with Gott's attorney John McDougal, argued that the jury did not convict the men on new evidence used during sentencing.

McDougal called it "unconscionable" that a list of 107 loans on which Southern Group had paid down payments was being used to increase the penalty at sentencing when the jury never saw that evidence.

Schalk told Collier that Dobson didn't set out to commit fraud.

Collier agreed.

In his experience, many in business are fundamentally optimistic, he said.

"You were not able to make enough sales," Collier told Dobson. "But you knew the next day was going to get better. Somehow this idea of furnishing down payments to borrowers came up."

But things did not get better the next day, week, month or year, Collier said. That's when the scheme came crashing down.

That's when Dobson should have closed shop and declared bankruptcy, Collier said.

"That's not a pleasant choice but that's a better choice than committing fraud or deceiving people," Collier said.

Contact staff writer Todd South at tsouth@timesfreepress.com or 423-757-6347. Follow him on Twitter @tsouthCTFP