BANK MERGERS

* CapitalMark, formed in 2007, will be acquired by the Nashville-based Pinnacle Bank for $187 million. * FSG, formed in 2000, will be acquired by the Atlanta-based Atlantic Capital Bancshares, Inc., for $160 million. * Cornerstone, started in 1985, will merge with the Knoxville-based SmartBank in a stock deal. * Southern Heritage Bank in Cleveland, Tenn., founded in 1999, was acquired in 2014 by First Citizens National Bank in Dyersburg, Tenn., for $32.2 million. Sources: Company reports, Federal Deposit Insurance Corp.

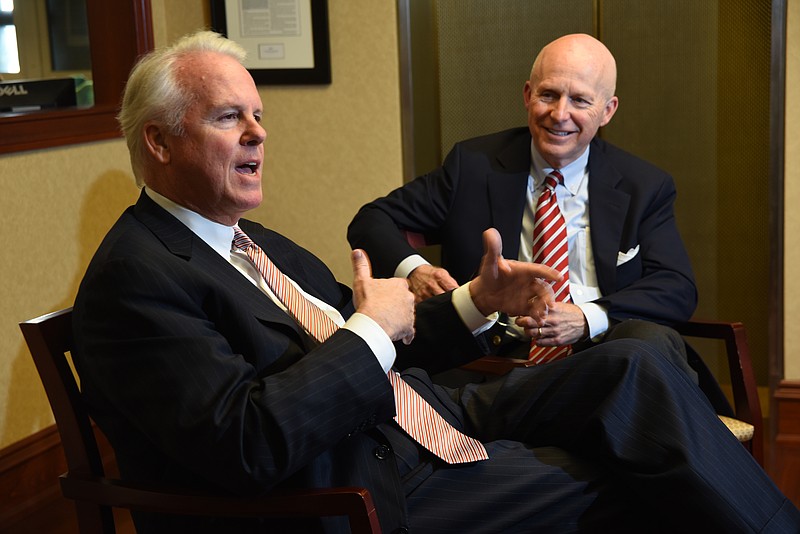

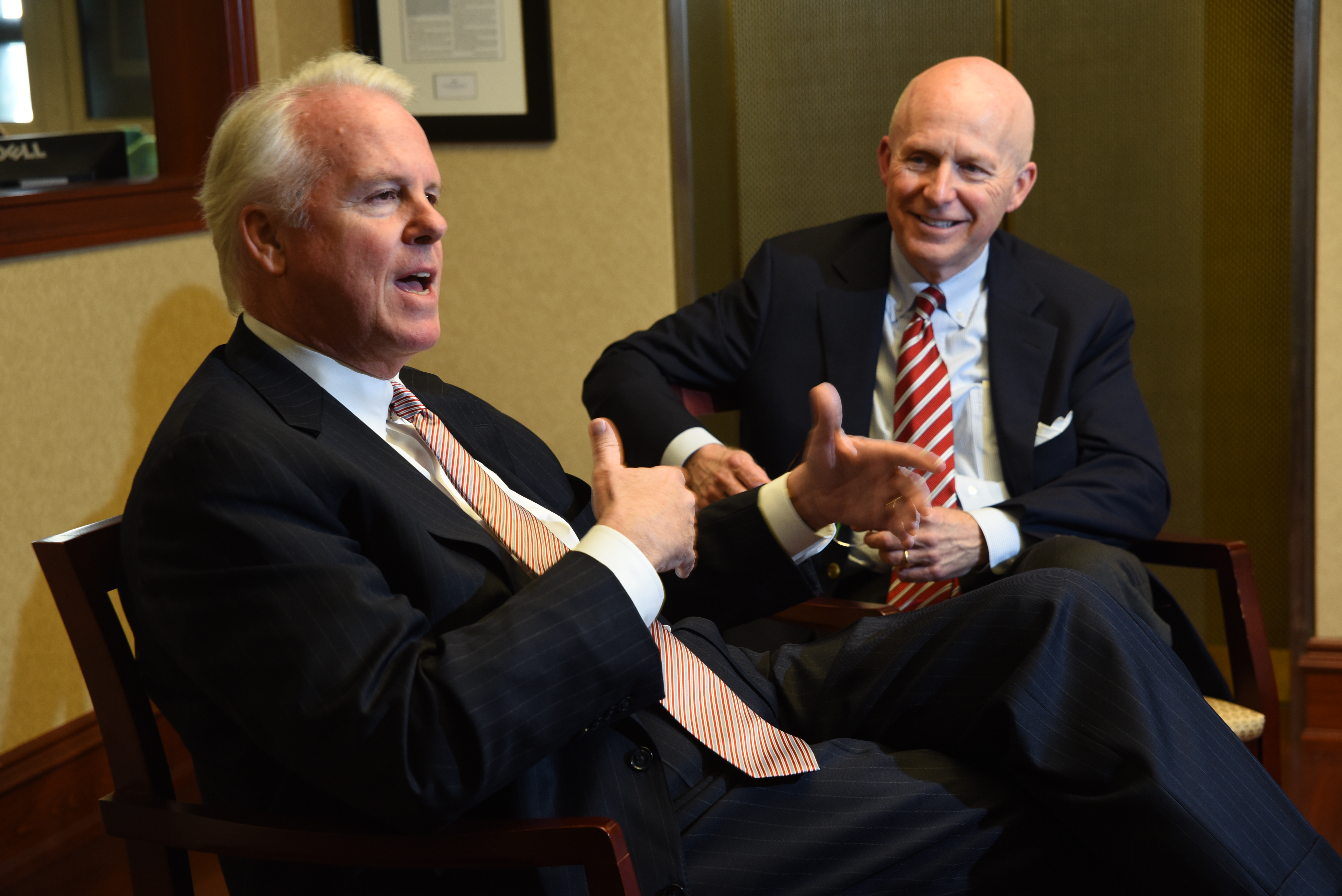

When Terry Turner began looking for the best way to grow his 15-year-old Nashville-based Pinnacle Bank, he says he found the ideal bank to buy in Chattanooga.

Turner, who agreed last week to acquire CapitalMark Bank & Trust for $187 million, said CapitalMark was the "most attractive" acquisition target anywhere in Tennessee because of its own growth and the potential of the Chattanooga market. Pinnacle used its elevated stock price to make its first acquisition since the Great Recession ended, buying Chattanooga's fastest-growing bank and planning to try to expand on CapitalMark's nearly $1 billion in assets by adding more branches and staff over time.

Out from the housing slump and eager to grow again, Turner is not the only regional banker eager to enter the Chattanooga market. Even with 27 banks now operating in metro Chattanooga, those hunting for banks to buy have put Chattanooga-area banks in their crosshairs.

Chattanooga's three biggest locally owned banks are all getting new owners this year. In the past four months, CapitalMark, FSG and Cornerstone banks each struck deals to merge with growing banks eager to expand into Southeast Tennessee. The pending sales, collectively valued at more than $400 million, will help the local banks get more capital and services while giving shareholders greater liquidity to cash in on their holdings.

Last year, one of Cleveland, Tenn.'s biggest banks, Southern Heritage Bank, agreed to a $32.2 million sale to the First Citizens National bank in Dyersburg, Tenn., one of the fastest-growing banks in West Tennessee.

"We're definitely seeing more merger talk and activity across the state, but the Chattanooga area seems to be the hottest market right now," said Collin Barrett, president of the Tennessee Bankers Association.

The pending deals in Chattanooga are expected to close over the next six months and leave Chattanooga with only one bank headquartered here -- First Volunteer Bank.

But other independent banks are headquartered in nearby Ringgold, Ga., (Northwest Georgia Bank), Dunlap (Citizens Tri-County Bank), Ooltewah (Community Trust and Banking Co.) Dayton (Community National Bank), Fort Oglethorpe (Capital Bank), LaFayette, Ga., (Bank of LaFayette) and Cleveland, Tenn. (Bank of Cleveland).

Three major Southeastern regional banks -- Memphis-based First Tennessee, Atlanta-based SunTrust and Birmingham, Ala.-based Regions Bank -- remain the biggest banks in the Chattanooga area. Collectively, the big three have just over half of the $8.5 billion in deposits in metropolitan Chattanooga, according to the Federal Deposit Insurance Corp.

Community banks, which split up the other half of the Chattanooga banking market, are being driven to sell or combine with other banks for several reasons, Barrett said. Increasing regulatory requirements, the economies of scale and consumer demand for more electronic and other financial services are all reasons why many banks have decided to consolidate.

"Generally after banks merge they are able to realize more economies of scale and become more efficient," said Julapa Jagtiani, a special adviser and researcher at the Federal Reserve Bank in Philadelphia who has studied bank merger trends. "The amount of financial reports that banks must prepare has increased, and because of the increased regulations it can be better for small community banks to grow or merge with others to spread those costs over a larger base."

From its peak in the 1980s, at 14,500 banks, the number of U.S. banks has dropped to about 6,000, even with a flurry of new banks started before the Great Recession.

Bank sales can help strengthen banks, boost their capital and lending limits and expand consumer services, Jagtiani said.

CapitalMark, which grew to $968 million in assets in less than eight years, was faced with having to repay a federal Small Business Lending Fund loan, which provided $18.2 million at an initial 1 percent rate that would rise to 9 percent in 2016 if not repaid by then.

FSG and Cornerstone both suffered hefty losses during the recession and were put under increased regulatory oversight until they were able to raise more capital. Both banks successfully issued more stock and succeeded in getting off of the regulators' watch list.

The banks being acquired also had strong presence in their markets, and their top personnel say they plan to stay on after the mergers.

"Like most banks, we want to be a top performer with one of the leading positions in the market," Turner said. "We think we can achieve that with CapitalMark and get under some of the big regionals that are in the market with the type of service we can offer from our experienced bankers."

Cornerstone is merging with SmartBank, which began in Sevier County but will be moving its headquarters to Knoxville. Miller Welborn, the Cornerstone chairman who will become chairman of the combined bank, calls the combination "a merger of equals." The new bank will be the seventh-biggest in Tennessee and the combination is expected to generate some efficiency gains while expanding each of the banks' market areas.

For FSG, the largest of the Chattanooga-based banks with 26 branches across East Tennessee and Northwest Georgia, the merger with Atlantic Capital will generate efficiency gains and a return for shareholders who invested in the bank last year. Atlantic Capital has grown to a $1.3 billion-asset bank in eight years with only a single office in Atlanta.

"Our goal is to build a premier financial institution in the Southeast by focusing on business and private banking," said Douglas Williams, chief executive of Atlantic Capital who will be the CEO of the combined bank.

Contact Dave Flessner at dflessner@timesfreepress or at 757-6340.