For 15 years, Chattanooga has paid the Hamilton County Trustee's Office $30,000 a year to handle the collection of the city's hotel-motel taxes, but the cost of doing business is catching up with the times.

In 2015, that $30,000 fee amounted to 0.5 percent for the $5.9 million in occupancy taxes the office collected on behalf of the city. With Chattanooga's hotel-motel revenues growing to $6.7 million in 2017, as projected in the city's budget last year, the compensation proportionally dwindles.

On Tuesday, the Chattanooga City Council voted 9-0 to set the service fee at 1 percent in a new five-year agreement with the trustee's office.

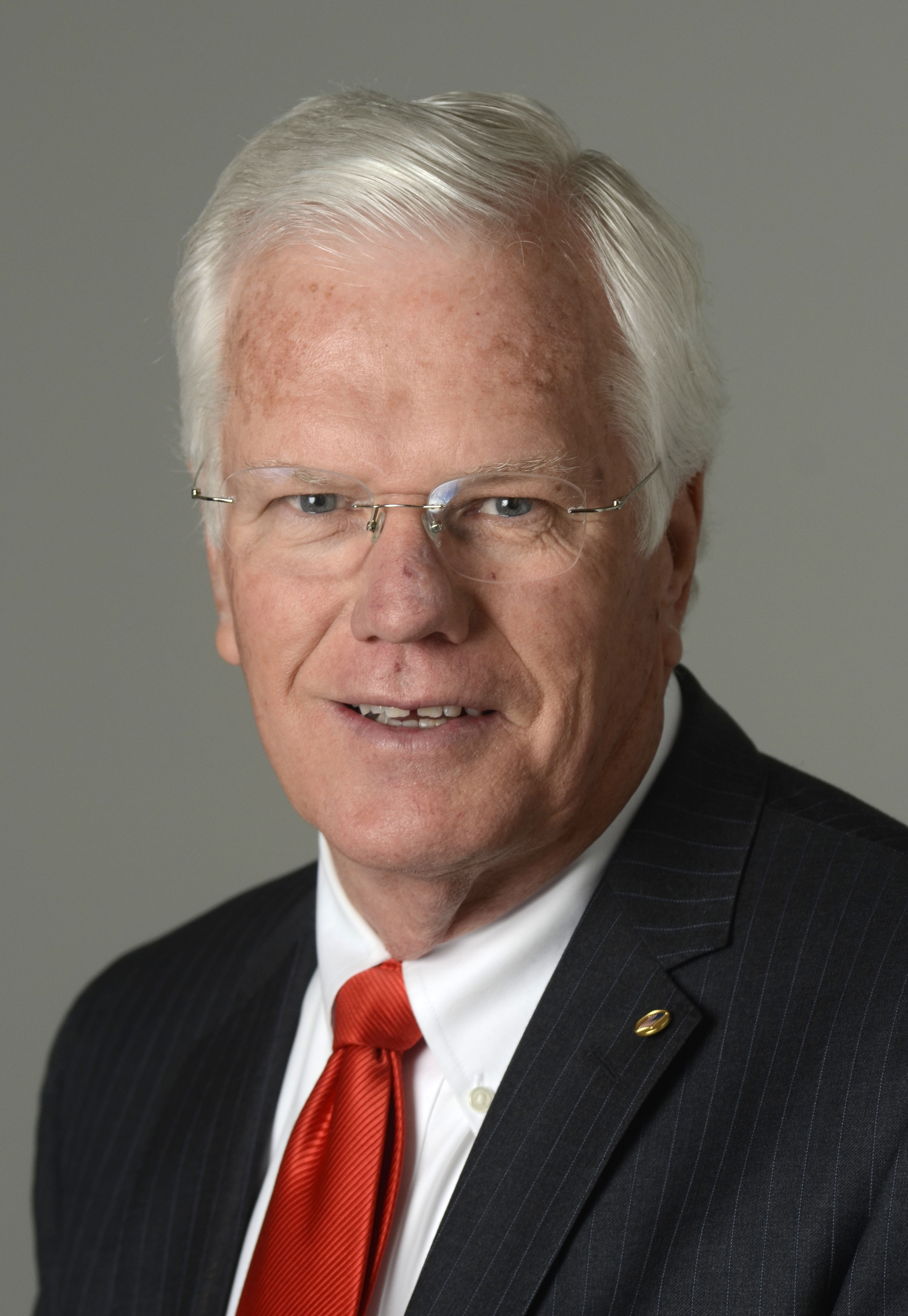

"I think this is one of those combined services that the county and the city work together on that's a win-win for everyone, including the taxpayers," Hamilton County Trustee Bill Hullander said to the council.

The $30,000 flat-fee agreement, launched in 2002, was only supposed to last for three years, City Finance Officer Daisy Madison said.

"The 1 percent that he's charging is consistent with what he's charging the other municipalities," Madison explained to council members.

Essentially, the trustee's office has "overlooked" the matter until now, Hullander said.

The service fee goes toward a number of increasing administrative costs, he said, adding field audits had resulted in an extra $37,000 in hotel-motel tax revenue for Chattanooga this year.

Councilman Chip Henderson asked Madison to look into whether the city could reduce incentives to help pay for the increased service fee.

According to hotel-motel tax remittance forms found on the Hamilton County Trustee's Office website, Chattanooga, East Ridge and Collegedale give a 2 percent discount to lodging operators who remit their taxes no later than the 20th day of each month.

A 1 percent discount would enable to the city to cover the increased handling cost, Henderson said.

Council members asked if any of the hotel-motel tax money could be used to offset the cost of administering a proposed overhaul of Chattanooga's short-term vacation rental regulations.

A plan to set up a special district within the city's core and Lookout Valley would encourage hundreds of short-term operators to "come into the light" and get on the tax rolls, Henderson has said.

Madison said she would research whether those revenues could be used to offset costs associated with administrating short-term vacation rental permitting and enforcement. Hotel-motel revenues mostly go toward paying for the development of the city's waterfront, she said.

Contact staff writer Paul Leach at 423-757-6481 or pleach@timesfreepress.com. Follow him on Twitter @pleach_tfp.