JASPER, Tenn. - The employee pension plan has been an increasing liability on Jasper's financial welfare in recent years, and city leaders say they are determined to find a solution.

Paul Johnson, an auditor with Johnson, Murphey & Wright in Chattanooga, said Jasper has lost money on its business-type activities recently because the pension costs came in "extremely high," and much higher than officials anticipated.

In June 2014, Jasper's pension liabilities were $735,000, and that has steadily increased to $1.456 million in June 2016, which is the most recent calculation.

"We are falling into that hole of pensions, and this is why private companies have gotten out of the pension business and so many other people are going the 401k [route]," Johnson said. "These liabilities are increasing at a rapid rate."

He said the biggest problem with pension funds is "people are living too long."

"I know that sounds like a strange thing to say, but when they started these pension plans, it was rare that somebody made it to 70," Johnson said. "Now, people are living to be 90 and older. This has become a real problem for all the towns."

Even though the calculations up to June 2017 might not be available for a while, he said, given recent trends, it's probably not going to be good news.

At the April meeting of the Jasper Board of Mayor and Aldermen, Mayor Paul Evans said he has been in contact with officials at the Tennessee Consolidated Retirement System about switching the town's retirement plan there like most other local municipalities.

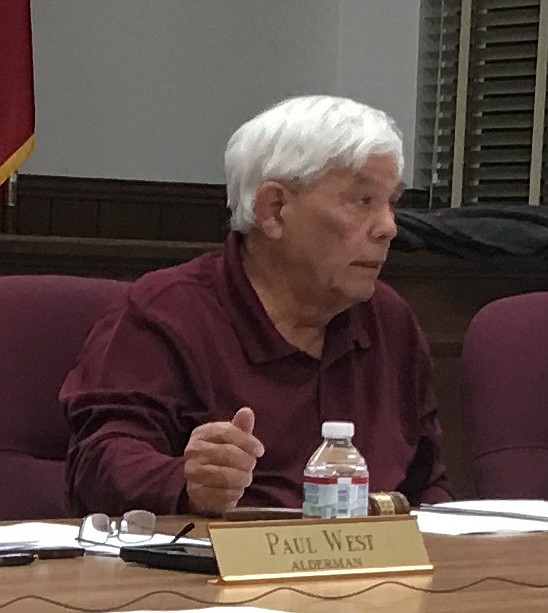

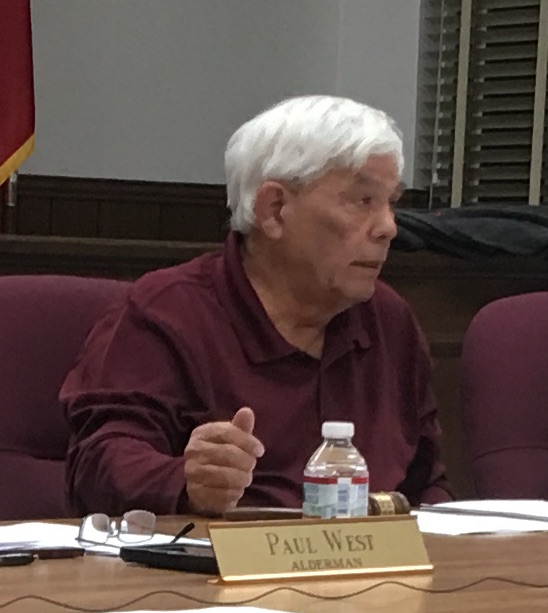

Jasper established its current plan with BB&T Corporation in Winston-Salem, N.C., in 1992, and Alderman Paul West said the company has been "impossible to deal with" for the town's current city leaders.

West said the board inherited the pension plan situation, and it's something that "should've never been done."

"We've been looking at this for three years," he said. "This just didn't come up today. The good news is if [every city employee] retired tomorrow and came to city hall, we've got the assets to pay it. It wouldn't be real comfortable, but the money's there to pay it."

City Attorney Mark Raines said the board will have to consider the sustainability of the current plan.

"As long as we have this plan in effect, the town is going to be responsible for coming up with the payments, and basically, we're at the mercy of whatever the [actuary] says," he said.

The town does have "sufficient" assets to cover the costs if all its employees suddenly retired, but Raines said "it would pretty well wipe out the reserve money that the city has."

"Those liabilities just keep growing and growing," he said. "I don't see how that's sustainable for the town."

The board voted unanimously to allow Evans to investigate various options for Jasper's pension fund, including the Tennessee Consolidated Retirememt System, and report back at its next meeting May 14.

"Ultimately, this board is going to have to vote on something that the town can sustain, that's going to take care of the employees and not bankrupt the town doing it," Raines said. "I don't know what that answer is, but we need to find out probably pretty quickly."

Ryan Lewis is based in Marion County. Contact him at ryanlewis34@gmail.com.