NEW YORK (AP) - The value of stocks, crude oil and the European currency is likely to fall this week as investors worry about what the Paris terror attacks will do to consumer confidence and key parts of the global economy.

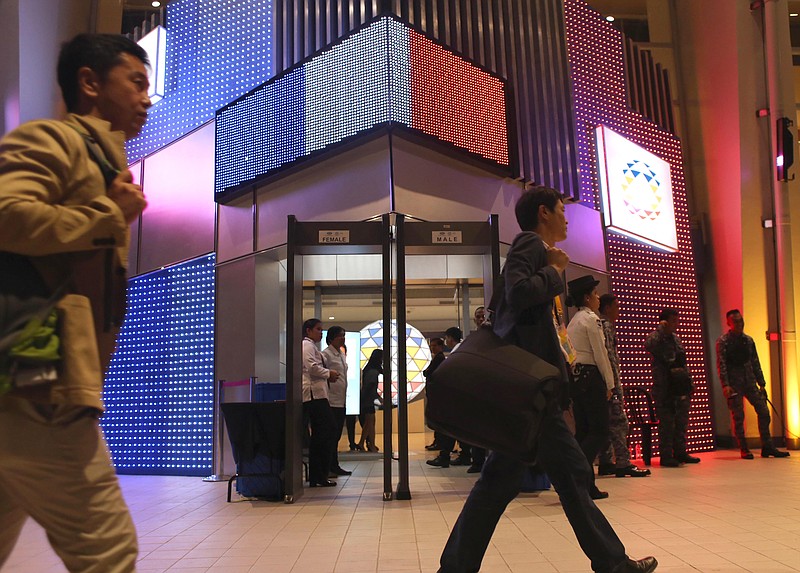

The public nature of the targets - cafes, a stadium and a concert hall - could make travelers hesitant about visiting Paris or other major cities. A drop in tourism in Europe could weaken the euro, while oil prices could fall below $40 per barrel once again on fears that demand will drop. The attacks also could hurt the stocks of major airlines in the U.S., Europe and Asia.

Friday night's suicide-bombing attacks, which left at least 129 people dead and more than 350 injured, come as investors are already nervous about slowing economic growth in China and the future of the eurozone.

Tom Kloza, global head of energy analysis for the Oil Price Information Service, said the attacks could exacerbate weak global demand and the strong U.S. dollar, trends that have pushed oil prices downward this year.

Some analysts, however, believe any economic impact will be short.

"It's not something that's going to throw the European economy into recession," said Sam Stovall, U.S. equity strategist for S&P Capital IQ. He expects the U.S. stock market to fall about 2 percent Monday, with larger declines in Europe. But based on the reactions to similar attacks in the past, Stovall expects stocks to begin recovering after about a week.

Stocks and economic growth fell initially after previous terror tragedies, but markets bounced back once it became clear that there wouldn't be a major economic impact, said Shane Oliver, head of investment strategy and chief economist at AMP Capital. The U.S. market recovered in just over a month from a 12 percent decline after the Sept. 11, 2001, attacks, he said, while the U.K. market rebounded in one day after a 1.4 percent fall the day of the 2005 London bombings.

"As horrific as these events are - and this is truly awful - economic activity does tend to be pretty resilient," said Howard Archer, IHS Global Insight analyst in the United Kingdom. "At the end of the day, people have to get on with their lives. And that is the best way of putting up two fingers to the terrorists."

____

Krisher reported from Detroit. Associated Press Writers Joe McDonald in Beijing, Pan Pylas in London, Mari Yamaguchi in Tokyo, and Kelvin Chan in Hong Kong contributed to this report.

___

Follow Tom Krisher at twitter.com/tkrisher.

His work can be found at http://bigstory.ap.org/content/tom-krisher