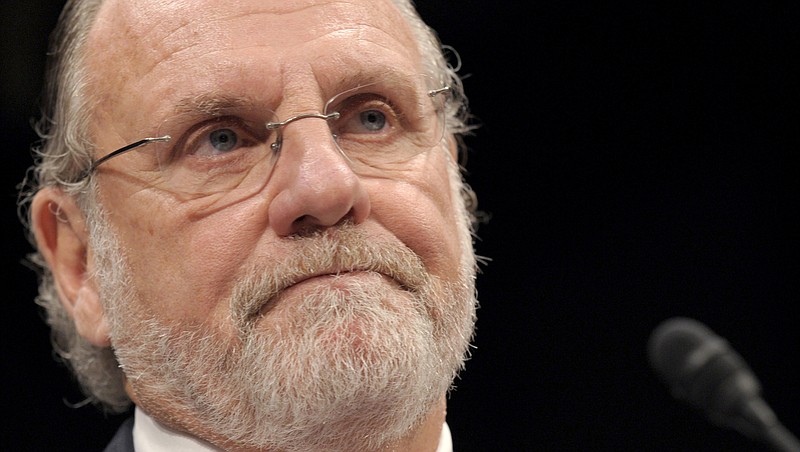

WASHINGTON (AP) - Jon Corzine, the former New Jersey governor who led the collapsed brokerage MF Global, has been ordered to pay a $5 million penalty for his role in the firm's alleged illegal use of almost $1 billion in customer funds.

A federal court in Manhattan on Thursday granted the order against Corzine to the U.S. Commodity Futures Trading Commission, which brought civil charges against him in 2013. Following the stunning collapse of the big Wall Street firm in late 2011, the CFTC alleged that MF Global misused customer funds in a vain attempt to remain solvent. Corzine failed to closely supervise the handling of customer money by the firm's employees, according to the order.

Corzine, who was the CEO of Wall Street powerhouse Goldman Sachs before entering politics in 2000, was banned by the court order from serving as an official or employee of any commodities trading firm. He also was banned from trading most commodities and other investments regulated by the CFTC, with some limited exceptions.

A related order issued by U.S. District Judge Victor Marrero imposed a $500,000 penalty on Edith O'Brien, an assistant treasurer at the firm who had the authority to approve transfers of customer money. She was said to have aided and abetted MF Global's alleged violations. O'Brien was banned from working at a commodities trading firm or trading commodities for 18 months.

The court action brought the resolution of a five-year legal drama for Corzine, enabling him to avoid a trial that had been set to begin in October. He had denied wrongdoing from the outset and insisted he didn't order anyone at MF Global to divert customer funds.

Corzine said he was pleased that the matter was resolved. "I have accepted responsibility for (MF Global's) failure, and I deeply regret the impact it had on customers, employees, shareholders and others," he said in a statement. "I remain gratified that several years ago all customer money was recovered and returned to MF Global customers."

New York-based MF Global imploded after a disastrous $6.3 billion bet on European countries' debt. The firm filed for bankruptcy protection on Oct. 31, 2011. The $41 billion bankruptcy was the eighth-largest in U.S. history at the time and one of Wall Street's biggest. About $1.2 billion in customer money was discovered to be missing.

The regulators had said that MF Global moved the money out of client accounts within days as the firm's cash dried up. The misuse of customer funds was on a scale never seen before, CFTC officials said. Corzine failed to fix MF Global's deficient controls and to prevent the firm from dipping into customer money, they said.

It was the first time in the 150-year history of the U.S. futures markets that customer funds disappeared in the failure of a commodities brokerage, according to lawmakers.

Much of the missing money belonged to farmers, ranchers and other business owners who bought and sold financial contracts with MF Global to reduce their risks from the fluctuating prices of corn, wheat and other commodities.

Amid the billowing scandal, Corzine stepped down as MF Global chief on Nov. 4, 2011.

Under Corzine's leadership, the firm bet $6.3 billion on debt issued by Italy, Spain and other European nations with troubled economies. The bonds plummeted in value in the weeks before MF Global's failure as fears intensified that some European countries might default.

Corzine, 70, was a prominent Democratic politician and a major fundraiser for Democrats. He stepped from Wall Street into politics in 2000, dipping into his personal fortune to fund a hugely expensive and successful bid for the U.S. Senate from New Jersey. He later became governor of the state. Corzine took the top job at MF Global in March 2010 after losing a bid for a second term as governor to Republican Chris Christie. His plan was to remake MF Global from a modest brokerage firm into a major Wall Street player.

For months, the regulators investigated whether the missing customer money was improperly used to cover MF Global's short-term needs when its trading partners lost confidence in the firm and demanded the cash owed them.

The Justice Department conducted a criminal investigation of MF Global; no criminal charges have been brought.