BY THE NUMBERSIf federally subsidized student loan interest rates double from 3.4 percent to 6.8 percent:Georgia• 225,008 -- Student loan borrowers affected• $205.4 million -- Additional debt createdTennessee• 138,315 -- Student loan borrowers affected• $134.6 million -- Additional debt createdSource: U.S. PIRG

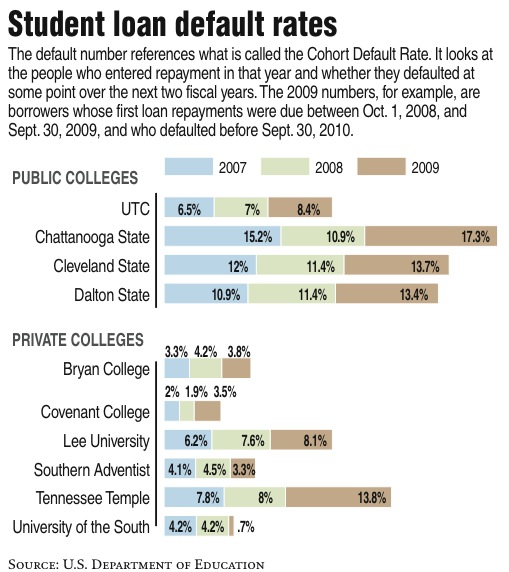

Default rates on student loans have risen in Chattanooga and across the country, reaching their highest levels in at least three years.

Experts say the trend is a recession-fed turnabout following some of the lowest years for defaults since the 1990s.

Department of Education data from 2011 shows that the default rate for Chattanooga State Community College rose over 2010 from 10.9 percent to 17.3 percent. That's the highest default rate among the area's colleges and universities and one of the highest rates for Chattanooga State in several years.

Georgia's overall default rate is 9.2 percent and Tennessee's is 10.8, both higher than the national rate of 8.8 percent.

And the burden on undergraduate students taking out new loans will ratchet higher if Congress can't agree on how to keep interest rates low on federally subsidized Stafford loans.

Lawmakers are deadlocked over how to come up with $6 billion needed to keep loan rates at 3.4 percent for one more year.

If Congress fails to bridge the partisan divide and act by July 1, the rate will double to 6.8 percent. About 7 million students nationwide would pay about $9 more per month on loans taken out after July 1. That's about $1,000 over the life of the loan, which averages about 10 years.

What impact higher interest rates would have on defaults is still up for debate. Some say the higher rate will aggravate default rates, although the effect won't be immediate. Others argue that, since the amount is so small and will apply only to loans taken out this year -- provided Congress fails this year but acts to lower rates next year -- it won't have much impact.

Beyond the immediate issue of interest rates, many agree that student debt and college affordability are a much bigger conversation, one that includes talking about default rates.

"People who leave school without completing are more likely to default on their loans," said Tammy Swenson, executive vice president for business and finance at Chattanooga State. The school advises students on loans and the repercussions of defaulting, she said.

"We are trying to do the best we can in helping them understand what that means," she said, but ultimately the school is not the one that decides who gets a loan and who doesn't.

School officials said that in the 2011-12 academic year, 5,677 Chattanooga State students took federal loans, with about 80 percent of them need-based.

The bad economy is partially to blame for rising default rates, said Jonathan Fansmith, associate director for government relations at the American Council on Education, a Washington, D.C.-based association that conducts research and public policy advocacy.

"A bad economy means fewer opportunities and less money," he said. "At the same time, more people need those skills and are more willing to go back to school and borrow and accumulate debt."

But Jason Delisle, director of the Federal Education Budget Project at the New America Foundation, said programs already are in place to help students who are unemployed or to lower payments based on income. The foundation is a public policy institute in Washington, D.C.

"Really, for people who are struggling, the rate change doesn't make any difference," he said, because the monthly savings is not significant.

Those who are defaulting may include those "who didn't know they had loans, people who don't care and others who didn't know they had options," he said.

Several bills have been introduced in Congress offering ways to pay for the cost of keeping student loan interest rates low for another year.

Senate Democrats have proposed closing a tax loophole that allows some corporations to avoid paying certain employment taxes.

U.S. Sen. Lamar Alexander, R-Tenn. introduced a bill -- co-sponsored by Sen. Johnny Isakson, R-Ga.-- that would repeal the prevention and public health fund for women's health and preventive care that was created under federal health care reform.

Neither bill has advanced for a full vote in the Senate.

"In February, the Middle Class Tax Relief and Job Creation Act was passed. It was voted on in the Senate, and every Democrat except six voted to take $5 billion out of the prevention and public health fund we are talking about to pay for it," Alexander said on the Senate floor Tuesday.

"It is not only the Democrats on that side who have supported taking from the fund, it is the president of the United States," he said. "President Obama, in his Fiscal Year 2013 budget proposal, proposed taking $4 billion away from the fund, and then in his 2011 deficit reduction package, he proposed taking $3.5 billion from the fund. So it is a bipartisan proposal."

Democrats contend the GOP is more sensitive to tea party conservatives and anti-tax stalwarts than to the financial needs of ordinary Americans.

U.S. Sen. Patty Murray, D-Wash, said in the Chicago Tribune that Republicans "are simply unwilling to allow the wealthiest Americans to pay a single penny more in the aid to the recovery of this economy."

Despite the election-year posturing, people on all sides believe there ultimately will be an agreement.

"I am optimistic that once the political gamesmanship ends, we will come to a solution and do what's right for the students of America," Isakson wrote in an email.

If the rate hike occurs, it will cost Georgia student loan borrowers about $205.4 million and Tennesseeans about $134.6 million in additional interest over the life of their loans, according to Rich Williams with the U.S. Public Interest Research Group. U.S. PIRG has a nonprofit network of more than 100 student chapters working to reduce student loan debt.

But Congress should be thinking of other ways to revamp the loan program, said Deisle with the New America Foundation. Only one-third of new federal student loans in the 2012-13 academic year will qualify for the 3.4 interest rate, he said.

"Offering borrowers fixed rates is better than variable rates, but I think the rates should be set based on something like the market, not on something Congress decided a decade ago," he said.

In the short term, it's critical that college doesn't become more expensive for students, said Fansmith with the American Council on Education.

But he believes the country is headed for the bigger conversation, too.

"Clearly the hype [the subject] is getting has a lot to do with the presidential election," he said, "but I don't think it will disappear after the elections."