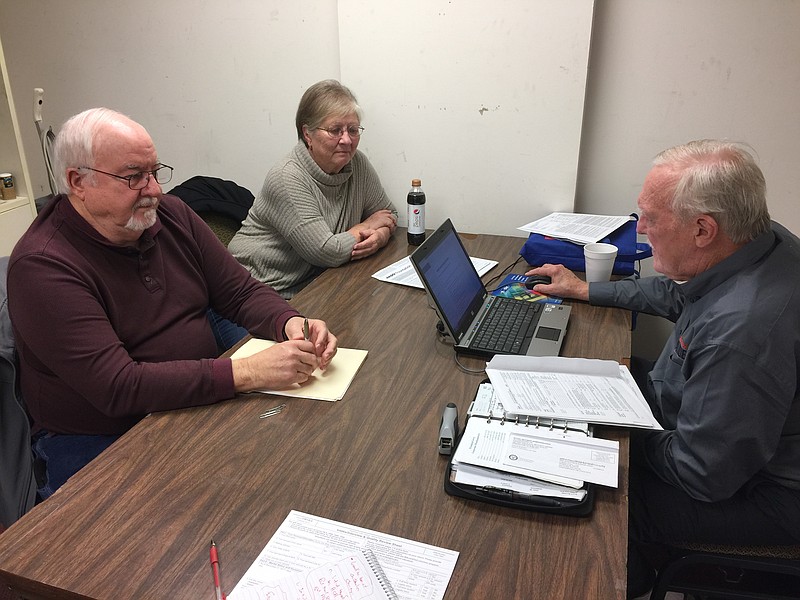

On Tuesday morning, Donald and Ann Fritz of Red Bank gathered their tax documents in a file folder and headed to downtown Chattanooga.

Later, in the basement of the Bessie Smith Cultural Center on M.L. King Boulevard, they sat across a table from George Davenport, one of several volunteer tax preparers, discussing the intricacies of health care and its impact on personal income taxes.

Davenport is part of a national network of volunteers deployed by the AARP Foundation to give Americans no-cost assistance with their tax returns.

About 1,500 people in Southeast Tennessee will get tax help and advice at AARP Tax-Aide centers in Chattanooga and Athens, Tenn. Statewide, 400 volunteers will staff 66 locations. (For Chattanooga-area locations and hours, see related article on Page C1.)

The AARP Foundation Tax-Aide program is the nation's largest network of free tax assistance. You do not have to be a senior citizen or a member of AARP to get help, although it is aimed at people over 50. Nationally, the Tax-Aide program has about 5,000 locations in public libraries, banks, malls community centers and senior centers.

View other columns by Mark Kennedy

Donald Fritz, a retired McCallie School carpenter, said he used to get help on his taxes from his dad. After his father died, he soldiered on for a few years before his wife's Affordable Care Act exchange insurance complicated the couple's taxes.

"It does save us some money," Donald Fritz said of the AARP service. "You can't beat it."

"And it takes maybe half an hour," said his wife, Ann Fritz.

Tom Shipp, the coordinator of the AARP's tax service in Southeast Tennessee, says the program is designed to help lower- and middle-income people avoid having to pay hundreds of dollars a year to professional tax preparers.

All the AARP volunteers are trained in tax matters, and the returns are filed electronically, he said. The volunteers use laptop computers provided by AARP or the IRS, which certifies the program.

Shipp, a 79-year-old retired IT worker with previous tax training, said he got involved in the program 10 years ago after reading about it in an AARP publication.

"It's one of the most rewarding things I've ever done," he says. "We save people a lot of money. I hate that some people have to pay $500 for what we do for free."

Shipp said there are some limits to what the AARP Foundation Tax-Aide can do. For example, people with small-business losses, self-employment expenses over $25,000, farm income or alternative minimum tax matters may have to get help elsewhere. But the vast majority of Americans won't have those issues.

Shipp said the centers are busiest now - at the beginning of tax season - and in April when the tax deadline approaches. The last day of operation this year is April 12, he said.

David Kling, a Chattanooga retiree, said that for a number of clients, the tax centers are a godsend.

"The tax laws have gotten so complex that people don't know what to do," he said.

To schedule an appointment at one of the AARP Tax-Aide centers, call 423-364-4517. Walk-ins are accepted, but expect to wait without an appointment.

To suggest a human interest story for this column contact Mark Kennedy at mkennedy@timesfreepress.com or call him at 423-757-6645.