Like county commissioners. And school board members. And common taxpayers.

Read more

In Tennessee, Haslam says no gas tax hike this year

That's the rub at the Georgia Capitol right now, where state legislators are trying to figure out how to raise annual transportation funding by 10 figures. A joint study committee says Georgia needs at least that amount to keep its infrastructure operating smoothly.

The money would be used to create more mass transit options, expand highways and repair bridges.

But how will the state get an extra $1 billion? The current plan in the state House strips some tax revenue from local governments, a blow that will hurt almost no one in Georgia as much as it will hurt Dade County.

If passed, House Bill 170 will increase prices at the gas pump. Right now, the state charges a 4 percent sales tax, plus a flat 7.5 cents per gallon in excise tax. At a current gas price of $2.10, that means a total of about 16 cents in tax per gallon.

Under HB 170, the state would drop its sales tax and charge an excise tax of 29.2 cents per gallon of gasoline. Based on federal estimates for miles driven per year and fuel consumption per car, the average driver would use 560 gallons, costing him or her $160 annually under the higher excise tax.

The state also world charge 33 cents per gallon for diesel fuel.

People who drive cars that run on electricity, natural gas or propane, meanwhile, would pay an annual fee when they register their vehicles. The fee will be $200 for most drivers but $300 for commercial vehicles.

The bill also would change how local governments can raise money from motor fuel sales. Right now, counties can charge 3 cents a gallon in sales tax and use that money for any need, like salaries for police officers and teachers and clerks.

But HB 170 ends the local sales tax on fuel. Instead, county officials could charge an excise tax of up to 3 cents or, if passed by residents in a referendum, up to 6 cents.

However, the money could be used only for transportation needs. That means taking away money from other important functions of local government.

City and county officials across the state are speaking out against the bill. On Monday, the Atlanta City Council unanimously approved a resolution asking state lawmakers to find a new plan to fund transportation needs.

The House Transportation Committee debated the bill during a hearing Thursday. The bill has not been voted on. Committee member Rep. John Deffenbaugh, R-Lookout Mountain, did not return multiple calls seeking comment.

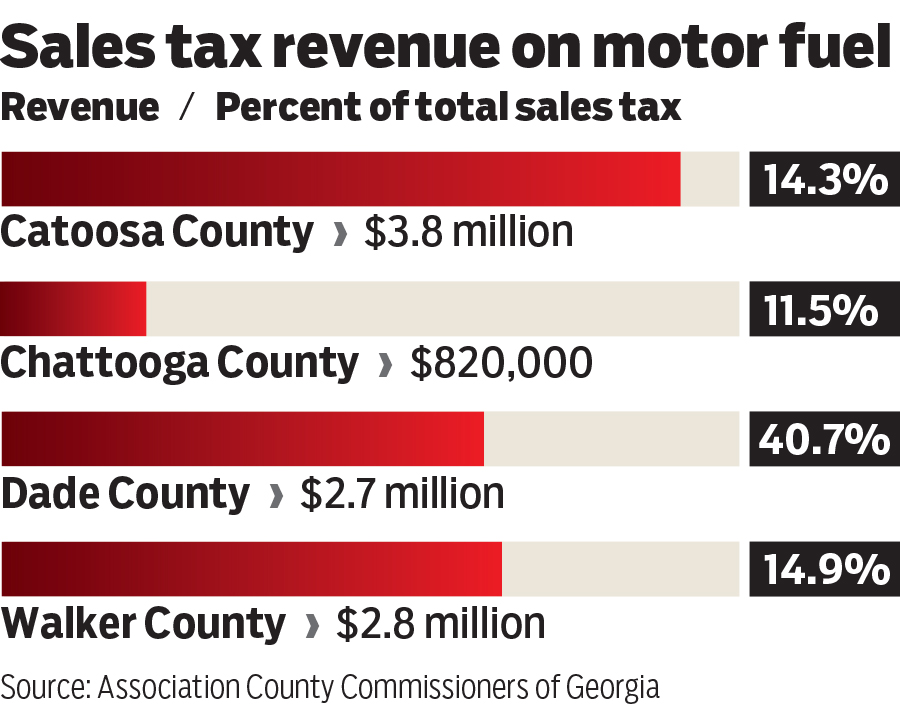

Walker County Commissioner Bebe Heiskell said local officials are exchanging emails to discuss what the plan would mean for their constituents. Walker County would lose control of about $2.2 million in revenue - about 15 percent of the total amount the county gets from sales taxes.

The county could still collect the money through a local excise tax, but could only spend it on transportation projects.

Heiskell, who increased local property taxes by about 1.6 percent last year because of budget shortfalls, said state lawmakers could put her in a bind.

"I don't want to keep doing it," she said of last year's tax hike. "I thought (that increase) would solve our problem. But it keeps showing its ugly little head."

Dade County's situation is worse than Walker's. Losing sales tax on motor fuel would cost Dade's government control of about $2.7 million. That represents about 41 percent of the county's sales tax revenue, much of it currently going to projects other than transportation.

Only Butts County (53 percent) and Dooly County (41 percent) would lose control of a larger chunk of their annual revenue, according to the Association of County Commissioners of Georgia.

"If the bill passes the way it's written right now," Dade County Commissioner Robert Goff said, "it would probably be the hardest thing to hit Dade County in a long time."

Dade County depends so much on gas tax revenue because it is located in the top left corner of Georgia, bordering two counties in Tennessee and two in Alabama. It gets a lot of out-of-state through traffic - people commuting from Jackson County, Ala., to their jobs in Chattanooga, for example.

Taking away the gas tax revenue would mean cuts in other areas of government, increases in property taxes or both. The rural county of 16,600 doesn't get as much sales tax from shoppers as other local governments do.

"We don't have a Wal-Mart," County Executive Ted Rumley said. "We don't have a Lowe's. It's a big deal to Dade County."

Last July, commissioners proposed raising property taxes 44 percent, and residents were livid. So many people protested at public hearings that some couldn't fit inside the Administrative Building, and county commissioners backed down.

A month later, they raised property taxes about 23 percent. They had to lay off and furlough 42 county employees.

If this bill passes, Goff warned, Dade County could see a similar hit.

"A couple years down the road, people aren't going to remember what happened unless we keep jawing our mouths," he said of HB 170. "We're the ones as a commission who will be blamed for a tax hike, not Atlanta."

Contact staff writer Tyler Jett at tjett@times freepress.com or 423-757-6476.