LaFayette's Edward Jones office is welcoming Ty M. Willeford.

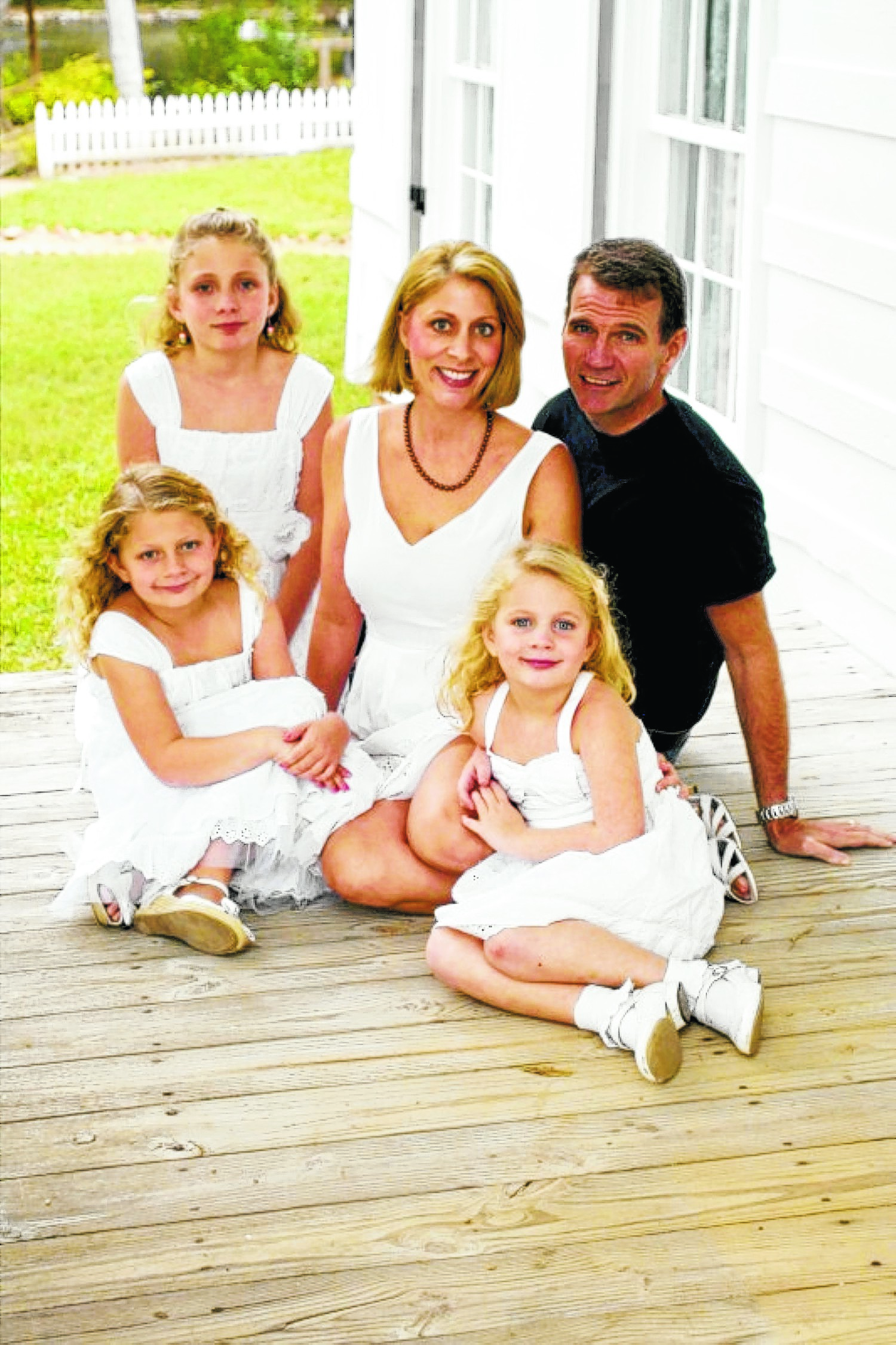

Practicing in LaFayette for the last three months, he is settling into his new home with his wife Rachel and their three daughters: Sarah, 12, Anna, 8, and Leah, 5. The family is happy to be able to live, work and go to school in LaFayette, he said.

"One of my partners in the firm accepted a leadership position," said Willeford. "He built this office [at 503 N. Main St.] and had his choice of who to choose to come here. He contacted me due to my history in the area and my client services. He thought I would be a good fit for LaFayette.

"It's the old adage of bringing Wall Street to Main Street," he added in regards to his new business's location.

Willeford is both a financial adviser and an accredited asset management specialist. He joined Edward Jones in 2009 after moving to the Chattanooga area in 1999. Before moving to LaFayette, he worked at the Ooltewah Edward Jones office.

"I help individuals and small businesses establish and achieve their long-term financial goals," he said. "I specifically handle retirement planning and estate planning. We provide tailored financial solutions."

Willeford helps his clients with stocks, bonds, mutual funds, life insurance and annuities tailored to a customized long-term financial plan.

He learned early on how to properly handle money.

"My father taught me to live within my means and to save for a rainy day," said Willeford. "I opened my mutual-fund account at the age of 20. I have a personal 401k. I have funded my retirement accounts my whole life. I am so glad because my family is on track to where we should be in the future. If you don't plan for retirement, then retirement will come and you won't be ready for it. You don't want to run out of money before you run out of your life."

Years ago, he said retirement was thought of as a pension plan, but those days have passed. Now, people need to plan five years ahead in order to purchase a car or home and need to plan many years ahead on leaving a financial legacy for their grandchildren, he said.

"If you don't make plans, no one will plan it for you," said Willeford. "We can't foresee what will change in your situation. We have to plan for the unexpected. It's an important part of long-term planning."

His office can be reached at 706-638-6673.