By NICHOLAS CONFESSORE and DAVID KOCIENIEWSKI

c.2012 New York Times News Service

Mitt Romney and his wife, Ann, made $27 million in 2010. They held millions of dollars in a Swiss bank account and millions more in partnerships in the Cayman Islands. His family's trusts sold thousands of shares in Goldman Sachs that were offered to favored clients when the storied investment house went public. The couple's effective federal tax rate for the year worked out to 13.9 percent, a rate typical of households earning about $80,000 a year.

Yet the hundreds of pages of tax documents released by Romney's campaign Tuesday morning did not readily reveal any elaborate financial legerdemain or exotic tax shelters. What Romney's returns illustrated, instead, was the array of perfectly ordinary ways in which the U.S. tax code confers advantages on the rich, allowing Romney to amass wealth under rules very different from those faced by most Americans who take home a paycheck.

Those differences leapt to the front of the national debate Tuesday when President Barack Obama - whose family's income was less than a tenth of Romney's in 2010 but whose effective federal rate was double - called for higher taxes on the wealthy in his State of the Union speech.

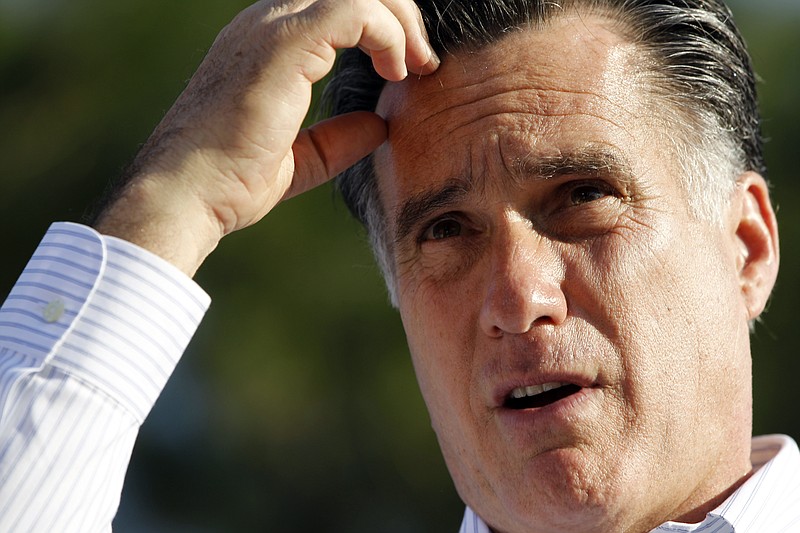

Romney's tax returns were posted on his campaign's website Tuesday morning after escalating pressure from the other Republican candidates, Democrats and even supporters, some of whom attributed his loss in South Carolina's Republican primary last weekend to his shifting and tentative responses to questions about his wealth, tax burden and overseas investments.

The 547 pages of documents included 2010 federal income tax returns for the Romneys, the couple's estimated 2011 return and returns for their charitable foundation and two blind trusts established in their names, as well as a trust established for their children.

The couple paid about $3 million in federal taxes on an adjusted gross income of $21.6 million, the vast majority of it flowing from myriad stock holdings, mutual funds and other investments, including profits and investment income from Bain Capital, the private equity firm Romney retired from in 1999.

The couple reported no wage earnings in 2010. But in a conference call with reporters Tuesday, Romney's campaign counsel, Benjamin L. Ginsberg, said that Romney and his wife collected more than $7 million worth of Bain profits in 2010.

That money - about a quarter of the couple's income during the last two years - came in the form of so-called carried interest. It would be taxed not as deferred regular income, but at the lower 15 percent rate normally reserved for long-term capital gains, thanks to federal tax rules that have sparked intense debate in recent years.

Obama and others have argued that carried interest should be taxed at the rates which normally apply to income earned by people providing services, topping out at 35 percent. If Romney's carried interest income in the last two years had been taxed at that higher rate, he would have owed about $4.8 million in federal taxes, roughly $2.6 million more than he would typically be assessed under current rules.

And like most of the wealthy, the Romneys paid only a tiny sliver of their income in payroll taxes, which cuts heavily into the weekly paychecks of wage earners but is barely a blip on the returns of the rich. While payroll taxes eat up 6 percent of the income of Americans earning the national median income of $50,221, Romney and his wife paid just one-tenth of 1 percent of their income in payroll taxes.

Romney's 2010 returns also suggest he may have paid far less taxes the previous year. The 2010 return shows the family made estimated tax payments for 2009 of $1,369,095. To avoid penalties, estimated tax payments must be at least 110 percent of the taxes owed the prior year. Assuming that is what he paid, his federal tax bill for 2009 would have been $1,244,632, far less than in 2010.

Romney and other Republican candidates have not only opposed higher taxes on the wealthy but also favor maintaining or expanding the relatively low rates for capital gains and interest income, breaks that Republicans and others favor as a way to spur investment and reward risk-taking but which critics say have fed the growing wealth gap.

Those reductions in taxes on investments began with a deal between Bill Clinton, a Democrat, and Romney's chief rival for the Republican nomination, Newt Gingrich, then speaker of the House. They accelerated under President George W. Bush, who cut taxes on dividends and capitals gains to their current levels, and survived a push by Obama and the Democratic majorities in Congress in 2010 to restrict tax advantages for financial managers. Indeed, if Romney became president and won approval of his own tax proposals he would pay less in federal taxes than he would under current law.

Gingrich has proposed even steeper reductions, which would nearly eliminate Romney's federal income tax burden. During the 15-minute conference call, Ginsberg argued that the documents should settle any lingering questions about Romney's investments and tax burden. Romney's tax return was "complicated - and it is also fully transparent," he said.

The documents suggest that the Romneys or the lawyer overseeing the family's blind trusts, R. Bradford Malt, may have been sensitive to the political implications of at least some aspects of the family's finances.

In 2010, the family's assets were held in a bank account in Switzerland. Malt said that the account complied with all Internal Revenue Service reporting requirements and that the family had paid all applicable taxes on the interest earned by those assets.

"It is a bank account," Malt said. "Nothing more, nothing less."

But the account, which held about $3 million, was closed in 2010, at a time when UBS was at the center of a Justice Department investigation regarding tax evasion by U.S. clients.

Malt also said that the Romneys' holdings in the Cayman Islands, Bermuda, Ireland and other low-tax countries did not provide any reduction in their U.S. taxes.

Bain Capital, as well as Romney's IRA, have significant holdings in funds based in the Caymans and other low-tax countries. But Malt said that Romney's income is taxed at the same rate it would be if the funds were in the United States.

The campaign declined repeatedly to answer questions about whether holding some of Romney's retirement investments in overseas vehicles may have allowed him to avoid a levy known as the unrelated business income tax, or UBIT.

The Romneys' family foundation, the Tyler Charitable Foundation, made gifts to more organizations in 2010 than it had previously. The largest amount paid that year, as in the past, went to the Mormon Church. Bush's presidential library in Dallas received the second-largest grant, $100,000.

Romney, a Mormon, tithes a portion of his income to the Church of Jesus Christ of Latter-day Saints. In 2010, his tithe appeared to include about $1.6 million in cash contributions.

Other assets held in the Romneys' trusts were managed by Goldman Sachs, which invested the Romneys' wealth in companies including Apple, Research in Motion and Comcast.

One notable sale Goldman made on the Romneys' behalf in 2010 was 7,000 original public offering shares of Goldman Sachs, purchased in 1999.

The Goldman shares were issued at $53 each. The family trusts held onto those shares for more than a decade, as the firm prospered, but unloaded them in December 2010, at a time when the Goldman name had became synonymous with Wall Street excess and Romney was known to be considering a second bid for the White House.

The shares sold for around $161 apiece for a total price of about $1.13 million.