A year after a Georgia man with broad holdings in the Chattanooga area was accused of running a massive Ponzi scheme, investors who were allegedly bilked may soon learn how they'll get money back.

A method for distributing money, garnered from the sale of assets, is expected to be discussed at a court hearing on Sept. 9 before U.S. District Court Judge Steven D. Grimberg of Atlanta, according to court filings.

There's no indication how much of the money from the asset sales, which are still ongoing, will be available to share between investors or when distributions may take place, court papers show. Losses to investors to date amount to about $68.2 million, filings show.

In August 2021, the U.S. Securities and Exchange Commission alleged that John J. Woods of Marietta, Georgia, operated the Ponzi scheme for more than a decade and defrauded more than 400 investors.

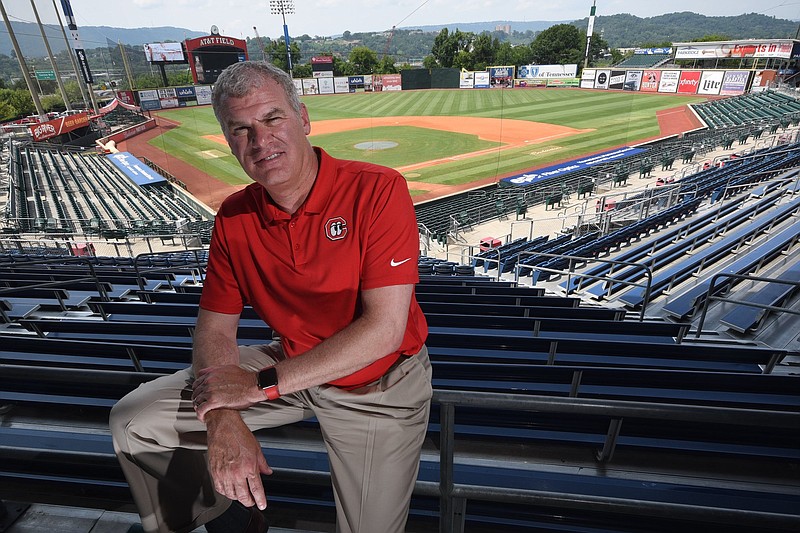

Woods, who at the time was a minority owner of the Chattanooga Lookouts minor league baseball team and had overseen operations of an investment firm in the city, allegedly collected $110 million from investors with promises of 6-7% returns.

But the SEC said in court papers that investments Woods made in a number of companies and in real estate deals, several in Chattanooga, were worth far too little for there to be any realistic prospect of paying back investors their principal, much less the promised returns.

An SEC spokesman declined to comment beyond the court filings earlier this month.

Woods, 57, who grew up in East Ridge, in court filings has denied the allegations by federal regulators of running the Ponzi scheme and asked for a jury trial in the civil case. Woods has not been charged criminally.

Woods attorney David Chaiken said earlier that the SEC's allegations "present only one side of the story." He declined to comment for this story.

A Charlotte, North Carolina, attorney appointed by the judge as the receiver in the case and who is responsible for selling off Woods' investment fund assets last week asked for the September court hearing.

The receiver, A. Cotten Wright, who did not return a phone call for comment, said in a filing that she's seeking approval next month of a procedure regarding the interim and final distributions on the investors' claims. Court filings don't specify how much money might be available to investors.

Earlier, Wright said in a filing that investors put in $134.5 million into Woods' investment fund that went by the name of Horizon Private Equity III.

Investors have so far received back $66.3 million in principal or interest from Woods' fund court papers show. But investor losses to date totaled $68.2 million, according to filings.

Of the 525 investors, 87 were determined to be "net winners," or received more money back than they invested, court papers show. Three investors received back exactly what they invested.

However, 435 investors have so far received back less money than they invested, according to filings.

Among Woods' assets, the receiver has worked on including his stake in a Chattanooga investment firm, Southport Capital. Woods was chief executive at one point in time for the company which was also accused of fraud last year by the SEC, an accusation which the company's attorney denied. Before the SEC leveled its accusations, Southport had managed more than $824 million in client investments.

Court papers show that Southport earlier this year consented to an asset purchase agreement providing for a sale to Meridian Wealth Management. According to the receiver, Southport is to remain in place as a legal entity for a reasonable period of time, and the SEC may continue litigation against Southport.

Last week, Southport's offices at the UBS building in downtown Chattanooga were dark.

Woods fund, among other investments, had included interests in Chattanooga area entities ranging from the Lookouts to real estate ventures involving strip centers and the former Sears and JC Penney's stores at Northgate Mall.

The receiver reported earlier that, aside from Southport Capital, Woods had valued the remainder of his share of the Chattanooga area assets, invested in 13 ventures, at $21.2 million.

In March, the judge in the case approved the sale of Woods' 26.6% share in a group that owns a Birchwood landfill for $100,000 to two local men who already held most of the rest of the interest in the tract, records show.

In October, the judge agreed to let the Chattanooga Lookouts buy Woods' share of the minor league team for $1.87 million. Woods owned a 20.1% interest in the team, court papers showed.

TO SEE HEARING

https://ganduscourts.zoomgov.com/j/1614817896

Meeting ID: 161 481 7896

Passcode: 557869

Contact Mike Pare at mpare@timesfreepress.com or 423-757-6318. Follow him on Twitter @MikePareTFP.