As the U.S. Senate prepares to debate the most sweeping tax reduction and reform plan in more than three decades, Tennessee business leaders are appealing to U.S. Sen. Bob Corker, R-Tenn., to support the cuts in corporate and other taxes.

Corker, who is not seeking re-election next year, is one of a handful of Republicans who the GOP leadership may need to push the tax cut plan through the Senate, where Republicans have a bare 52-48 majority. Voting on a series of tax changes and amendments is expected to continue through the night.

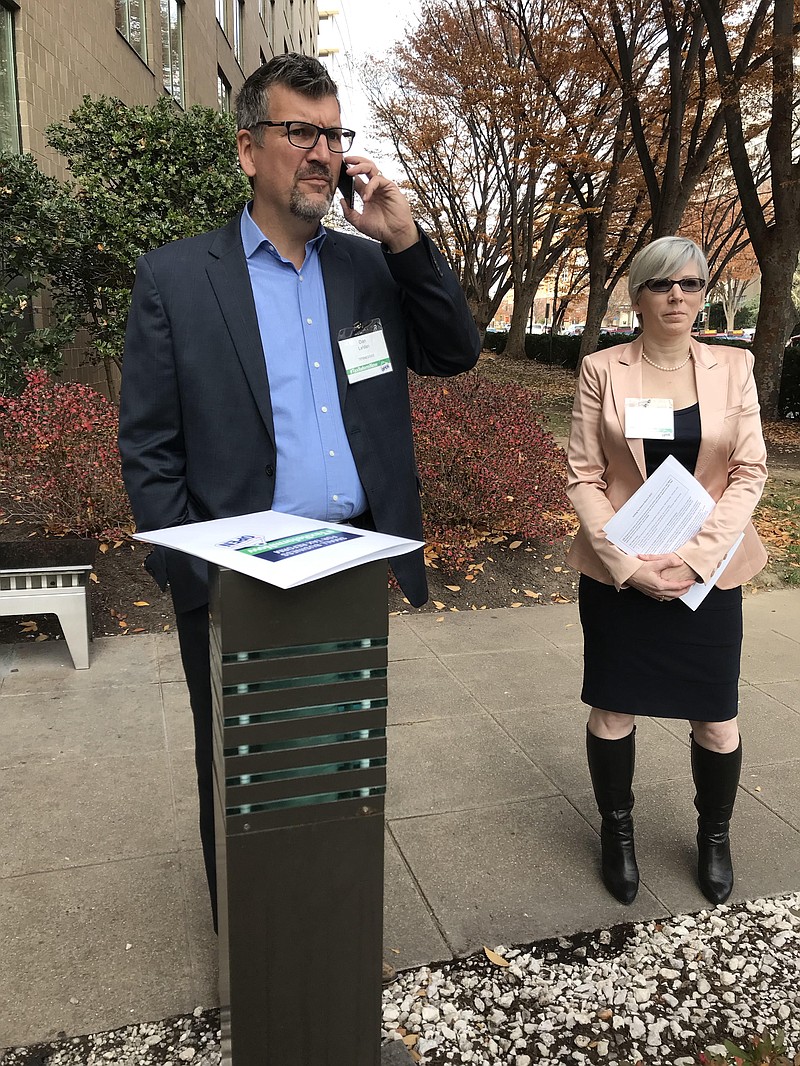

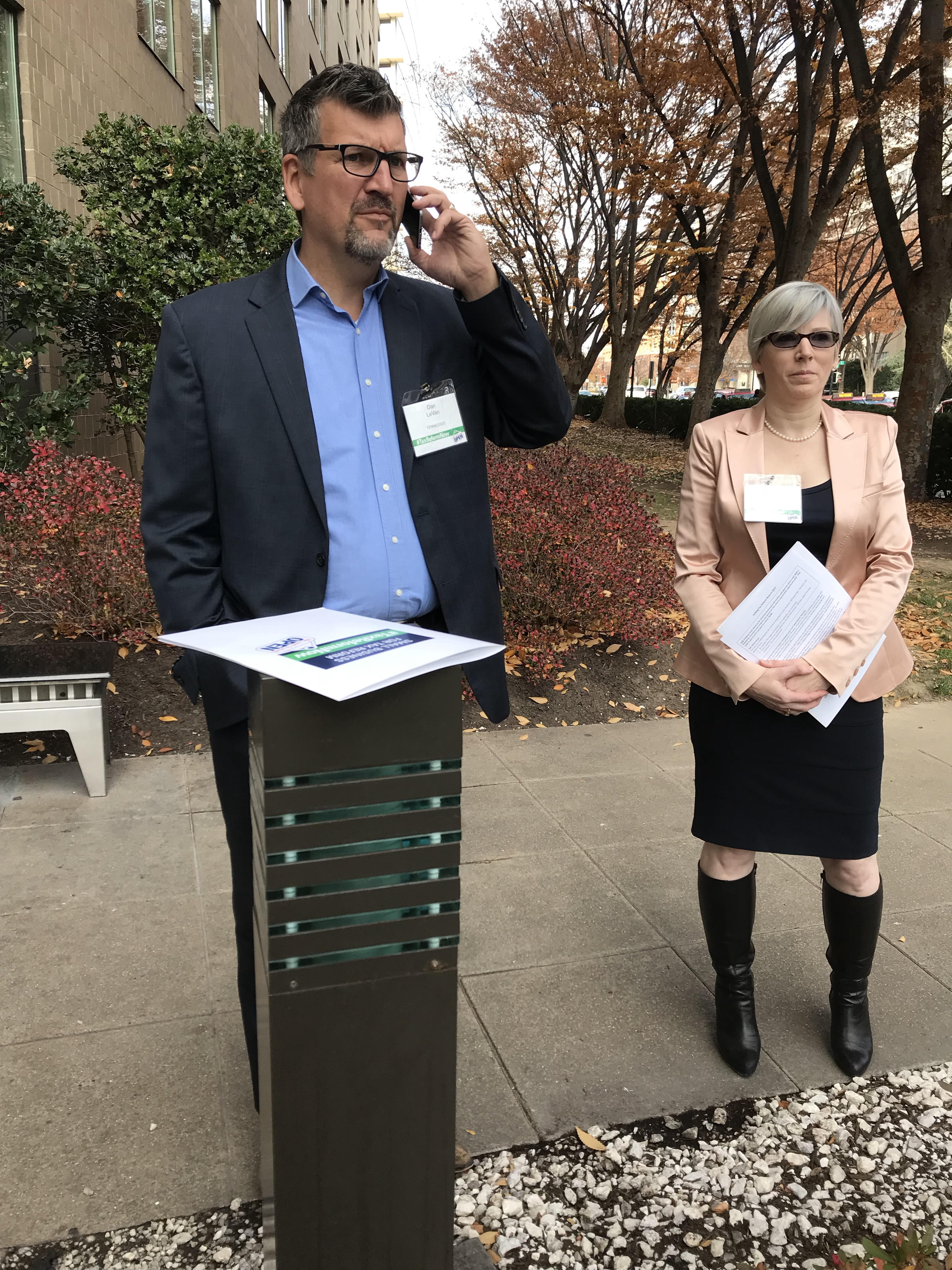

Dan LeVan, owner of EnerG3 and the 2017 Tennessee Small Business Person of the Year, said today that economic growth should accelerate if Congress approves tax cuts to allow businesses to immediately expense more of their investments and nearly cut in half the U.S. marginal corporate tax rate which is now one of the highest from the one of the highest in the world.

"The current tax system puts our businesses at a competitive disadvantage with those around the world," said LeVan, one of nearly two dozen small business owners who met with Corker in Washington today.

LeVan predicts economic growth will rise if Congress cuts taxes, although perhaps not as much as what is needed to pay for the tax revenue losses from the tax cuts. In anticipation of the Senate passage of tax reform and cuts, stocks are rallying today on Wall Street.

The average tax rate for businesses globally is about 23 percent, but the top U.S. tax rate on businesses is 35 percent.

On Tuesday, Tennessee manufacturers also urged Corker to support the GOP plan to cut business taxes.

"Tax reform is the manufacturing issue of our generation," said Jay Timmons, president of the National Association of Manufacturers. "We respect and appreciate all that (Sen. Corker) has done for our sector during his many, many years of public service, and we're encouraging him to be there for us again."

Amy Davis, the general manager of Nashville-based Cummins Filtration, said tax cuts and reform is needed to "unleash our full potential when it comes to hiring and investment.

"For too long, an outdated tax code has hindered economic growth and higher wages for workers," she said. "Innovation-driven companies like Cummins who are based in the U.S. are at a severe disadvantage globally because of our antiquated tax code."

LeVan said the current tax code is too complicated and needs to be streamlined and simplified.

"I'm a CPA and I can't even do my own taxes, which is really a shame," LeVan said. "Any time I and other small business owners are taking time away from the core business and working on administrative and tax issues, I'm losing money and productivity."

Kathryn Mahoney, a Nashville business consultant to small businesses, said details of the tax plan which Senators will soon begin voting on today could make a big difference in the impact of the measure. Higher taxes on some individuals could hurt some growth and investment, although Mahoney said most small business owners are eager to use extra funds to grow their companies even in the currently robust economy.

"The people I work with started their businesses and they are passionate about taking advantages of more opportunities for growth and hiring more people if they have more resources available to them," she said.

Democrats opposed to the GOP tax plan complain that it would worsen the federal deficit by a projected $1.4 trillion over the next decade and give most of its advantages to wealthy persons and big businesses.

"This bill was written for Donald Trump, Senator Bob Corker and their wealthy friends, not for hardworking Tennessee families," said Mary Mancini, chairman of the Tennessee Democratic Party. "Despite the fact that Senator Corker has previously said he would oppose any tax legislation that would add 'one penny to the deficit,' this Republican tax scam bill would substantially add to the federal deficit, hurt Tennessee workers and homeowners, teachers and older Americans; it would take away health insurance from millions and make it harder for people to save for retirement."