With Tennessee's jobless rate falling last year to an all-time low, the state is cutting what employers pay the state for jobless claims in the new year.

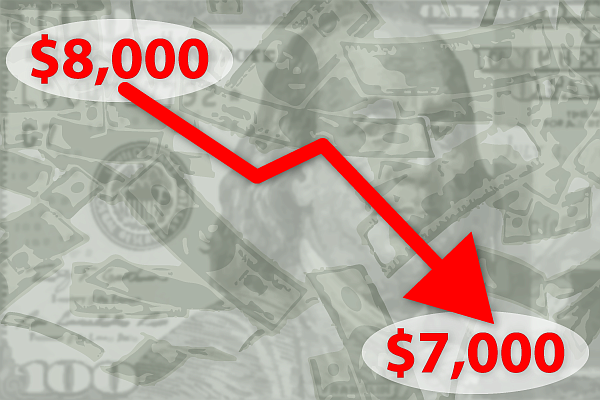

Effective Monday, Tennessee cut the wage base on what employers pay for unemployment insurance from $8,000 to $7,000, effectively reducing what most employers pay to the state for unemployment insurance fees by 12.5 percent.

The taxable wage base is the annual amount of wages paid to an employee, which is subject to state unemployment tax.

"This will amount to a tremendous savings for each and every Tennessee employer," Tennessee Labor Commissioner Burns Phillips said Thursday. "They pay taxes into the state's unemployment insurance trust fund and this will greatly reduce that tax bill."

The move comes two years after Tennessee cut the wage base on unemployment insurance premiums paid by employers from $9,000 to $8,000 of workers' annual income and five years after the state dropped an extra fee imposed after the Great Recession nearly forced the unemployment insurance trust fund into insolvency.

During the Great Recession when unemployment in Tennessee rose to a statewide average of 11 percent, Tennessee's unemployment insurance trust fund nearly became insolvent because of a tremendous increase in unemployment claims. The federal government also extended jobless benefits for unemployed persons during the economic downturn.

In an effort to ensure adequate funding to pay unemployment benefits, state lawmakers passed legislation to push up the employer tax used to fund the jobless benefits program, which pays unemployed workers in the state up to $275 a week for six months.

The average weekly benefit paid for those who are laid off from their jobs through no fault of their own in Tennessee was $214.56 last year, according to the National Employment Law Project.

Unemployed persons getting jobless benefits in Tennessee also are allowed to make $50 a week without jeopardizing those benefits, although they must prove they are looking for another job by showing they have made at least three job searches every week.

Last fall, Tennessee's unemployment rate fell in October to 3 percent - the lowest level on record, according to the U.S. Bureau of Labor Statistics.

On June 30, Tennessee's unemployment insurance trust fund balance continued to remain above $1 billion, which triggered the lowering of the taxable wage base to $7,000, effective Jan. 1, 2018. As of Nov. 30, the unemployment insurance trust fund in Tennessee stood at nearly $1.1 billion, according to Chris Cannon, a spokesman for the Tennessee Department of Labor and Workforce Development.

"We want our fund to have a strong balance sheet, but we don't want the fund to get too big with more than is necessary to pay benefits in the future because we've seen other states use their surplus funds for other purposes," said Bradley Jackson, president of the Tennessee Chamber of Commerce and Industry. "I will commend the state Legislature and the governor for making sure we have a strong trust fund and responsibly operating our UI [unemployment insurance program to make sure our business environment is attractive."

Jackson, a member of the advisory board on the unemployment insurance program in Tennessee, said the Volunteer State was among a minority of states that didn't have to take long-term loans from the federal government when the Great Recession hit to replenish its trust fund and keep paying benefits.

"We weathered the recession better than many other states and now our trust fund has fully recovered from the hit it took during those difficult years," Phillips said.

Billy Dycus, president of the Tennessee AFL-CIO Labor Council, said Tennessee's increase in employment and drop in unemployment has combined to both increase contributions to the trust fund and limit its expenses.

"From an employer perspective, there is no doubt that this is good news to lower their premiums and make our state more competitive," Dycus said. "Perhaps the benefits paid under our UI program is something that ought to be looked at, but it is somewhat difficult because many of the surrounding states also have benefit levels that also are below the national average."

The outplacement consulting firm Challenger, Gray & Christmas, which tracks major employee layoffs across the country, said Thursday the number of job cuts last year fell by more than 20 percent from the total in 2016 and was the lowest yearly total since 1990. Despite a record number of store closings, most employers added workers, or at least didn't lay off employees, during 2017.

"The retail pivot that caused thousands of store closures and job cuts was not seen in any other industry this year," said John Challenger, Chief Executive Officer of Challenger, Gray & Christmas Inc.

Contact staff writer Dave Flessner at dflessner@timesfreepress.com or at 423-757-6340.