ATLANTA (AP) - A Georgia program that provides tax credits for donations to rural hospitals does not ensure that the neediest hospitals receive the most money and will likely experience a decline in funding, according to a state report.

The Rural Hospital Tax Credit - established by a state law that took effect in 2017 - allows taxpayers to reduce their state income tax bill by donating to eligible rural hospitals. Many of the state's rural hospitals are under tremendous financial stress. Seven have closed since 2010.

The tax program has generated tens of millions of dollars that hospitals have used to upgrade equipment, offset expenses and pay salaries, among other things.

But the ability of taxpayers to earmark their donations for particular hospitals and the criteria used to determine eligibility for the money "limit the extent to which the rural hospitals most in financial need receive the most support," a report released Wednesday by the state Department of Audits and Accounts found.

The Department of Community Health uses three criteria to rank each hospital by financial need, according to the report. The agency could instead group hospitals into broader categories of financial distress such as "high need"or "low need" and consider additional criteria to make those determinations, the report said.

The report also said contributions under the program are likely to decline because the IRS no longer allows taxpayers to use them as charitable deductions on their federal taxes.

Donations between January and November of this year totaled $31 million - a decline of roughly 50 percent over the same period in 2018.

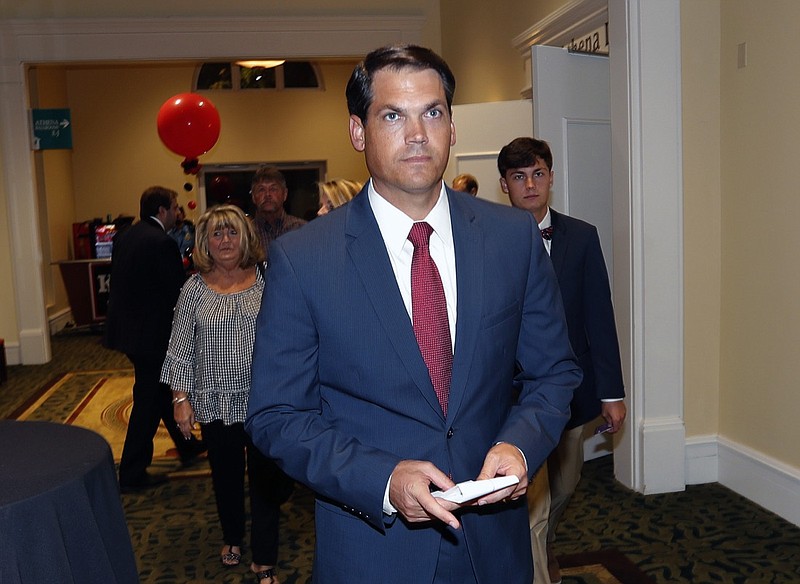

Lt. Gov. Geoff Duncan, who championed the tax credit in the Georgia legislature, said in a statement that he expected to see some changes, but wants "to ensure it continues to be a vital lifeline to rural communities and their ability to deliver quality healthcare all across this state."

The report additionally raises concerns about fees collected by an outside vendor, Georgia HEART, that assists taxpayers and hospitals with the tax credit program.

A call and email Friday to a spokeswoman for Georgia HEART, Kate Saylor, was not immediately returned.

The report raises several issues that lawmakers will look to address when the legislature convenes in January, said State Rep. Terry England, R-Auburn. England heads the House Appropriations Committee, which requested the report.