* Seventh-day Adventist Church, Collegedale: This site focuses on helping taxpayers age 60 and up, by appointment, 423-396-2134* Tyner Methodist Church, Chattanooga: This site focuses on helping taxpayers age 60 and up, by appointment, 423-892-0444* Eastgate Mall City Center, Chattanooga: Tuesday 2-7 p.m. Saturday 10 a.m.-2 p.m.* Urban League of Greater Chattanooga: Tuesday and Thursday 10 a.m.-1p.m.* Northgate Mall, Chattanooga: Monday 1-6 p.m.; Wednesday noon-4 p.m.; Saturday 10 a.m.-2 p.m.* Brainerd Recreation Complex, Chattanooga: Monday and Wednesday 5:15-8 p.m.; Tuesday and Thursday 4-8 p.m.; Saturday 10 a.m.-2 p.m.* Golden Gateway, Chattanooga: Wednesday and Thursday 10 a.m.-3:30 p.m.* Church of Koinonia, Chattanooga: By appointment, 423-629-5400* Silver Life Center, Chattanooga: This site focuses on helping taxpayers age 60 and up. Tuesday, Wednesday and Thursday 9 a.m.-3:30 p.m.* Soddy Daisy Senior Center: By appointment, 423-332-1702* Northside Neighborhood House, Chattanooga: By appointment, 423-267-2217

When Charles Moore shows up at church with his family Sunday, they'll finally be wearing the nicer clothes he's wanted for them.

Moore has been doing his best to keep the bills paid and food on the table, taking whatever work he can get from a local temp agency.

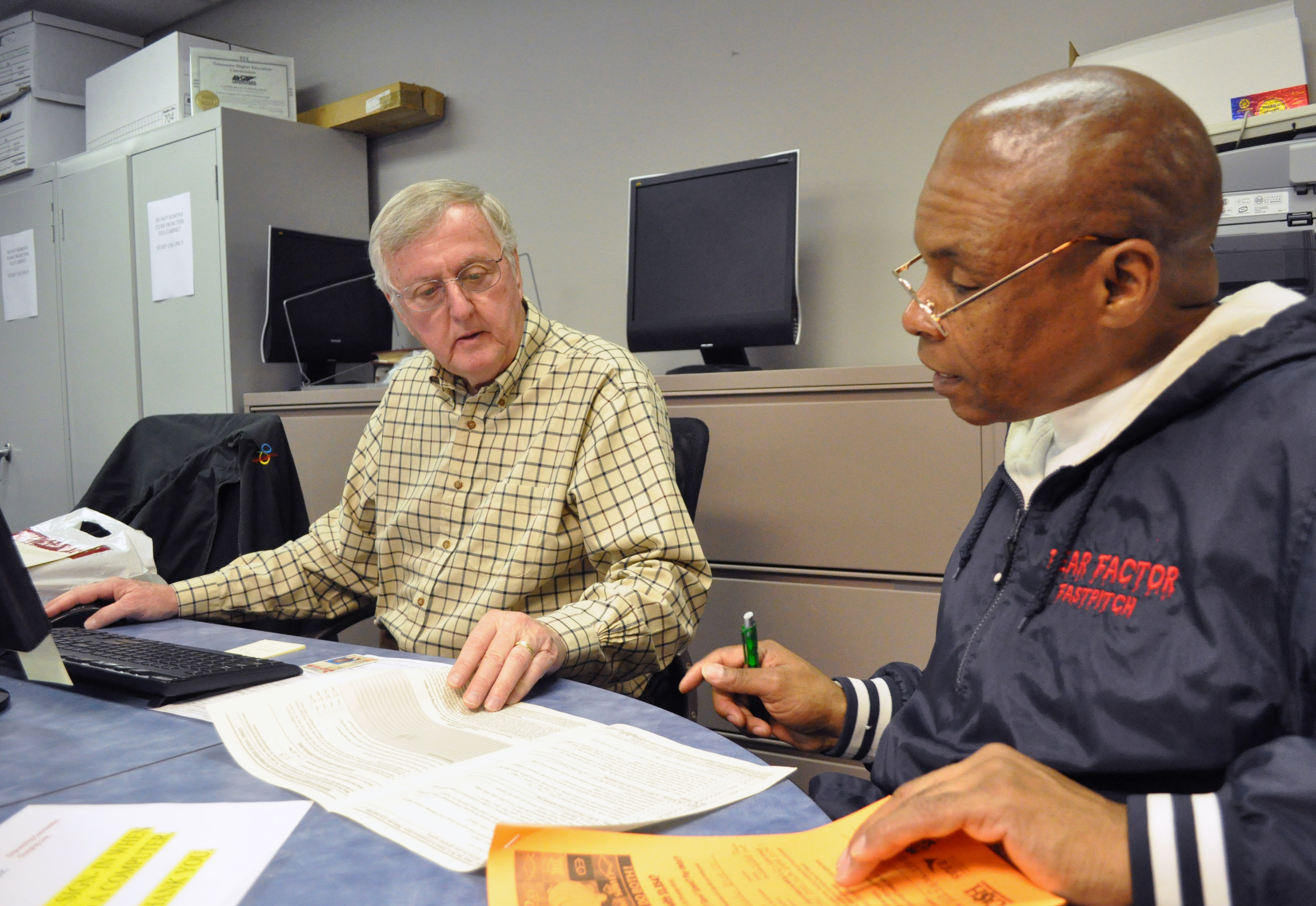

So he was excited to get the free tax preparation help offered at the Urban League last week and to learn he was getting back $3,999.

"It's going to help me help my family," he said. "It took a lot of stress off me."

After he pays off some bills, he said, he'll grab a couple of nice outfits for himself and the kids.

Moore is one of thousands of low- and middle-income taxpayers who will stop by Internal Revenue Service-sponsored sites for free tax preparation before the April 17 income tax filing deadline.

Volunteer Income Tax Assistance centers across the country offer free preparations for any household making less than $50,000 a year. Individuals over 60 years old also may get a free preparation at a IRS-sponsored Tax Counseling for the Elderly site. That means about 70 percent of the state's population is eligible for free preparations, said Dan Boone, spokesman for the government agency.

Volunteers at the 177 sites across the state are IRS certified to do preparations and have been trained to look for tax credits and refunds typically benefiting the people volunteers are helping.

Bill Cox, who coordinates the Northgate Mall VITA center, has volunteered for more than 20 years. The former accountant said his site's staff is ready for whatever taxpayers can throw at them.

"We can handle most of the things in the low-income market that we're dealing with," he said. "If Donald Trump comes in, we'll send him somewhere else."

But the sites do their best not to turn anyone away. Last year, more than 65,000 taxpayers across the Volunteer state took advantage of the free service, and officials expect that number will rise this year.

No matter the number, Donna Thomas, VITA coordinator for the Urban League, said her staff is there to help.

"We want to make sure people get the largest refund they can, so if that involves itemizing, we can itemize," she said. "If we're not sure, we run it both ways to make sure we get the largest refund possible."

Most taxpayers see an immediate savings on their return of $200 to $300, which they would have owed to a private preparer, Thomas said. On top of that savings, the preparers often are able to highlight credits taxpayers may miss on their own, leading to bigger checks from the government.

Several taxpayers eligible for the free service also are able to take the earned income tax credit. The credit brought $1.51 billion to Tennessee in 2011, but IRS officials project only four out of every five Tennesseeans who could take the credit did. That means the state is missing out on more than $377 million of unused earned income tax credits.

"A lot of people are eligible for it," Boone said. "There's a whole lot of money that's potentially available to people."

Taxpayers who need the credit most often can slip through the cracks. People who are exempt from income tax filing because they don't have enough income still could see money from the credit, but don't bother to file, Boone said.

It wasn't too long ago that Moore was in that position. After he found out just how much money he was getting this year, he couldn't help but imagine how many people would benefit from those funds.

"It would have helped me to get lodging, to get out of the wilderness," he said. "It's kind of heartbreaking. I'm putting myself in their shoes."